Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hi there, @pareshfairdeal.

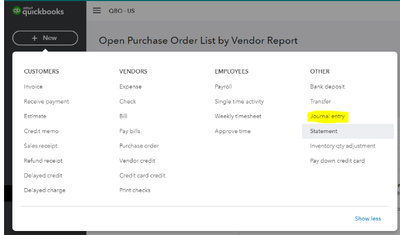

You can create a journal entry to add employee advance. I'd recommend consulting an accountant on what specific accounts to use to record the transaction to ensure the accuracy of your books. If you don't have one, not to worry! You can visit the ProAdvisor site to find an accountant.

Here's an article you can read to learn about the basics in creating a journal entry: Create a journal entry in QuickBooks Online.

You can also check out our guide on recording payroll transactions manually.

To clarify, are you trying to bill an expense from the petty cash that your employee incurs on your customer's behalf? To set up a Petty Cash account, follow these steps below:

For more info, refer to this article: Set up and use petty cash.

Then, to bill an expense your employee incurs on your customer's behalf, you can easily track them as a billable expense. First, let's turn on billable expense tracking.

Once done, proceed to step 2 in this article: Enter billable expenses.

Please let me know should you need further assistance. I'm always here to help. Have a great day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.