- Global QuickBooks Community

- :

- QuickBooks Q & A

- :

- Tax

- :

- Re: VAT Returns

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

VAT Returns

Hi,

I want to prepare and file the VAT returns from January 2020 but the QBO is showing only the VAT periods from 2021.

What is the issue?

1 Comment 1

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

VAT Returns

Thank you for choosing QuickBooks as your tax tool, @TAS5. I can help you file the previous VAT returns from January 2020 in QuickBooks Online.

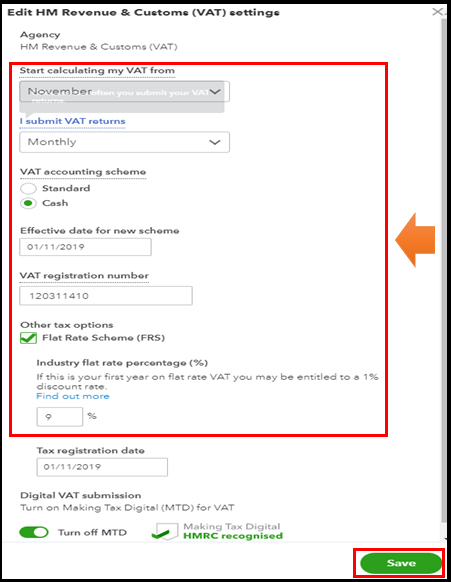

You'll need to select a VAT scheme to edit or enter the starting date of your return. I'll show you how:

- Go to the Taxes menu, and then choose VAT.

- Select Edit VAT from the Edit settings drop-down.

- Choose which month from the drop-down list on Start calculating my VAT.

- Make sure to select the right filing frequency and Effective date for new scheme.

- Click Save.

When you're ready, you can now submit your VAT returns directly to HMRC from QBO. Once received, you'll be able to see a message that your return has landed safely. When it's successful, the status will change to Approved by HMRC.

Furthermore, the default tax agencies created by QuickBooks have input and output tax accounts in the Chart of Accounts. When you enter an invoice, the output tax account is credited. When you enter a bill, the input tax account gets debited.

To give you more insight about submitting a VAT return, refer to this article: Everything you need to know about Making Tax Digital (MTD) for VAT with QuickBooks Online. This is for the UK, but will work the same in international versions.

Check out these articles to keep you updated and for additional information:

- VAT Feature Update FAQ

- How do I set up sales GST/VAT rates and use them on forms? (International QBO)

Keep me posted on how it goes in the comments below. If you have other concerns about managing VAT returns in QBO, I'll gladly help. Take care, and I wish you continued success.

An Unexpected Error has occurred.