Save over 30 hours per month on average by using QuickBooks#

Instantly sync with your Etsy shop

Track your sales, expenses, tax-deductions and more

Less work. Better insights.

- Automatically sync Etsy Shop transactions and reduce manual data entry

- See breakdown of income, sales tax and fees for each transaction

- Etsy Shop income and expenses appear in your Profit and Loss statement

Explore the features

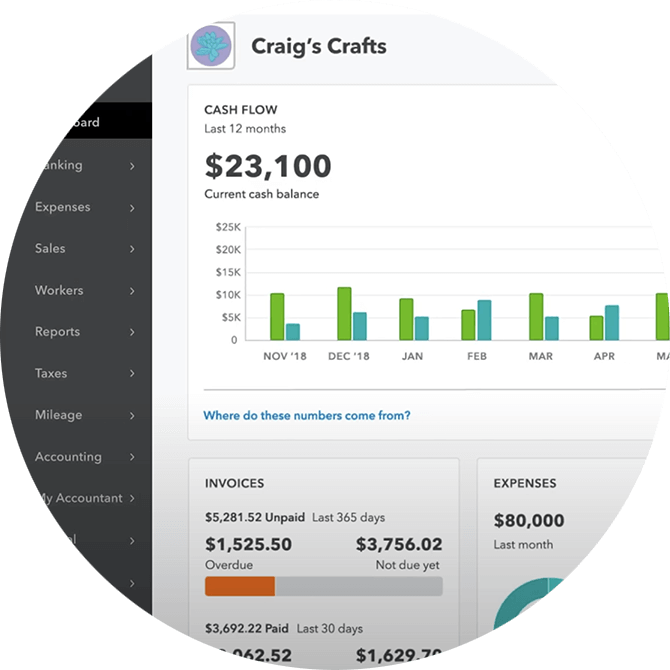

See profit at a glance

Get a clear view of what you make and spend over time.

Get every tax deduction

More tax deductions, more money in your pocket.

Manage & pay bills

Organize bills in one place, plus schedule and make payments online right in QuickBooks.

Invoicing

Create and send professional invoices with smart invoicing software

E-commerce

Easily track and fulfill orders from all of your online sales channels in one place so that nothing falls through the cracks.

Sales tax calculations

We keep track of thousands of tax laws so you don’t have to.

Explore the features

Your mileage on autopilot

Track mileage automatically with your smartphone’s GPS, then categorize trips with just a swipe. Now your business miles are in order and ready for tax time.**

Keep business and personal separate

Business and personal expenses are automatically sorted into categories, so you can track your spending and maximize tax deductions.

Your finances, your taxes. All in one place.

Exclusively for Schedule C filers—save time and effort by seamlessly moving from books to taxes in QuickBooks. Prepare your current tax year return with unlimited help from live tax experts, powered by TurboTax. Pay only when you file.**

Run your business anytime, anywhere

Easily track business mileage, send invoices and estimates on the go, view reports, and more—all with the QuickBooks Mobile app.**

Get setup for success – faster

Speed up your initial setup by automatically importing your spreadsheet data for instant business insights and simple bank connections.

Create goals. Then take action.

Set up business goals with target dates. We’ll suggest actions to achieve them. Then track your progress from your dashboard.