Earn 5.00% APY** with savings envelopes—that’s over 70x the US average.1

Manage your cash flow from anywhere

Reach business goals

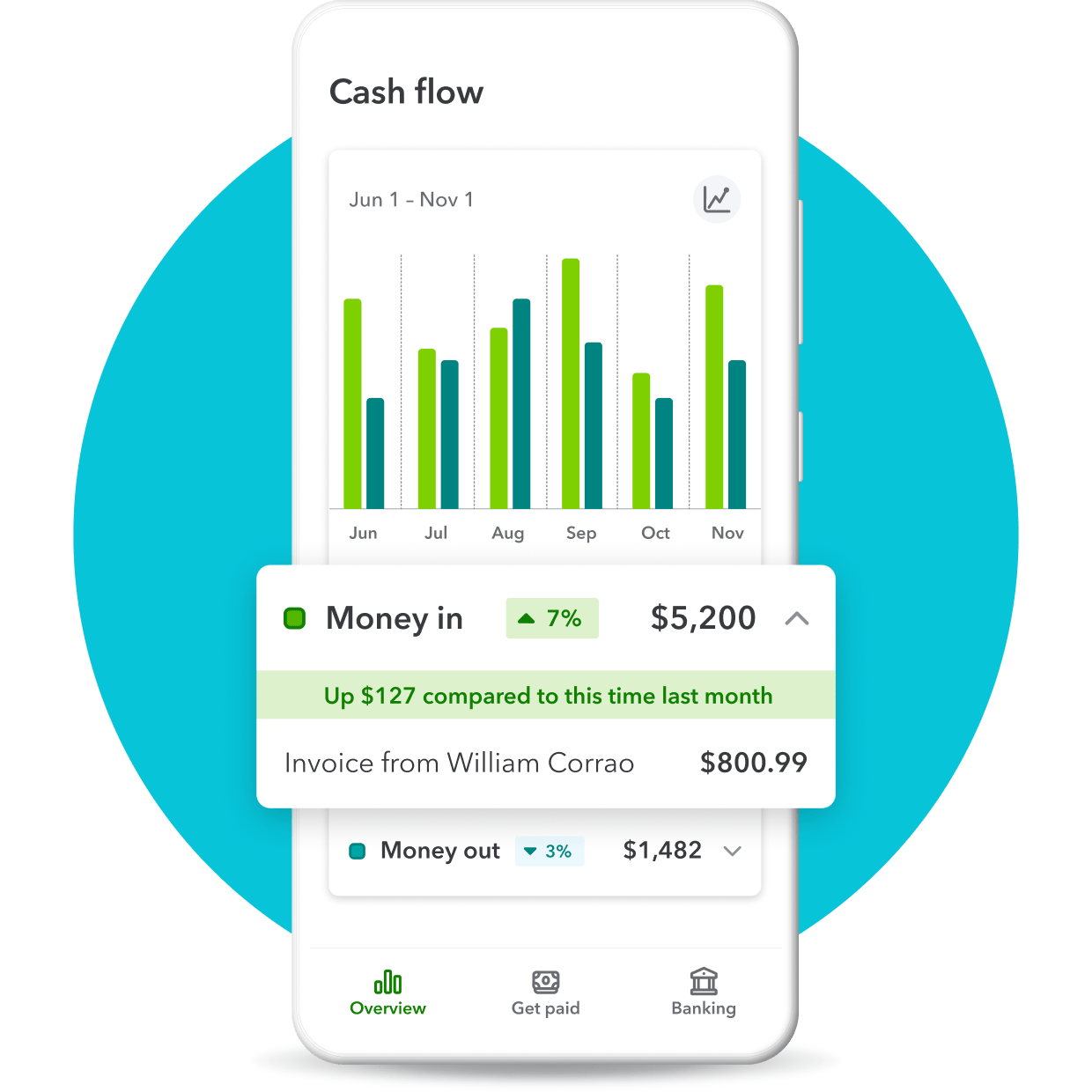

Check your cash flow anytime, making it easy to spot trends so you can keep growing.

Understand trends

See your historical cash flow to understand when you can spend more or need to save

Everything at a glance

See all your business balancesNot included with QuickBooks Money. on one dashboard—no messy spreadsheets.

CASH FLOW CHART

Rest easy with instant insights

See your business money come in and out over time, so you can make smart business decisions, reflect on historical data, and pivot as you grow.