Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

We can use the expense entry, @admin427.

Before we begin, can you clarify what transaction was posted in your bank statement? Is this the remaining P30 payment from the P30 liability after accounting for the VAT refund?

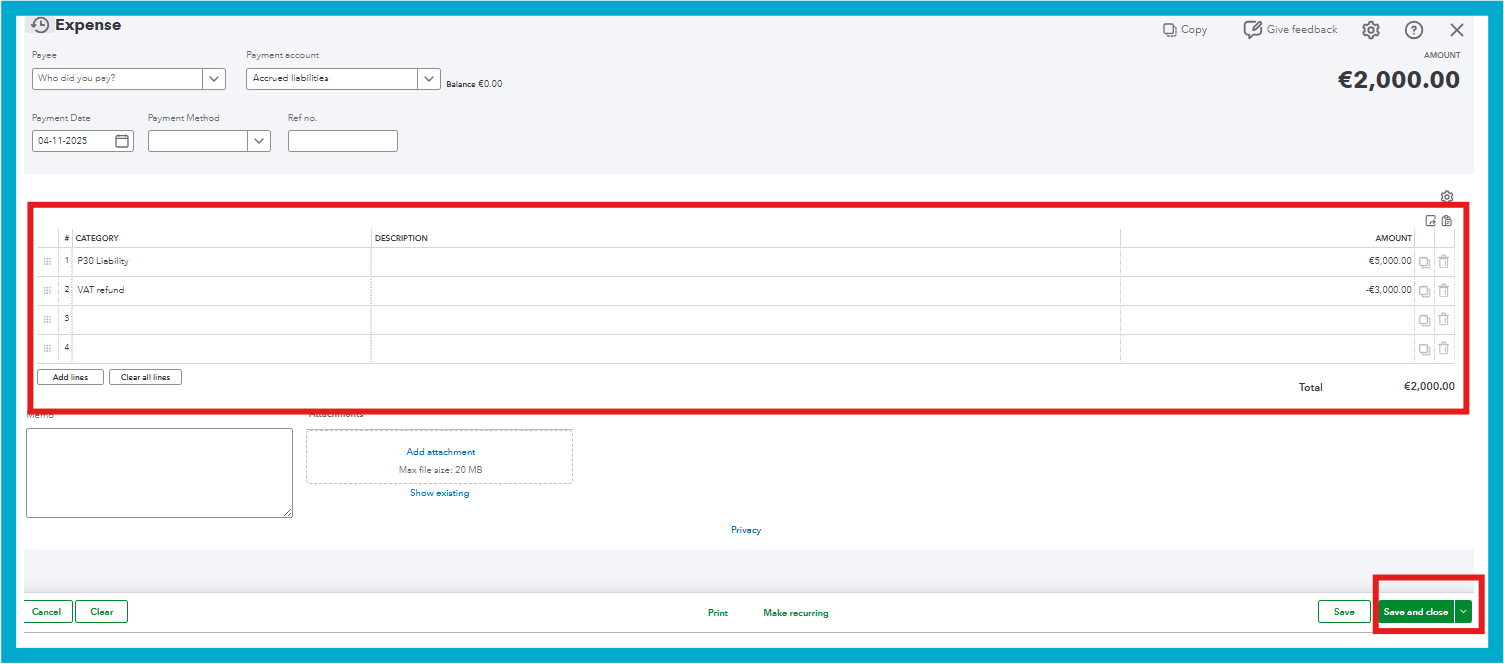

In QuickBooks Online (QBO), even though you have a single offset transaction in your bank, we still need to create a corresponding record to handle the VAT refund. Here's how to enter this transaction using the Expense feature:

This process allows us to record the P30 payment and the VAT refund to match the physical bank transaction.

To learn more about handling the VAT refunds, check out the article: Record a VAT payment or refund.

I'll keep an eye on your response. Please don't hesitate to get back on this thread.

That's great, thanks so much. Will that automatically sync with our VAT capability on Quickbooks online, when I mark a VAT filing as 'returned'?

Thank you for your reply, Admin.

Could you provide clarification on what you mean by "mark a VAT filing as returned"? We want to ensure that we fully understand your inquiry so we can guide you effectively.

Based on your original post, you only need to use the Record Refund option for the affected VAT period in QuickBooks Online to account for the VAT refund, since there's no option to mark a VAT filing as returned.

Please note that the process described by my colleague above is about documenting how to offset the refund and your P30 payment.

Feel free to provide any additional clarification or details below so we can assist you promptly.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here