Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

We receive direct deposits from donors in our foreign bank and will often withdrawal the funds, exchange it to USD at the local exchange and then deposit the funds into our US bank. What is the best way to capture this process in Quickbooks Online?

Solved! Go to Solution.

The Community got you covered, @jwnickel. I'm here to help you record your donations in QuickBooks Online.

The best way is to create a sales receipt when receiving direct deposits from donors. Then make a transfer for the funds. Let's start by creating the revenue account for the donation. After that, add the donor to identify where the fund is coming from, then make an item specific for financial donation.

Here's how:

Here's how to add the item:

If you're done, add the donor and the item. Then, follow the steps below to record the donation.

Then, follow these steps to make a transfer:

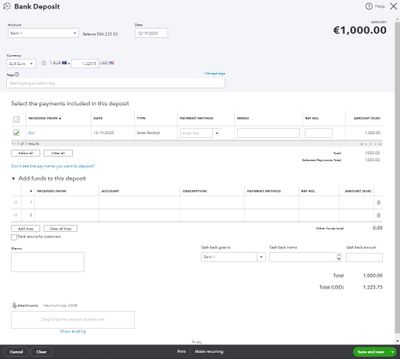

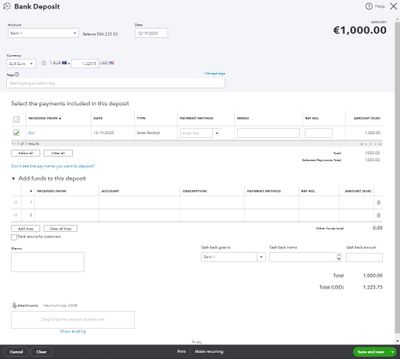

If you've got your money in the Undeposited Funds account, follow these instructions to record the bank deposit into your US bank:

You can check out this link for more info on how you can record the transaction: Track funds you receive from donors in QuickBooks Online.

Please let me know should you need further assistance recording your donations in QuickBooks using the multi-currency feature. I'm always around to help. Have a good one.

Thanks for coming back, jwnickel.

The option to assign the foreign bank account directly in the Deposit to field when creating a sales receipt is unavailable. You'll be encountering an error message "Transactions can have only one foreign currency at a time" when saving the transaction. We can follow the recommended solutions provided by my colleague.

If this does not apply to your situation, we can create a Journal entry. Then, consult your accountant on what are the posting transactions you'll need to apply. Here's how:

Feel free to visit our Banking page for more insights about managing your bank transactions.

I'll be right here to continue helping if you have any other concerns or questions about QuickBooks. Assistance is just a post away.

The Community got you covered, @jwnickel. I'm here to help you record your donations in QuickBooks Online.

The best way is to create a sales receipt when receiving direct deposits from donors. Then make a transfer for the funds. Let's start by creating the revenue account for the donation. After that, add the donor to identify where the fund is coming from, then make an item specific for financial donation.

Here's how:

Here's how to add the item:

If you're done, add the donor and the item. Then, follow the steps below to record the donation.

Then, follow these steps to make a transfer:

If you've got your money in the Undeposited Funds account, follow these instructions to record the bank deposit into your US bank:

You can check out this link for more info on how you can record the transaction: Track funds you receive from donors in QuickBooks Online.

Please let me know should you need further assistance recording your donations in QuickBooks using the multi-currency feature. I'm always around to help. Have a good one.

In the photo it shows you are putting the sales receipt into undeposited fund and then moving it into the U.S. bank via a bank deposit. This is not how ours are processed. We would need to create a sales receipt and have the funds go direct to the foreign bank. Then we would need to withdrawal those funds into the undeposited fund and then deposit them into the U.S. bank. The issue I see is that unless we use the transfer option to move the funds around, doing bank deposits seems to want a customer associated.

Thanks for coming back, jwnickel.

The option to assign the foreign bank account directly in the Deposit to field when creating a sales receipt is unavailable. You'll be encountering an error message "Transactions can have only one foreign currency at a time" when saving the transaction. We can follow the recommended solutions provided by my colleague.

If this does not apply to your situation, we can create a Journal entry. Then, consult your accountant on what are the posting transactions you'll need to apply. Here's how:

Feel free to visit our Banking page for more insights about managing your bank transactions.

I'll be right here to continue helping if you have any other concerns or questions about QuickBooks. Assistance is just a post away.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.