You’ve built your business from the ground up. But one person can only scale for so long. At some point, you’ll need to hire employees. But it takes more than just finding the right person. Our guide can help you determine how to hire employees and go about the hiring process.

How to hire employees: 8 steps to simplify the hiring process

The 8 hiring process steps

To simplify the hiring process, we condensed them into 8 easy steps to recruit, interview, and hire employees at any business.

- Consider the legal requirements

- Define the roles and responsibilities for each job

- Find your ideal candidates

- Conduct interviews with qualified candidates

- Select your candidate

- Notify the candidate of job offer and compensation

- Report hires to state employment agency

- Establish a payroll system

Running a business is an entirely different ball game when you become an employer. There’s a lot to manage, so don’t be afraid to consult an HR professional or labor law expert regarding your situation.

Step 1. Consider the legal requirements

There are certain numbers, documents, and provisions you’ll need to consider to be ready to hire employees. And it can be easy to overlook essential steps because of local, state, and federal requirements.

To hire employees, you’ll need:

- An Employer Identification Number (EIN): The IRS will need to issue you a unique Employer Identification Number (EIN), or Tax Identification Number (TIN). Employees will use your EIN when they need to file their income taxes. And you’ll need it to report and file payroll-related taxes. You can apply for an EIN online .

- To register with your state revenue department: While sign-up processes and state tax ID numbers vary, many states use an Employer Account Number (EAN) for tax purposes. For specifics regarding your state, visit your state’s revenue or tax department, or consult a tax professional.

- To register with your state labor department: To hire employees, you’ll need to register your business as an employer with your state labor department. The U.S. Department of Labor (DOL) has published a guide to state labor departments . As you look into your state labor department, note state unemployment benefits and requirements for reporting new employees.

- To calculate each employee’s withholding tax: To calculate withholding tax, employees need to fill out Form W-4 . Calculating withholding tax rates for your employees is only one step. Withholding taxes and paying the appropriate tax bodies is a much bigger task. Automated payroll software can help you simplify this process as you bring on employees.

- To purchase workers’ compensation insurance: Workers’ compensation is a form of insurance that may help you compensate workers who sustain injuries while under your employment. Ultimately, your business’s requirements will depend on your state laws on workers’ compensation .

- To issue Form I-9 to each new hire: Each employee must verify their eligibility on Form I-9 . This form ensures that the employee is who they say they are and that they’re authorized to work in the U.S. You must submit an I-9 for every employee you hire, including U.S. and non-U.S. citizens.

- To display workplace posters: Workplace posters are a federal requirement. The DOL produces updated workplace posters for labor laws, but you may subscribe to a workplace poster compliance service to ensure you get the right posters for your business.

Step 2. Define the roles and responsibilities for each job

With the legal boxes checked, it’s time to define job roles and responsibilities. When creating a role and drafting job descriptions, ask yourself: What problems am I trying to solve? What skills and activities will solve that problem?

Once you answer those questions, translate them into job descriptions. Avoid vague descriptions or roles that cover too much ground. Prioritize your pain points, and define roles that will attract candidates who can meet your business’s needs.

At this stage, you might also conduct market and salary research for your jobs. If you pay too little for a complex job, you may not attract the right candidates. It will be important to set realistic expectations around what you can pay for the new role.

Step 3. Find your ideal candidates

Your future employees are everywhere: on social media, at trade shows, on career sites. You must find them where they are and entice them to join your business. That means you need to post your jobs where your ideal candidates will find them.

Here are 3 places to find job candidates:

- Job boards and career sites: There’s no shortage of these sites and it can be hard to make your jobs stick out from the competition. However, people on these sites are actively seeking employment. If you don’t have a presence on career sites, you may be missing out on the easiest way to find candidates.

- Your network: Regardless of how connected our world becomes through the internet, your personal network may be the best source for qualified candidates. A strong network can help you find trusted referrals.

- LinkedIn: Whether you’re posting new jobs or expanding your network, LinkedIn is where candidates and employers expect to meet in the modern world.

Key takeaway: While posting to online job boards can help recruit a multitude of applicants, take advantage of your network through platforms like LinkedIn to connect with a wide applicant pool.

Once you’ve found the right candidates for the position, the interview and job offer process begins. Distinguishing the best candidates from the applicant group can be a difficult ordeal, but we’ve outlined steps to simplify the process.

