Reviews that speak volumes

Discover why 88% of customers say QuickBooks helps their business be more successful.3

★★★★★

Having the online version just makes sense. There are apps that integrate with it, you can log in on your phone, [and] the data is easily accessible to both the client and the accounting team.

★★★★★

The software is very easy to use, even for people who do not have an accounting background.

Features for all kinds of businesses

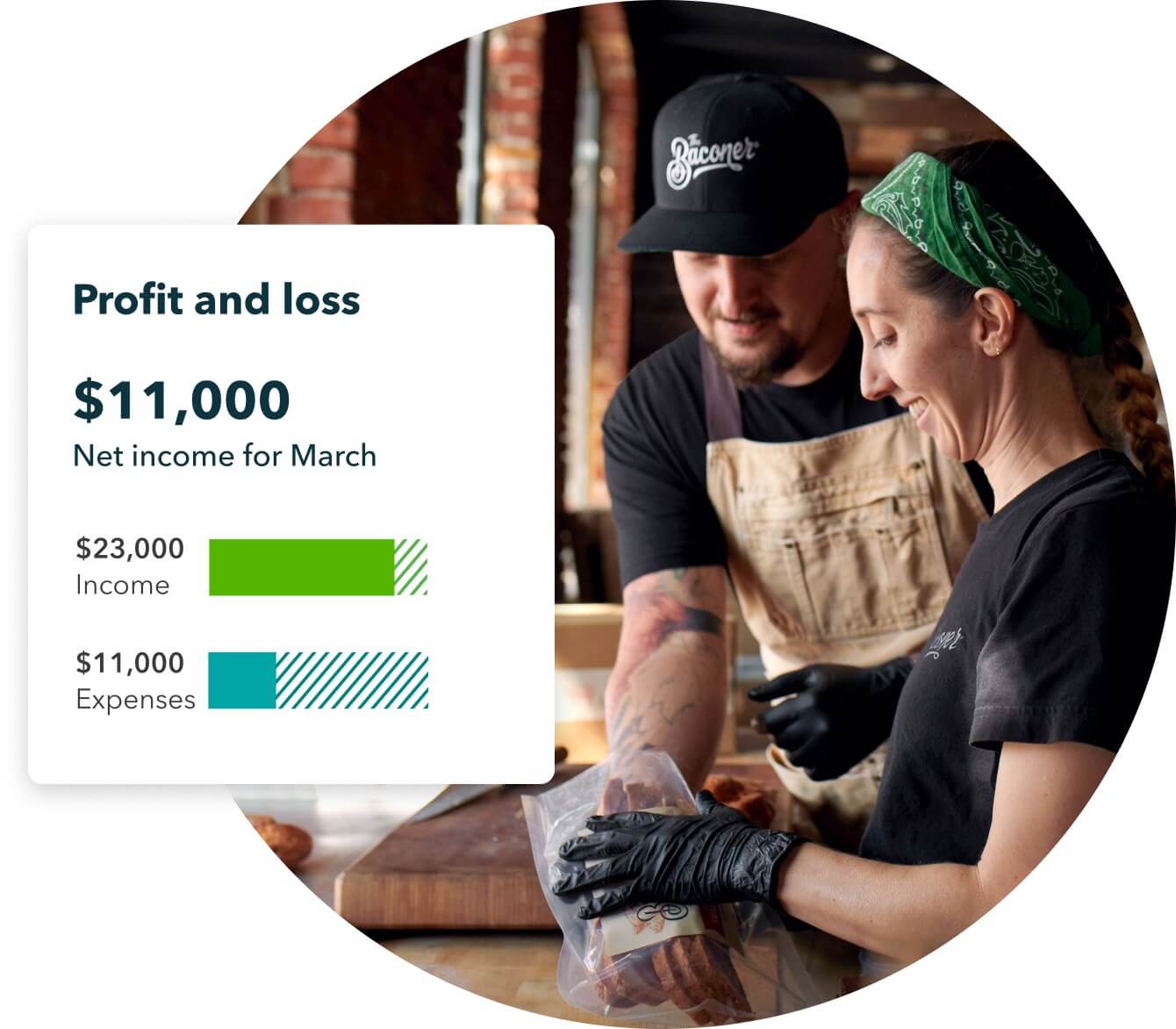

Calculate tax deductions

Find deductions you didn’t know about to get all you deserve.

