By Ana Bentes

October 13, 2023

By Ana Bentes

October 13, 2023

When it comes to adding workers to your business, the number of forms you’re faced with can seem endless.

You might have independent contractors who receive a 1099 form to report their income. But you might also have workers your business employs directly and receive regular pay and employee benefits, who will need a W-2 tax form.

Whatever the case, you may be scratching your head trying to understand the difference between the two. Read on to explore the differences and benefits of 1099 vs. W-2 regarding both the forms and workers, as well as other considerations to know before hiring a position for your business.

What is a 1099?

A 1099 is a form stating to the Internal Revenue Service (IRS) that a nonemployer paid money to an individual or business. There are many types of 1099 forms, but the most common are 1099-NEC and 1099-MISC .

These forms—typically issued to freelancers and independent contractors—report wages without taxes withheld, such as Medicare and Social Security, to the IRS. Those who earn more than $600 for nonemployee compensation will receive the 1099-NEC form, which replaced Form 1099-MISC.

1099 workers

A 1099 worker is a self-employed worker, independent contractor, freelancer, or gig worker. Generally, businesses hire these workers to complete a specific task or work on a specific project as defined in a written contract.

These workers are considered “self-employed,” so they pay their own taxes and provide their own benefits. You don’t need to withhold or file payroll taxes on their behalf or offer 1099 workers the same benefits you offer W-2 employees.

Some benefits of hiring 1099 workers include:

- They can bring additional skill sets: 1099 contractors can provide specialized skills and expertise beyond the capabilities of your core team. They are well-trained in their fields and can bring additional experience that may be more challenging to find in a W-2 employee.

- They can have short-term contracts: Typically, companies hire independent contractors for a specific project or amount of time. They can focus on a project without increasing your employee head count or compensation budget. When the contractor completes the project, they move on.

- It can cost less to hire them: You don’t need to withhold or file payroll taxes on 1099 compensation. You also don’t need to provide benefits like health insurance or retirement savings to 1099 contractors. Additionally, you can pay contractors per task or project. These factors can save you money you would otherwise spend on employee compensation.

However, there are also some disadvantages to hiring 1099 workers:

- You have less control over their work: Contractors define when and where they work, the tools they use, and how they do the job. So, they may provide a contract that outlines their payment terms, rates, and scope of work. Read their terms carefully or agree to mutual terms before you move forward with a 1099 contractor.

- You don’t have the protection of workers’ compensation: You don’t have to provide health benefits or workers’ compensation to your 1099 contractors. But if a 1099 worker injures themself on the job, they could hold your business responsible.

- There are additional legal considerations:While you might be able to fire an employee at will, dismissing a contractor for any reason could be a breach of contract. It’s good to have a trusted legal professional review the worker’s contract. You might also consider drafting legal protections in your own contract.

Lastly, hiring 1099 workers is usually best for businesses that need to hire help for one-time, specialized projects.

What is a W-2?

Form W-2 reports all payments an employee receives within a year. The employer provides this form to all employees at the end of the calendar year.

The information on a W-2 form includes:

- State income: The amount withheld for state income tax purposes.

- Medicare and Social Security income: The amount of money the employer withholds to pay FICA taxes.

- Taxable income: The amount an employee made that year and the amount withheld for federal taxes.

This information on the W-2 form is necessary to file income taxes during tax season.

