Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

SALE EXTENDED 70% OFF QuickBooks for 3 months* Ends 12/8

Buy nowYes, munise, the Form 4797 would be suitable for a multi-member partnership LLC engaged in real estate flipping. However, when using QuickBooks Online as a partnership, you can utilize the Form 1065 to report your transactions. Allow me to provide more information regarding this.

For your real estate flipping LLC with multiple partners, let's refer to these guidelines from the IRS website:

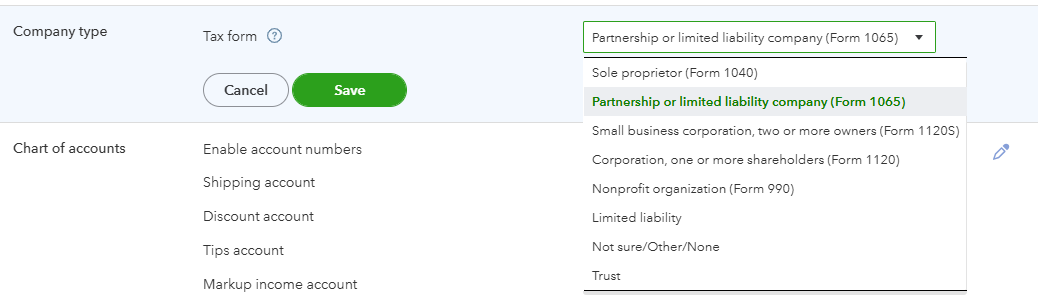

To configure settings for a partnership or limited liability company in QBO, follow these steps:

To file Form 1065 in QuickBooks Online (QBO), you can follow these steps:

Meanwhile, getting the Form 4797, you'll need to file this manually outside QuickBooks Online by visiting the IRS website: 2024 Instructions for Form 4797.

Furthermore, for optimal support, it is advisable to consult an accountant to address this matter. Should you not have an accountant, we offer a ProAdvisor service that enables you to connect with our qualified experts. To utilize this service, simply enter your zip code to explore the available options on the Find My Accountant website. In many of the profiles, a complimentary consultation is offered, allowing you to receive valuable guidance.

If you have additional questions about using the appropriate IRS form, don't hesitate to reach out here. We're available to offer assistance. Have a great day.