Step 4. Conduct interviews with qualified candidates

Don’t walk into an interview without a plan. You need to be as strategic with your interviews as you were with defining your jobs and finding candidates. Keep up that problem-solving mindset and create a list of questions that you can pose to all candidates.

There’s no perfect set of interview questions, but the following can keep you on track when assessing how each candidate can meet your business’s needs.

- What are your top 3 skills that qualify you for this position?

- What’s the first project or challenge you’d want to tackle?

- How can you help grow the business?

- What’s one thing you would do to improve or change the business?

These questions can help you gauge whether the candidate understands your business and how they can impact the business. Now is also the time to discuss each candidate’s pay expectations based on their experience, education, and skill set.

Compare the figures your candidates present with what you found in your market and salary research. And remember not to dismiss a candidate out of hand if their salary expectations are higher than you anticipate. A higher number may mean you need to adjust the job responsibilities or incentivize your ideal candidate with more benefits and perks.

Step 5. Select your candidate

There’s no formula for choosing the best candidate. Qualifications and education are important, but so is the candidate’s character and core values. Sometimes skills and experience alone won’t cut it. The right candidate will bring the right qualifications and values to the business. And they’ll bring a level of intelligence and creativity that you haven’t imagined yet.

Before you notify the candidate of the job offer, be sure to let them know you will be conducting a background check. Background checks allow you to see the employee’s criminal and driving records which could potentially affect your business. This is often done through a background check service to make sure all the information you’ve been provided is correct.

Step 6. Notify the candidate of their job offer and compensation

When you’re ready to extend a job offer, stay positive and congratulatory in your communications, but make sure you don’t give the candidate an open-ended time frame to accept the offer. You may make your offer contingent on an answer by a specific date, and propose or ask for their preferred start date. When you extend a job offer, be positive, but know that it’s OK to put your business needs first.

With your job offer letter, you’ll want to include information about the candidate’s compensation package. If the compensation you offer is lower than what the candidate expressed in their interview, communicate your company’s perks and benefits. You might also include a progression path so that the candidate can assess your expectations for improvement and higher compensation.

Key takeaway: Provide new hire candidates with a concrete job offer letter that outlines the compensation package and benefits of joining your organization.

Hiring your first employees is a landmark achievement, but the work doesn’t stop there. Make sure you take the necessary steps to fully onboard your new hires successfully, a couple of which we’ve covered below.

Step 7. Report hires to state employment agency

Now that you’ve hired the best candidates, you’ll need to report them to your state’s labor agency. Depending on what state your business operates in, the process may be different, so be sure to search your state’s hiring requirements .

Reporting new hires to the state is required for payroll tax purposes and you will need to provide information like your employer payroll tax account number, branch code, your EIN, business name and address, as well as your contact information. You will also need to obtain your employee’s full name, SSN, home address, and start date to send to your state’s employment agency.

