Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hi,

if I run a Profit and Loss report for January 2023 it is showing me wages information for people who no longer work for the company and is not showing wage information for some people who do work for the company. how do I fix the report?

Best Regards,

Noel

Hello there, @TUSSU.

I'd be glad to share some insights on how to show the wage information of your employees in the Profit and Loss report.

You'll want to ensure that you set the correct date when running the profit and loss report. This way, it will show the transactions created for that specific month.

Then, customize the profit and loss report and filter the employee section. From there, choose the active employees to show their wage information.

Here's how:

For more details, see this article: Run reports in QuickBooks Online.

However, if you set all the filters correctly, I'd suggest performing some troubleshooting steps to determine if this is a browser-related issue. The stored cache can affect the performance of QuickBooks Online (QBO).

To start, I'd suggest opening your QBO account via a private window. Here are the keyboard shortcuts:

Once done, run the report again to check the wages information of your employees. If it works, go back to your regular browser and clear the cache. Alternatively, you can use other compatible browsers.

Feel free to look into these articles for more details in running profit and loss directly by bank account and learning about the accounting methods you use in QuickBooks:

Let me know if you have other QuickBooks concerns. I'm always around to help. Have a good day.

Hi,

many thanks for you quick response, unfortunately, this is not what I want to do, I nned to remove several employees who no longer work here and track some new employees, the filter option only allows me to track one employee

Best Regards,

Noel

I appreciate you getting back, @TUSSU. I'll help you with removing inactive employees from your record.

You can delete the employee names to take them out from your record. Here's how:

I'm also adding this article for the detailed instruction: Delete an employee's profile from payroll.

After that, set up the new employees by following these steps:

Once done, you're now ready to process or run payroll for your employees. Here's an article you can open as your guide: Create and run your payroll.

If you have follow-up questions, let me know by leaving a comment below. I'm always here to help. Have a good one!

Hi,

thank you for your quick response, I don't use payroll through Quickbooks so do not have an employees list, my bank is connected to QB and when the wages come in I just save under a category using that Employee's name e.g. "Noel Lackey Wages"

Best Regards,

Noel

I appreciate your clarification regarding deleting your employee, @TUSSU. I've got other ways you can perform to delete them under a category.

Since you've added your employees under a category, please know that we're unable to delete them. We can make them inactive instead. This way, you still have access to past transaction data for reporting purposes.

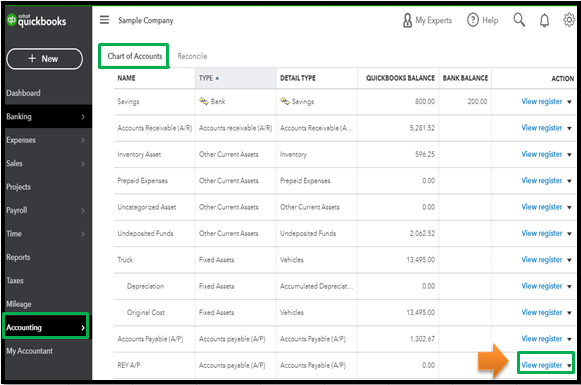

Here's how:

Additionally, you will no longer see them in the COA unless you filter it to include inactive accounts. See this article to learn more about making an account inactive and organised: Make an account inactive on your chart of accounts in QuickBooks Online.

You can also refer to these guides to learn more about special accounts that can't be edited or deleted:

Feel free to post your concerns or click the reply button for any follow-up questions about categories. I'll be here if you need help.

Hi

thank you very much for your quick reply, can you tell me what information the P&L should show (should it be showing wages?) if yes, how do I get it to include employees who work for the company but are not shown in the report at the moment?

Best Regards,

Noel

I appreciate you for getting back to us, Noel.

A profit and loss report is also called an income statement. This report shows your total income, gross profit, expenses, and your company's net income or loss. That said. we're unable to customize it and add your employees. If you want to show your employee's information, you can run the Employee Contact List report. I'll walk you through the steps.

If you want to run a profit and loss report by bank account, you can check this reference: Run a Profit and Loss report by bank account in QuickBooks Online.

Keep me posted whenever help is needed.

Thank you for the great information. I am wondering why the P&L shows some of the employees instead of all employees even though all are categorised exactly the same in Quickbooks and there is no way that I can customise the P&L to include them, which is going to give false figures for the P&L.

Best Regards,

Noel

Thank you for following up so quickly, TUSSU.

I'll add some details to clear up any confusion about the Profit & Loss (P&L) report in QuickBooks Online.

That's correct. If you properly categorised your employee's transaction to a specific distribution account it should show you the right figures.

You can also customise the report to distinguish the total amount and to show the name of your employees by modifying the Columns by Employees.

However, keep in mind that the period of your report and the employee's transactions must be considered as well, or else the figure will change and some of your employees will not appear.

To learn more, you can check out this article: Customise reports in QuickBooks Online.

Feel free to let me know if you still need help or have other questions about financial reports. I'll be here to assist. Keep safe!

Hi Thank you for your response, Modifying the columns to show employees will still show employees who no longer work here and some employees who work here are missing.

I also tried to make the employees who no longer work inactive and I get this message:

This account has a non-zero balance. Inactivating this account will cause an adjusting transaction to be created. Is this OK?

Clicking YES:

This account cannot be deleted because it is used by a recurring template or scheduled liability payment.

The error you received appears to have two causes, @TUSSU. I'll share them below to ensure you can inactivate your unused accounts and run the P&L report with your active employees.

The error "This account cannot be inactivated because there are transactions in it that have a non-zero balance" shows up if it has multiple transactions in it or if it's a default account in QuickBooks.

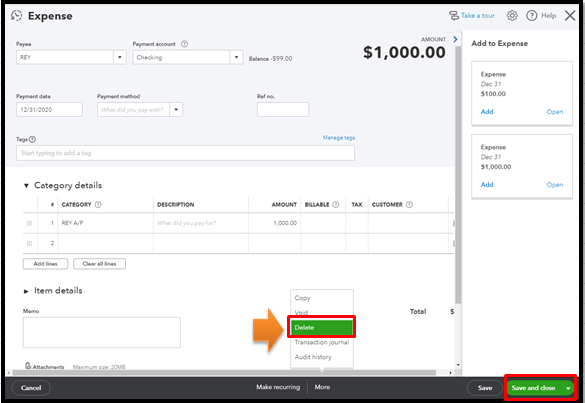

To get around this issue, we can delete the transactions before inactivating the categories. Before proceeding, I recommend consulting your accountant for assistance. This way, you can prevent messing up your records.

Here's how:

Once done, you can now inactivate the categories you used to record your employees' wages. If you don't want to delete the said entries, you can merge the account to the default one. This way, QuickBooks will use the original account to code your transactions. To learn more about this, please see this article: Merge accounts in QuickBooks Online.

Finally, run the profit and loss report. You can also refer to this reference to learn how to personalize and filter reports in the program: Customise reports in QuickBooks Online.

Feel comfortable to tag my name in the comment section if you need further assistance or other questions. It would be my pleasure to lend a helping hand. Take care.

Thank you for your response and apologies for the delay in replying, I am working with my accountant to resolve the issue and will report back later

Best Regards,

Noel

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.