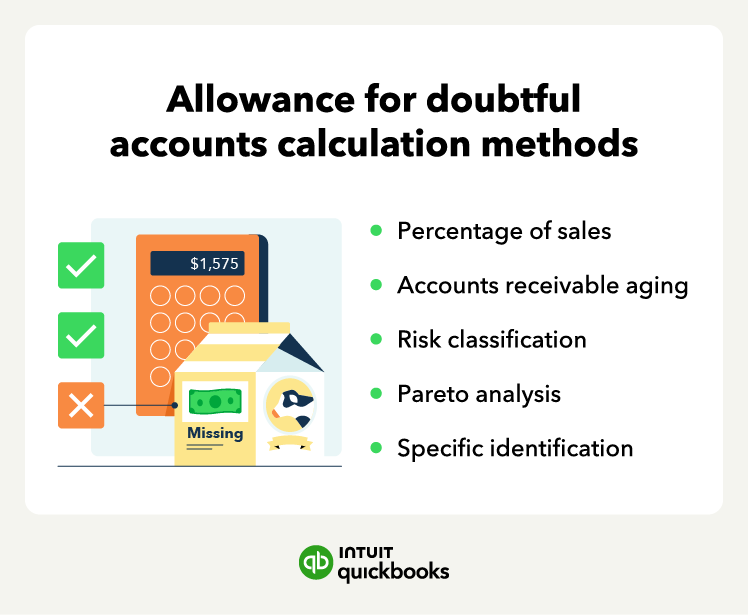

The risk classification method involves assigning a risk score or risk category to each customer based on criteria—such as payment history, credit score, and industry. The company then uses the historical percentage of uncollectible accounts for each risk category to estimate the allowance for doubtful accounts.

To use the risk classification method:

- Assign a risk score or category to each customer.

- Determine the historical percentage of uncollectible accounts for each category.

- Multiply the accounts receivable amount for each category by the historical percentage.

- Add up the estimated allowances for each category.

For example, our jewelry store may assign a customer a risk category of C. That category has a historical percentage of uncollectible accounts of 10%. The customer has $5,000 in unpaid invoices, so its allowance for doubtful accounts is $500, or $5,000 x 10%.

Pareto analysis method

The Pareto analysis method relies on the Pareto principle, which states that 20% of the customers cause 80% of the payment problems. By analyzing each customer’s payment history, businesses allocate an appropriate risk score—categorizing each customer into a high-risk or low-risk group. Once the categorization is complete, businesses can estimate each group's historical bad debt percentage.

For example, our jewelry store has 1,000 customers:

- We determine 200 customers are high-risk and 800 are low-risk.

- The historical bad debt percentage for the high-risk group is 5% and 1% for the low-risk group.

- The outstanding balance for the high-risk group is $500,000, and $1,500,000 for the low-risk group.

As a result, the estimated allowance for doubtful accounts for the high-risk group is $25,000 ($500,000 x 5%), while it’s $15,000 ($1,500,000 x 1%) for the low-risk group. Thus, the total allowance for doubtful accounts is $40,000 ($25,000 + $15,000).

Specific identification method

The specific identification method allows a company to pick specific customers that it expects not to pay. In this case, our jewelry store would use its judgment to assess which accounts might go uncollected.

For example, it has 100 customers, but after assessing its aging report decides that 10 will go uncollected. The balance for those accounts is $4,000, which it records as an allowance for doubtful accounts on the balance sheet.

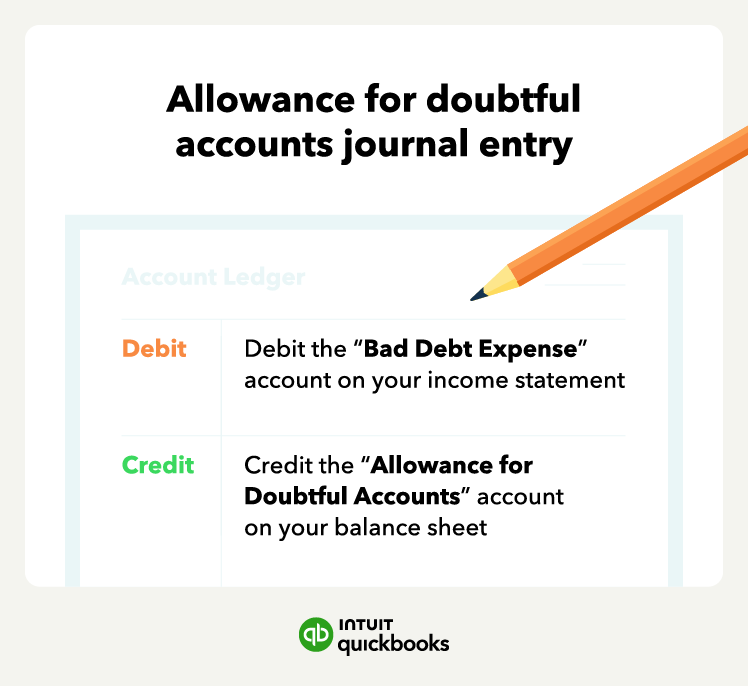

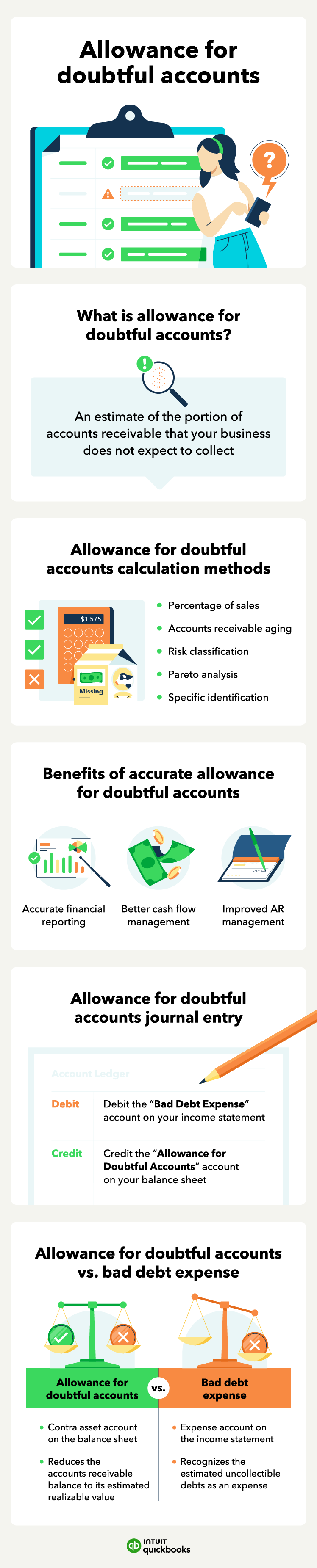

How do you record allowance for doubtful accounts