- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Employees & Payroll

Payments under a registered SUB (Supplemental Unemployment Benefit) plan are not considered insurable earnings, meaning EI premiums are not deducted, Cowancountry.

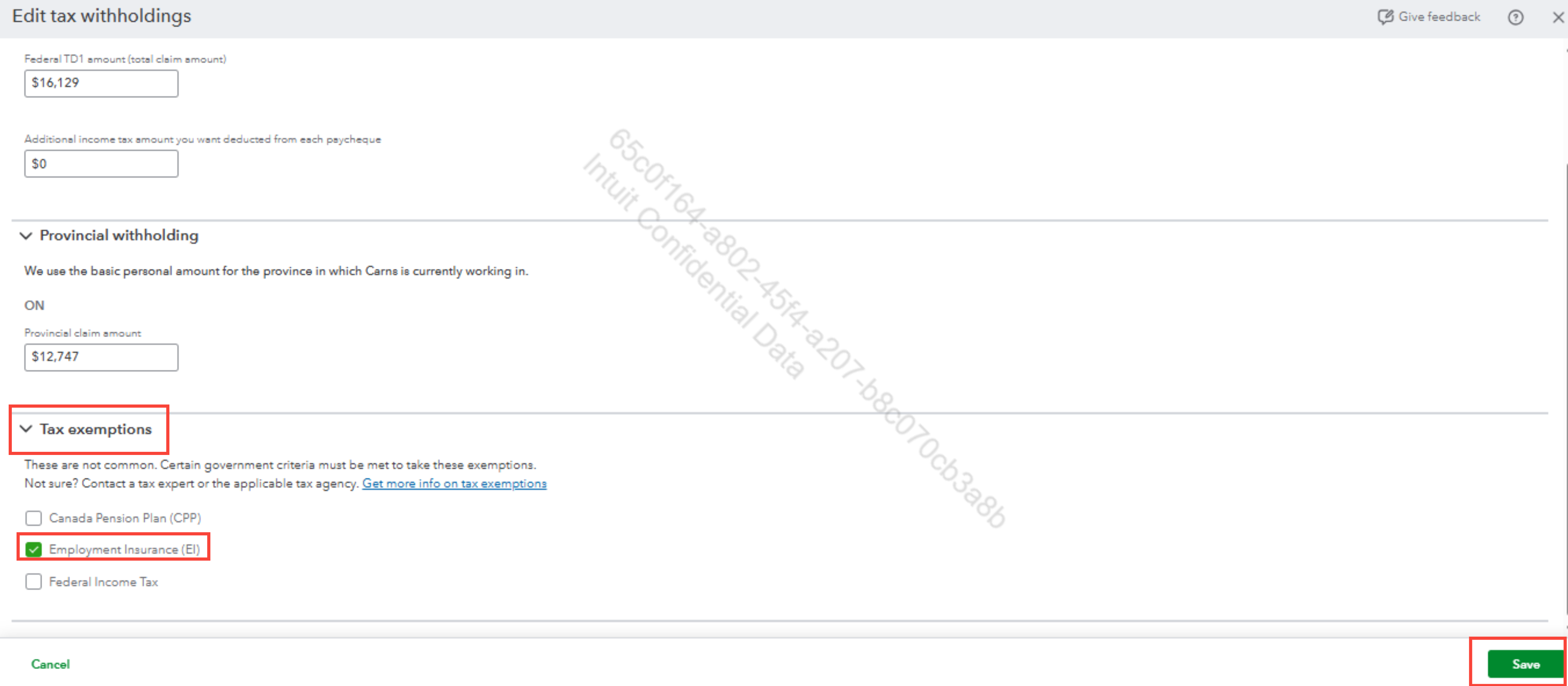

To ensure this is reflected in QuickBooks, EI needs to be marked as non-taxable. Here's how you can set this up:

- Navigate Payroll and select your Employee.

- Under Tax withholding, click Edit.

- Scroll down until you reach the Tax exemptions section and select Employment Insurance (EI).

- Click Save.

If you have any additional questions, please don't hesitate to reply. We're here to help.