Get to know the GoPayment app

Flexible ways to get paid

Let customers insert, tap, or use digital wallets to make in-person payments seamless, wherever they happen.**

Never miss a sale

Key in customer card info right from the app. So you stay on top of sales, even if you don’t have the card reader.

Let others take payments

Give your team the ability to take payments on a mobile device, without them accessing any of your sensitive business info.

Keep tabs on deposits

All your deposits are listed in one place with status updates on pending funds, so you don’t have to wonder where your money is.

Instant payments, 24/7

For an extra 1.75% fee, eligible payments are deposited instantly so you get the money you need in minutes, not days.**

Accurate books all year

Limit those tax-time mistakes. We’ll record and organize in-person payments for you to keep your books updated Not included with QuickBooks Money as you go.

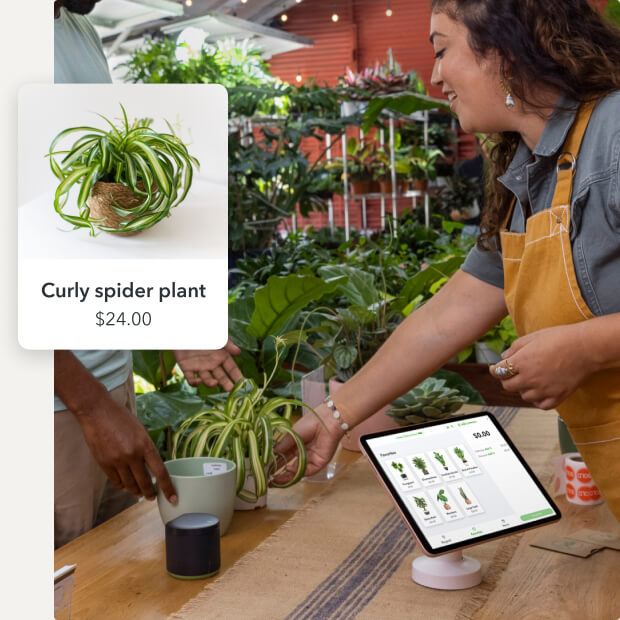

Speed up in-person sales

Create an easy-to-scan inventory—with labels, prices, and images—to help you quickly find the product or service you need for a sale.

No more slowing down the line to pass devices back and forth. With the card reader, your customers can pay and tip all from the display.**

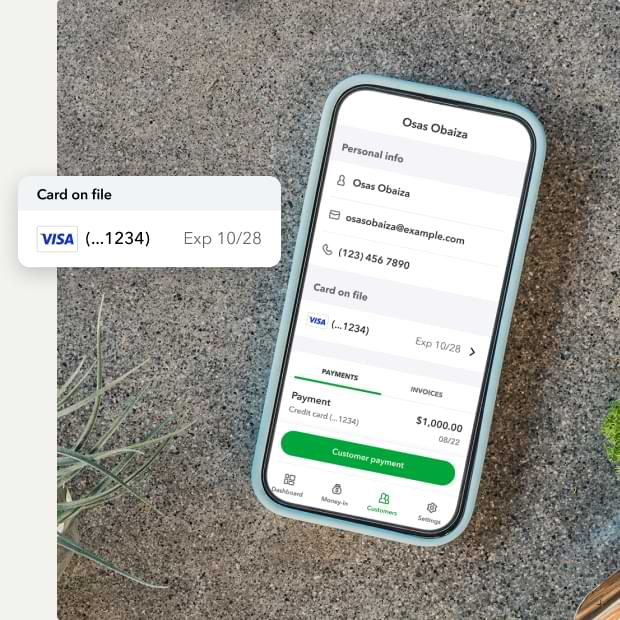

Keep card info on file, so your repeat customers are set up and ready to go for their next transaction.

CARD READER

Convenient card payments

The QuickBooks card reader connects wirelessly to your phone or tablet via bluetooth in the app. Add the power stand, which can double as a phone charger, for even longer battery life.**

Customers can tap or insert debit and credit cards or use Apple Pay® and Google Pay™.

Frequently asked questions

Build your knowledge

Harness powerful tools to find real solutions.

Simplify in-person payments

Download the GoPayment app to start taking payments from anywhere.