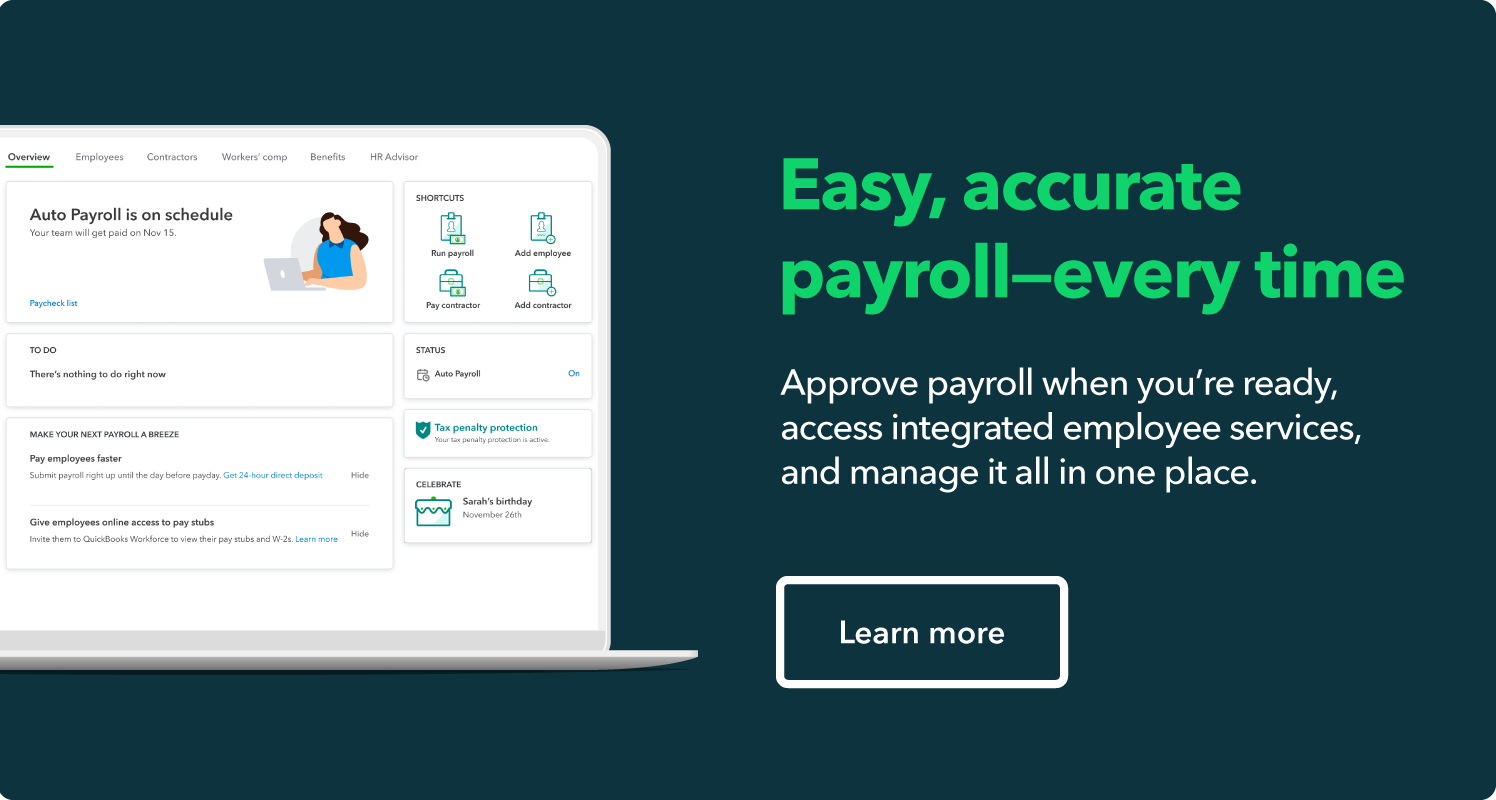

Step 8: Establish a payroll system

To make sure employees are compensated for their work as well as paying the appropriate taxes, companies need a payroll system . Although payroll can be conducted independently, you can also hire an accountant or use a payroll service. Many business owners opt for using a payroll system since you can combine this service with a human resources platform as well as having the complicated process of taxes taken care of.

Best way to hire employees: 5 best practices from top companies

There’s no shortage of hiring best practices to find across the web. But which best practices are worth their salt? You may consider looking at some top companies and take inspiration from what they’re doing.

1. Create a culture deck for job candidates

Netflix believes that its success depends on its culture. From its early days, Netflix has published a culture deck that outlines what it expects from employees. This deck helps candidates and employees understand expectations and what it takes to succeed at the company.

Key takeaway: Having a visual representation of what it’s like to work at your company may encourage candidates to apply, given they have a better idea of what your business vision and mission is.

2. Audition candidates instead of interviewing them

After some basic screening, Automattic —the makers of WordPress, a content management system—has largely done away with traditional interviews. Instead, the company pays prospective employees to work in the positions they’ve applied for. It’s more of an audition than an interview. Consider how a job audition, instead of an interview, would work for your business.

Key takeaway: Transforming the interview process can show candidates that your business values innovation and new ideas.

3. Launch a recruitment campaign

Chipotle and McDonald’s are two examples of companies that have successfully executed massive recruitment campaigns. You might not be ready to hire thousands of workers at once, but the concept allows you to promote your business to a broader audience. If you have several positions to fill, a recruitment campaign may help you bring in more candidates.

Key takeaway: Investing in a recruitment campaign can expand your reach to more candidates than you otherwise would have.

4. Prioritize diversity and inclusion

Be sure to consider how you are appealing to candidates from a variety of backgrounds during the hiring process. Messaging platform Slack publicly shared its employee demographics including gender identity, ethnic backgrounds, and other minority identities. To better its efforts at representation and inclusion at the company, Slack also partnered with a coding nonprofit called Code2040 in order to help Black and Latinx computer science students excel in their career.