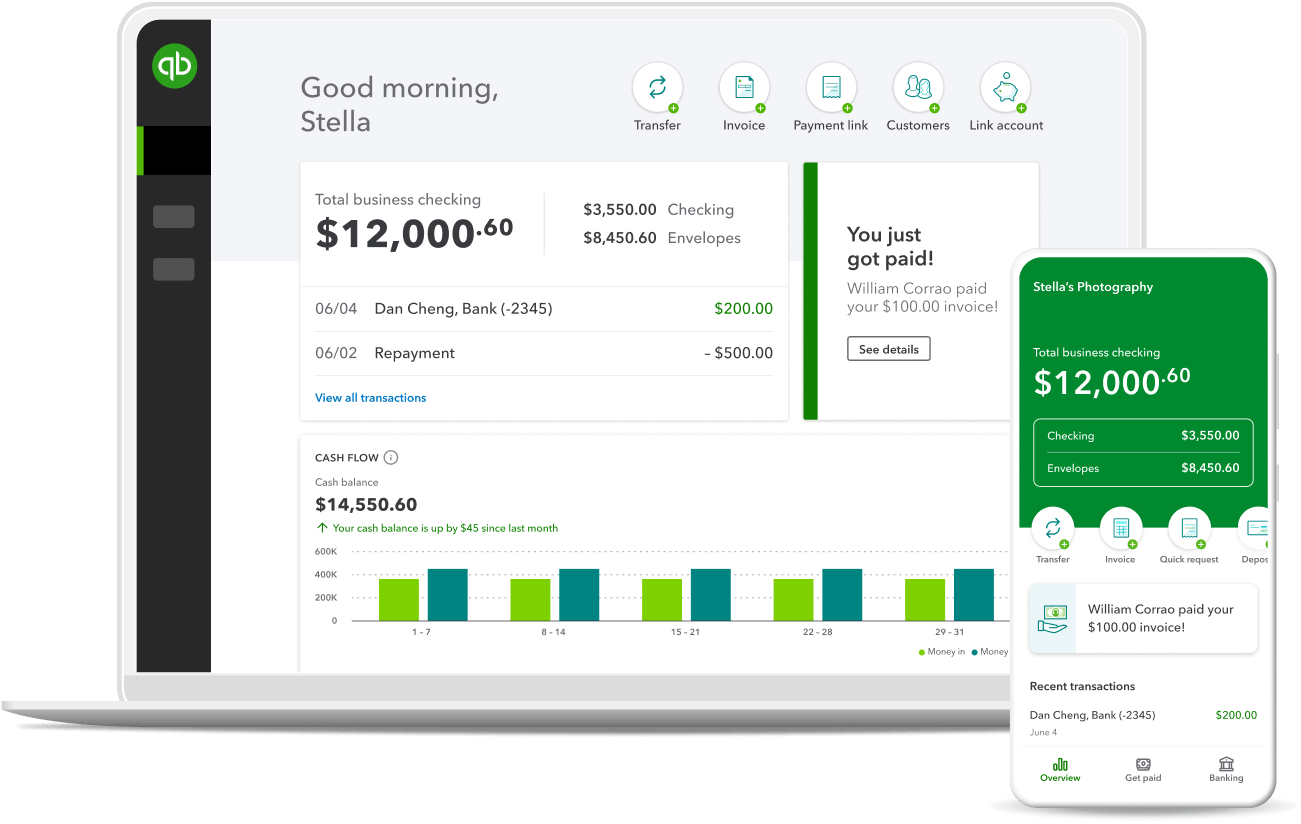

Software that keeps you in control

See how you can track and manage your whole financial picture in one place—from bank transactions, expenses, and beyond.

All of your bank and credit card transactions automatically sync to QuickBooks to help you seamlessly track income and expenses.

Organization made easy means less stress—and less work—at tax time. Snap and store receipts and track mileage from our mobile app to maximize deductions and stay compliant.

