Survey findings: 79% of mid-sized business owners report digital tools are too small or too large

Growing pains: Mid-sized businesses are challenged to find right-sized digital tools

Mid-sized business owners say they are caught in the middle in their search for the right-sized digital tools to support their growth. They’ve outgrown the digital tools they started with when they were smaller, and also say they’re not yet large enough for enterprise-level systems.

This is just one of the findings from a recent study conducted by Wakefield Research, which surveyed 1,000 business owners at US-based companies with 10 to 100 employees to understand how well their digital tools are meeting their needs.

Key research findings

The survey revealed numerous insights regarding how mid-sized businesses feel about their digital tools. Among the highlights:

- 93% 1 of businesses surveyed with 10 to 100 employees say they have outgrown at least some of their digital tools or are paying for features they don’t use

- Among these businesses, many saw purchasing Enterprise Resource Planning systems (ERP) as a path to growth. Nearly half report they bought their system to grow beyond their business tools (49%) or because it fit their business needs at the time (48%)

- A majority (81%) of those surveyed acknowledge there aren’t many ERP solutions for medium-sized businesses, highlighting a significant, underserved market

- 47% say they don’t use all of their ERP capabilities and feel they overpaid

- A lack of customization is one of the top disadvantages to their current system, as noted by 47% of businesses

What does “mid-sized” mean, anyway?

There’s no concrete definition for what constitutes a mid-sized business versus a small or large one, so businesses themselves often subjectively define their own size. For this study, 1000 businesses were selected as mid-sized based on having 10 to 100 employees. However, when asked how they viewed themselves, answers were varied:

- 67% describe their company as a small business

- 19% describe their company as medium-sized or mid-market

- 14% describe their company as large or enterprise

Regardless of how businesses size themselves, survey results reveal larger companies have a greater need for insight and organization. More than half (53%) of surveyed businesses with 50 to 100 employees say they’ve outgrown most or all of their digital tools.

The research also demonstrates a direct correlation between business size and satisfaction with digital tools—businesses that described their companies as large/enterprise or medium-sized/mid-market are far more likely than their “small” counterparts to report that their tools aren’t meeting their needs.

Fast facts: Mid-sized businesses and apps

- 86% of businesses use some type of app.

- Among businesses using apps, 19 apps are in use, on average.

- Companies with 50 to 100 employees are much more likely to use 20+ apps than companies with 10 to 49 employees.

- 67% of businesses using apps say they are willing to pay $100+ per month for one app.

- 22% say they would spend between $200 and $300 for an individual app.

Top 3 reported challenges to business growth

- Technology management: 47%

- Recruiting talent: 42%

- Time management: 41%

Businesses are outgrowing their digital tools

Companies are increasingly relying on digital tools to manage critical data and processes, making software solutions an essential part of their growth strategy. An overwhelming 93% of businesses surveyed have outgrown at least some of their digital tools from when they first started the business—23% of those surveyed report they have outgrown all of them.

More than half (53%) of businesses with 50 to 100 employees say they’ve outgrown all or most of their tools compared to 38% of owners with 10 to 49 employees. Compounding the dissatisfaction: businesses say they feel they are unable to customize their digital tools for the specific needs of their business. As for the way these tools perform without customization, 48% of businesses report their digital tools are not designed for a business like theirs.

ERPs are often an unsatisfactory solution

More than half (54%) of businesses have an ERP solution and report adapting it to manage their day-to-day business processes. Many businesses saw purchasing ERP systems as a path to growth or as a means of overcoming the limitations of their previous tools. Nearly half (44%) reported they needed a larger ERP system to keep pace with their growth.

However, for businesses, the reality of their experience with ERPs often falls short. The survey revealed:

- 47% feel like they overpaid

- 20% barely used the system at all

- 53% aren’t using up to 25% of their system

- 32% of system capability goes unused

- 84% say their system is too large

These excess capabilities often come with a corresponding blow to the budget. With more touchpoints and processes to manage, 41% of businesses cite the financial costs of operating the ERP as a cause of exceeding project budgets.

Businesses demand flexibility and scalability

Forty-seven percent of businesses with ERP systems cite a lack of customization as one of the top disadvantages of their system. Faced with the challenges brought on by an ever-changing marketplace, maintaining a flexible posture is key. And while all-in-one ERP solutions are perceived as preferable to buying individual tools and integrating them together, there remains a concern among businesses about feeling locked into one set of tools (32%) and lack of adaptability with all-in-one tools (28%).

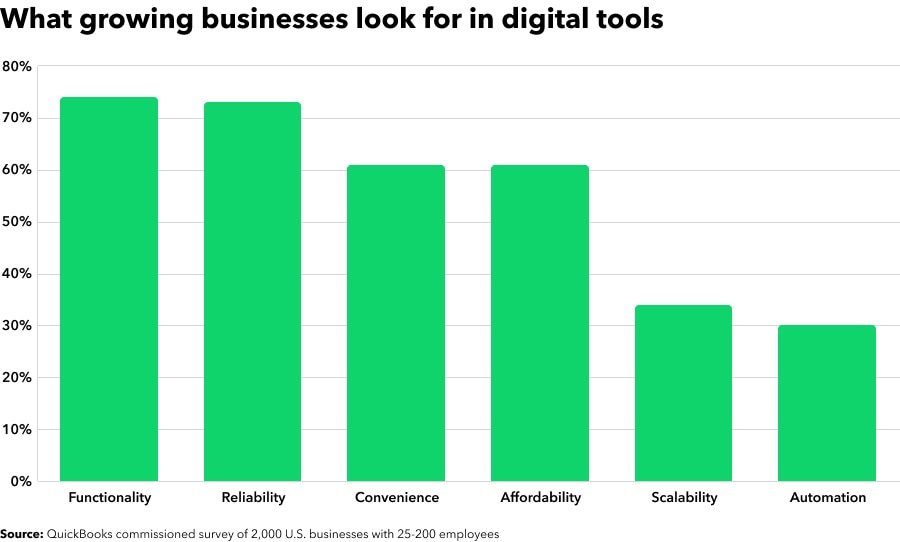

Of similar note, with 34% of businesses saying scalability is a defining value for their business, businesses need an impactful solution that fits their growing needs. Companies that described themselves as medium-sized/mid-market (42%) cite the need for scalability more frequently than their large/enterprise counterparts (20%).

Learn more about how QuickBooks helps

To learn more about the ways that QuickBooks Online Advanced fits the needs of growing mid-market businesses, or to get additional information about the research study cited in this article, contact Lyda Scrogings at lyda_scrogings@intuit.com.

1. Methodology:

The Intuit QB SMB Survey was conducted by Wakefield Research (www.wakefieldresearch.com) among 1,000 business owners at companies of 10 to 100 employees, between October 14 and October 25, 2021, using an email invitation and an online survey. Data has been weighted to ensure accurate representation of business owners at companies of 10 to 100 employees.