Key takeaway: Showing candidates that their representation and inclusion is important to your company will ensure they see your organization as somewhere where their voice is heard and valued.

5. Collect candidate feedback

Candidates who apply to DocuSign receive a candidate experience survey regardless of whether or not they received an offer to provide feedback on their experience with their recruiter. The survey asked candidates if their recruiter gave them a satisfactory overview of the company, their value proposition, how they were treated, and if they received timely updates on their application status. Showing candidates that their experience matters can encourage them to apply for positions in the long run.

Key takeaway: Making your candidates feel heard during the hiring process allows for a positive relationship with the company for future communication down the line.

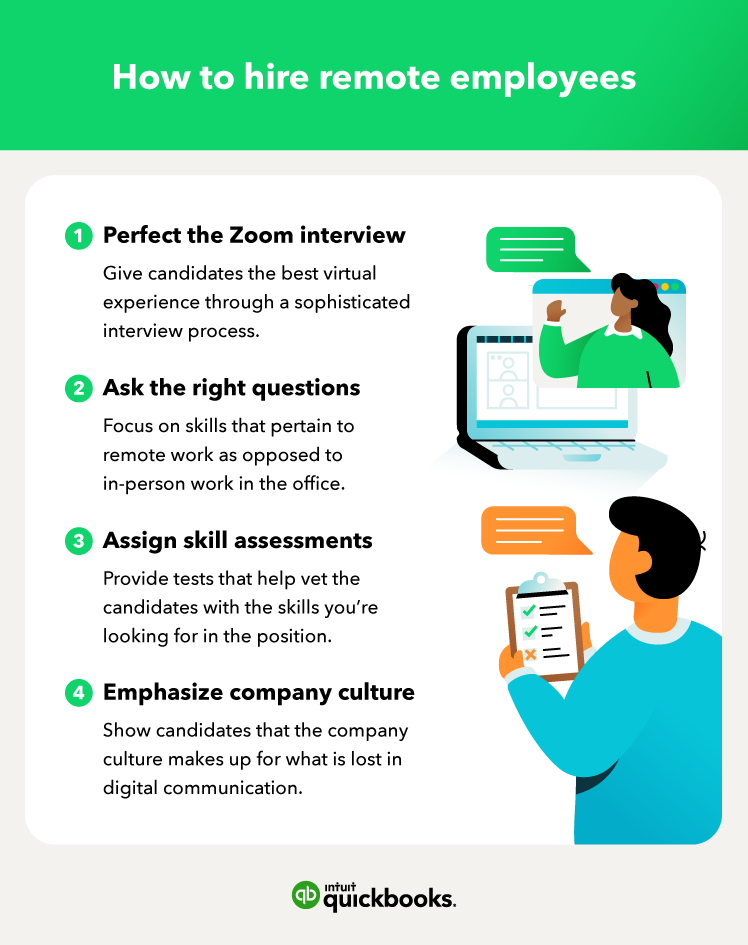

Tips for hiring remote employee

Now that we’ve covered best practices during the hiring process, we’ll cover some best practices that apply specifically to hiring remote employees.

- Utilize video conferencing. Platforms like Zoom, Google Meet, and Microsoft Teams are excellent video conferencing softwares you can use to conduct video interviews. This helps supplement the face-to-face communication that is lost to the virtual hiring process and gives you a better idea of who the candidate really is.

- Focus on what makes a good remote worker. Remote work requires employees to be self-directed, organized, and have good digital communication skills. Make sure your hiring criteria includes skills specific to remote work so that candidates have an accurate understanding of what is expected of them.

- Try using skill assessments. Online job boards like LinkedIn often have skill assessments to go along with certain job applications. These can help determine if the candidate has the skills you need prior to onboarding so that they meet the expectations for the role. Skill assessments can cover anything from a certain software like Microsoft Word to a technical skill like coding.

Key takeaway: Remote hiring may be more challenging than in-person hiring, but hiring managers can still get a strong understanding of candidate skills through video conferencing and skill assessments.

Make the best hiring decisions for your business

Whether you’re hiring your first employee or improving how you’ll hire your next one, take your time. You shouldn’t rush yourself to hire just anyone—you’re hiring a team member, someone who shares a lot of the passion you have for nurturing your business . Your hiring decisions, especially your early hiring decisions, are among the most critical you’ll make for your business. Be strategic and make a plan that you can scale as you grow.