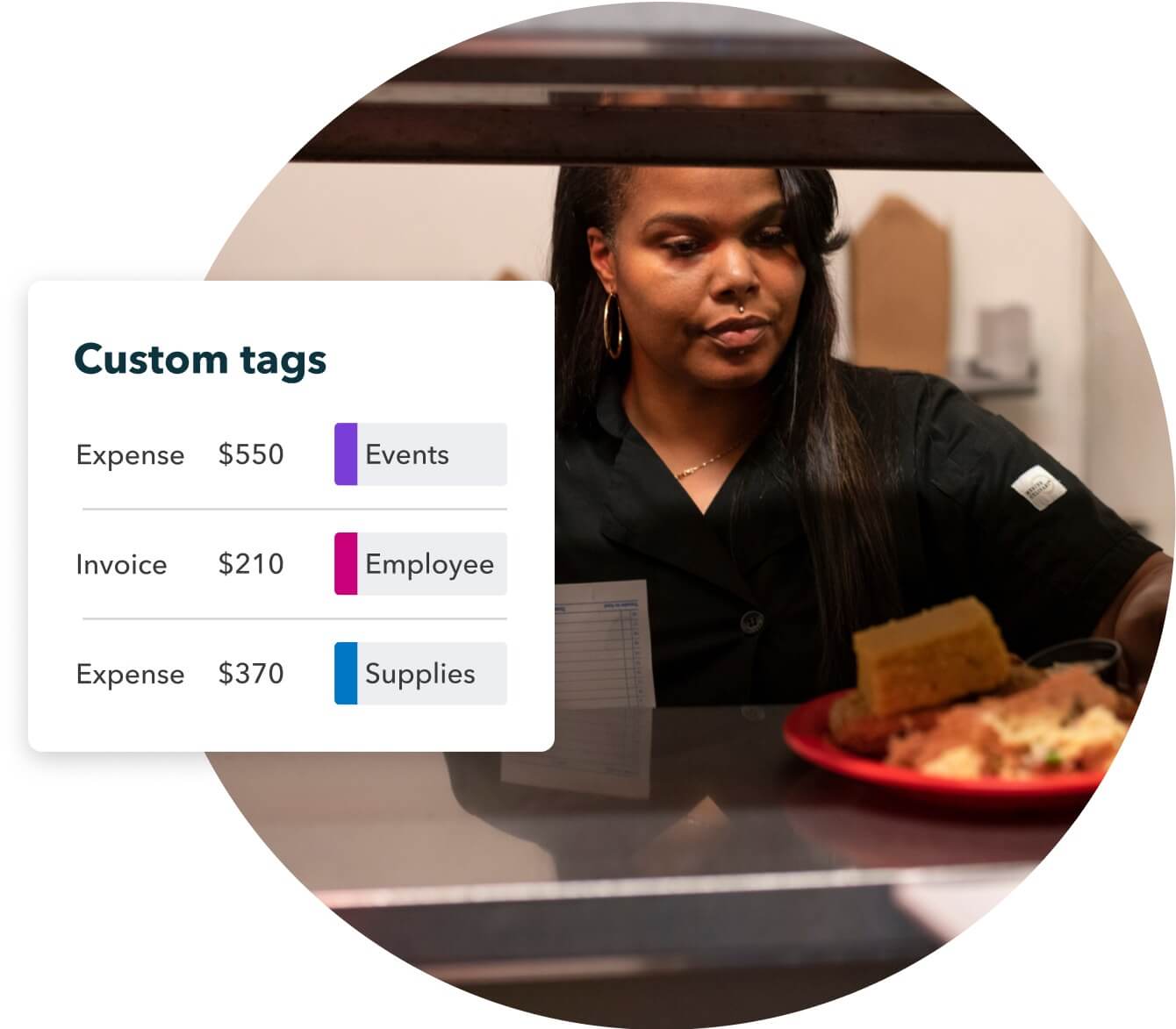

Tag things as you work to track events, projects, locations, and anything that matters. Run custom reports based on your tags for an instant view of insights that matter most to you.

Accounting software integrations

Grow confidently when you’re ready with our easy-to-add solutions.

Payroll

Set up auto-pay for your team and rest easy with taxes calculated for you.

Time tracking

See everyone who’s working and all your projects at a glance, from any device.

Plans for every kind of business

Now with Live Assisted Bookkeeping (add $50/month)

- Add $50 per month

- Add $50 per month

- Add $50 per month

- Add $50 per month

NEW

NEW

Get help from our bookkeepers when you need it. They’ll provide guidance, answer your questions, and teach you how to do tasks in QuickBooks, so you can stay on track for tax time and run your business with confidence.

QuickBooks-certified bookkeepers can help you with:

- Automating QuickBooks based on your business needs

- Categorizing transactions and reconciling accounts correctly

- Reviewing key business reports

- Ensuring you stay on track for tax time

Add $50/month

QUICKBOOKS LIVE

Real experts. Real confidence.

All QuickBooks Online plans come with a one-time Guided Setup with an expert and customer support.

Need more help? QuickBooks Live helps you stay organized and be ready for tax time with:

- Live Assisted Bookkeeping

- Live Full-Service Bookkeeping

Ready to get started?

Or call 1-800-365-9606

Success is in the story

Success is in the story

See QuickBooks in action

Try QuickBooks small business accounting software for free. You don’t even need a credit card.

Boost your small business accounting knowledge

Get tips to manage your finances, so you can fuel your passion.