Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Solved! Go to Solution.

Hi there, @userharis. I'd be delighted to help you start over and make a fresh start right now.

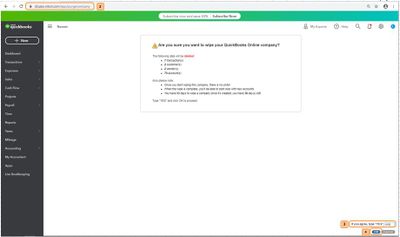

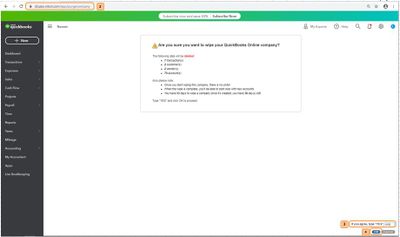

How old is your account? If your account is less than 60 days old, you have the option to delete all your data and start from scratch. This feature is available to QuickBooks Online Plus or Essentials subscriptions. Let me guide you on how this works.

However, for accounts that are more than 60 days, you'll have to cancel your current account and start a new one.

To cancel your account:

To start a new account:

For future reference, refer to these articles for more info about managing your account, as well as the latest subscription rate:

Additionally, to help you get a better grasp on the VAT feature, you can check out these article for the steps and videos:

Don’t hesitate to post a comment below if you have further questions. I'm always available for help at any time. Have a great day.

Hi Haris,

Welcome to the QuickBooks Community!

I know how important it is to have the right setup for VAT. I'll help you out. However, it would be best to have an idea of your current setup is, so we can start from there.

Can you please describe your current setup, and why you think it has to be corrected? Are you missing anything? When you use tax rates on your transactions, what do you notice?

We also have articles about VAT in QBO International for your reference.

Any additional information can help me understand your concern better.

Hi JessT

Thank you for your quick response.

When I initially set up the company and the VAT, for the purchases I did not select that option that VAT on purchases is reclaimable. This was my mistake which I would like you to correct.

As a result, when I try now to create a new tax rate, in purchases when the system asks to fill the account I do not have the option to choose liability as I have the option is sales.

Looking forward to your response and I hope I was clear with my explanation :)

All best

Haris

Thanks for sharing more details about your concern, userharis. I'm here to share some insights about your concern.

Once the VAT is set up in QuickBooks Online, we're unable to change the settings to correct it. As a workaround, we'll have to create and set up a new VAT agency.

Here's how:

Additionally, you can always browse our Tax Help articles page for reference. From there, you can read articles that will guide you in completing your future tasks.

In case you'll need assistance in the future in managing your VAT, you can always visit us here in the Community. Our help will be sent right away.

Hi

We've tried the solution you're proposing with my accountant and he's telling me that this is not correct. He's suggesting we delete the company from the system and set it up again correctly this time. Is this something that we can do?

Please keep in mind that we're still in the very early stages of using the software and we haven't really added too much info into the system so this solution, if doable, could be the fastest way forward.

Many thanks

Hi there, @userharis. I'd be delighted to help you start over and make a fresh start right now.

How old is your account? If your account is less than 60 days old, you have the option to delete all your data and start from scratch. This feature is available to QuickBooks Online Plus or Essentials subscriptions. Let me guide you on how this works.

However, for accounts that are more than 60 days, you'll have to cancel your current account and start a new one.

To cancel your account:

To start a new account:

For future reference, refer to these articles for more info about managing your account, as well as the latest subscription rate:

Additionally, to help you get a better grasp on the VAT feature, you can check out these article for the steps and videos:

Don’t hesitate to post a comment below if you have further questions. I'm always available for help at any time. Have a great day.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.