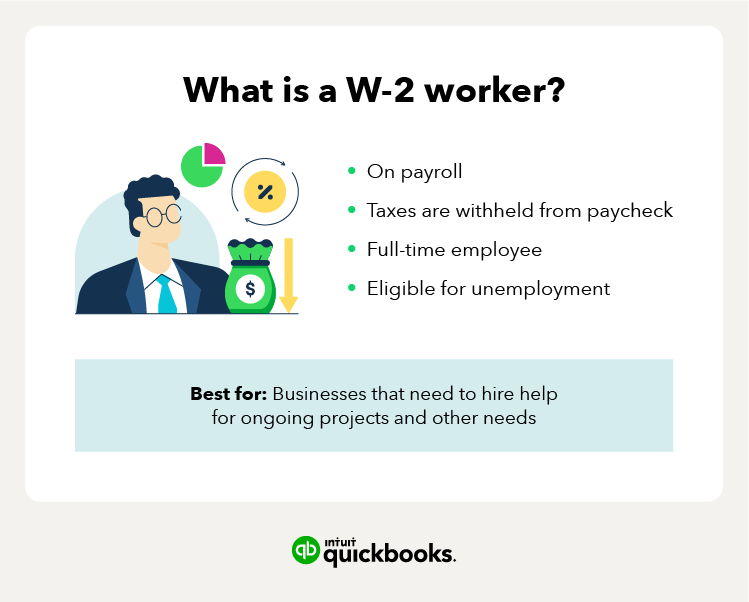

W-2 workers

A W-2 worker is an employee of your business, and you can hire them full-time or part-time. Employees work according to your business policies and schedule. They participate in employee benefits programs like health insurance, paid time off, and overtime pay. You must also pay them at least minimum wage.

You are required to withhold Social Security and Medicare taxes and file payroll taxes for W-2 employees. Additionally, it’s up to you to provide your employees with the tools and supplies they need to get their jobs done. W-2 employee is the default classification for any worker you can’t classify as a 1099 contractor.

Benefits of having W-2 workers include:

You have more control over their work:

Employers have control over employee schedules, business processes, and company policies. Employees must deliver work that meets company standards. If you need help in a certain way at a certain time, hiring an employee makes sense.

Your company benefits from employee longevity

While contractors tend to jump from gig to gig, employees stay with the company. The longer they stay, the better they understand your business objectives and brand. And they can provide more value over time. Employees can easily shift focus on short notice or wear multiple hats.

Employees are more committed to your company

Employees can develop a sense of loyalty to your business. This loyalty can translate to a better work ethic, higher morale, and a thriving company culture.

Disadvantages to hiring W-2 employees:

Employees require more time and effort

When you take on W-2 employees, you need to train and manage them. These tasks take an incredible amount of time and energy.

You supply the resources for employees

You’ll need to give your employees everything to do their jobs successfully. These resources include everything from additional training to tools and materials. And you’ll need to reimburse any business expenses.

The true cost of an employee is higher than you might expect

Employees cost more than just their salaries or hourly wages. You’re responsible for paying your share of Social Security and Medicare taxes. And you may provide employee benefits like health insurance and paid leave. These costs add up.

Lastly, hiring W-2 employees works best for businesses that need to hire help for ongoing projects and other needs.

What’s the difference between a W-2 and 1099?

1099 and W-2 forms are both common small business tax forms, but the differences include who receives the forms and how they are handled regarding tax rates and practices.

The main difference between 1099 and W-2 is that you issue 1099 forms to independent contractors and issue W-2 to full-time employees. Additionally, 1099 workers file their payroll taxes while you deduct payroll taxes from your W-2 employee's paycheck.

There are also some other differences between 1099 and W-2. Let’s take a look at some of them.

Taxes

Your tax obligations vary between 1099 contractors and W-2 employees. You pay 1099 workers per the terms of their contract. At the end of the year, they receive a 1099 form to report their income on their taxes.

As a business owner, you’re not on the hook to withhold or pay taxes for 1099 contractors, as they pay their own taxes and provide their own benefits.

If you pay a 1099 worker $600 or more for services provided during the calendar year, you’ll need to complete Form 1099-NEC. You must provide a copy of this form to the contractor by January 31 of the year following their payment.

W-2 employees receive a regular wage and employee benefits. As a business owner, it’s your responsibility to withhold taxes from their paychecks and report those taxes to the IRS on a W-2 form.

You must also deposit federal income taxes and unemployment taxes for unemployment insurance, as well as deposit Social Security tax and Medicare taxes for yourself and your employees. You must report on the taxes you deposit, as well as employee wages, tips, and other compensation.

Finally, you must deposit and report your employment taxes on time. The IRS has helpful information on depositing and reporting employment taxes for W-2 employees.

Hourly rates calculations

Another W-2 and 1099 difference is hourly rates. For 1099 workers, you may pay them a set amount, either hourly or by the project. Many contractors will outline their payment terms and rates in their contracts. 1099 contractors who get paid hourly may ask for a higher hourly rate than you pay your regular employees. Additionally, 1099 contractors pay their own taxes and supply their own benefits, so they may need to charge more per hour to cover those costs.

On the other hand, businesses will usually hire W-2 employees full-time or part-time with a monthly salary. Because of that, employers will pay half the employment taxes, such as Social Security and Medicare taxes. Currently, the tax rate for these employment taxes is 15.3% of a worker’s gross wages, so employers have to pay 7.65 of that and withhold the other half from W-2 employee paychecks.

1099 contractors pay the full 15.3% from the money they earn. They also need to file quarterly estimated tax payments and pay quarterly estimated federal and state taxes.

With this in mind, 1099 contractors need to make a minimum of 7.65% more per hour to cover the employer's share of Social Security and Medicare taxes.

Salaries and benefits

Contractors don’t always get the added benefits of health insurance, paid time off, and other employer-paid benefits that W-2 employees do. 1099 workers have to provide these benefits themselves. As a rule of thumb, benefits are worth about 30% of a worker’s total compensation package, according to the US Bureau of Labor Statistics.

A March 2023 report found that employer costs for employee compensation for civilian workers averaged $40.79 per hour they worked. Wages and salaries cost employers $28.76, while benefits cost $12.02. These benefits include paid leave, health insurance, and retirement savings

This means, a 1099 contractor needs to make a minimum of 30% more than W-2 employees to match employee compensation, including benefits.

Why it’s important to know the differences

It’s important to know the difference between 1099 independent contractors and W-2 employees for a few reasons:

- Misclassifying an employee: as an independent contractor may lead to hefty financial penalties, including up to a $1,000 fine for misconduct.

- Calculating taxes incorrectly: Employee classifications affect how both you and your workers are taxed. You’re required to withhold income taxes and pay taxes on the wages you pay to W-2 employees. You don’t usually have to withhold or pay taxes on the payments you make to 1099 contractors.

- Mistaking your working relationship: Employee classifications determine how much control you have over a worker’s schedule, payment, and other aspects of their job. Independent contractors define when, how, and where they work.

Every small business owner should understand the differences between these classifications and when to hire a W-2 versus a 1099 worker.

1099 vs. W-2: Which is better for your business?

The type of worker you hire depends on your business needs. If you’re working on a temporary or short-term project, a 1099 worker might be the right fit. But if you need temporary help during a busy holiday season, a seasonal W-2 employee is likely the more appropriate choice. Hiring both 1099 and W-2 workers is also a viable option, depending on your business’s needs.

Whether you have 1099 workers or staff employees, Quickbooks Online can help you manage your whole team by tracking your income, expenses, and tax deductions, as well as processing payroll.

QuickBooks offers 1099 e-filing services with QuickBooks Payroll1 and QuickBooks Contractor Payments. When you use QuickBooks Payroll or Contractor Payments, your 1099s will be automatically generated and e-filed for you, saving your time and helping you prepare for tax season. You can file unlimited 1099s, including 1099-NEC and 1099-MISC2.

1099 vs. W-2 FAQ

QuickBooks Online Payroll & Contractor Payments: Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services, subject to eligibility criteria, credit and application approval. For more information about Intuit Payments Inc.’s money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/.

1. Additional fees apply.

2. Unlimited 1099s: 1099s are e-filed only for the current filing year and for payments recorded in the system. Excludes amendment.

Related:

- https://quickbooks.intuit.com/r/employee-management/employee-benefits/

- https://quickbooks.intuit.com/r/payroll/what-is-workers-compensation/

- https://quickbooks.intuit.com/r/manage-employees/pto-policies/

- https://quickbooks.intuit.com/r/innovation/5-types-of-training-to-help-boost-employee-productivity/