An invoice is a document used to itemize and record a transaction between a vendor and a buyer.

Typically, a business sends an invoice to a client after they deliver the product or service. The invoice tells the buyer how much they owe the seller and sets up payment terms for the transaction.

In this post, we’ll explore the purpose of invoices and provide an example. We also have an invoice generator so that you can set up invoices for your small business needs.

What is the purpose of an invoice?

Businesses can use invoices to track what customers owe in total as a way to monitor cash flow.

Invoices can help companies receive payment in full, on time. And they serve as records of sale and provide a way to track:

- The sell date of a good or service.

- How much the business charged for the good or service.

- Any outstanding balances the client owes.

Additionally, invoices can help you protect your company in the event of an audit, as they help to create a paper trail. Detailed invoices will show the IRS exactly where your money came from should they question your tax returns.

When selling products or services, enter the invoice amount as accounts payable on the buyer’s end. For a business, the invoice is in accounts receivable.

Is an invoice a receipt?

While similar information is included in sales receipts and invoices, they are not the same. An invoice is issued to collect payments from customers, and a sales receipt documents proof of payment that a customer has made to a seller. Receipts are used as documentation to confirm that a customer has received the goods or services they paid for, and as a record that the business has been paid.

What’s the difference between an invoice and a bill?

Both invoices and bills are records of a sale that indicate how much a customer owes a seller, and both are issued before a customer has made payment for the transaction. However, there are some differences between each term.

Invoice vs. Bill

- An invoice documents a sales transaction where the seller collects payment for products or services at a later date. A supplier may use the term “invoice” or “sales invoice” to describe a customer payment request.

- A bill refers to a document of sale wherein customers pay immediately. Customers may also use the term “bill” to describe a request for payment due to their vendor.

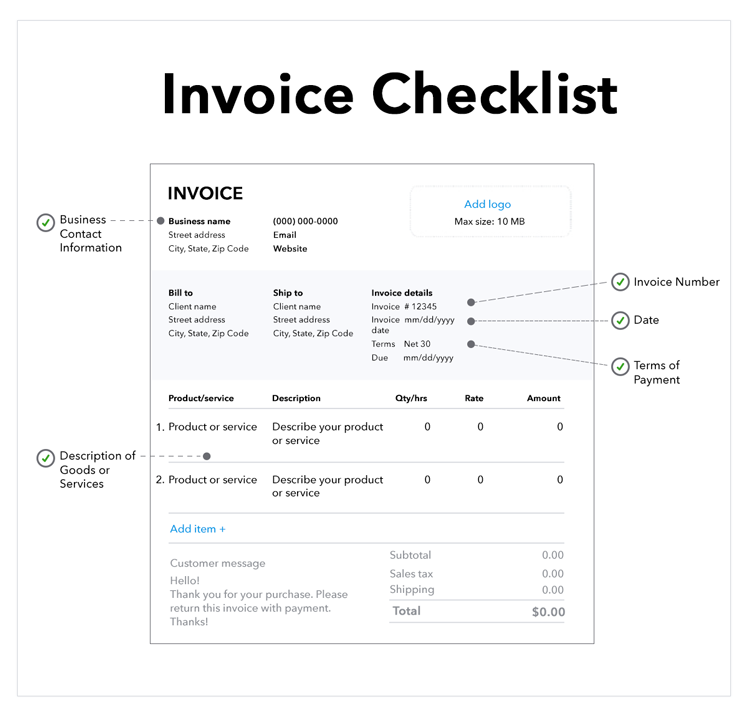

What does an invoice include?

Invoices aren’t necessarily standardized. They can vary by vendor or contractor. However, all invoices should include five components:

- An invoice number

- A date

- Business contact information

- Descriptions of goods and services

- Payment terms

Invoice number

An invoice number should be assigned to each invoice you issue. This reference number establishes a paper trail of information for you and your customers’ accounting records. Assign invoice numbers sequentially so that the number on each new invoice is higher than the last. Invoices aren’t necessarily due immediately when customers receive them. You may choose to set invoice payment terms of up to three months to give your customers the flexibility to manage their cash.

Date

The invoice date indicates the time and date the vendor officially records the transaction and bills the client. The invoice date is a crucial piece of information, as it dictates the payment due date and credit duration. Generally, the due date is 30 days following the invoice date. But this can vary based on a company’s needs and the agreement with the client or buyer.

Business contact information

Within an invoice, you must provide your business contact information, including name, address, phone number, and email address, along with your client or buyer’s information.

Descriptions of goods or services rendered

You should enter every product or service you provide as a line item on your invoices. Include price and quantity for each line item. At the bottom of the invoice, add up all of the line items, and apply any tax charges.

Here’s a quick checklist of what to include when listing products or services provided:

- The date you completed service

- A description of services that specifies what you provided at the unit level

- How many units your customer ordered

- The rate per unit

- The total number of units

- The total amount due

- Any applicable tax

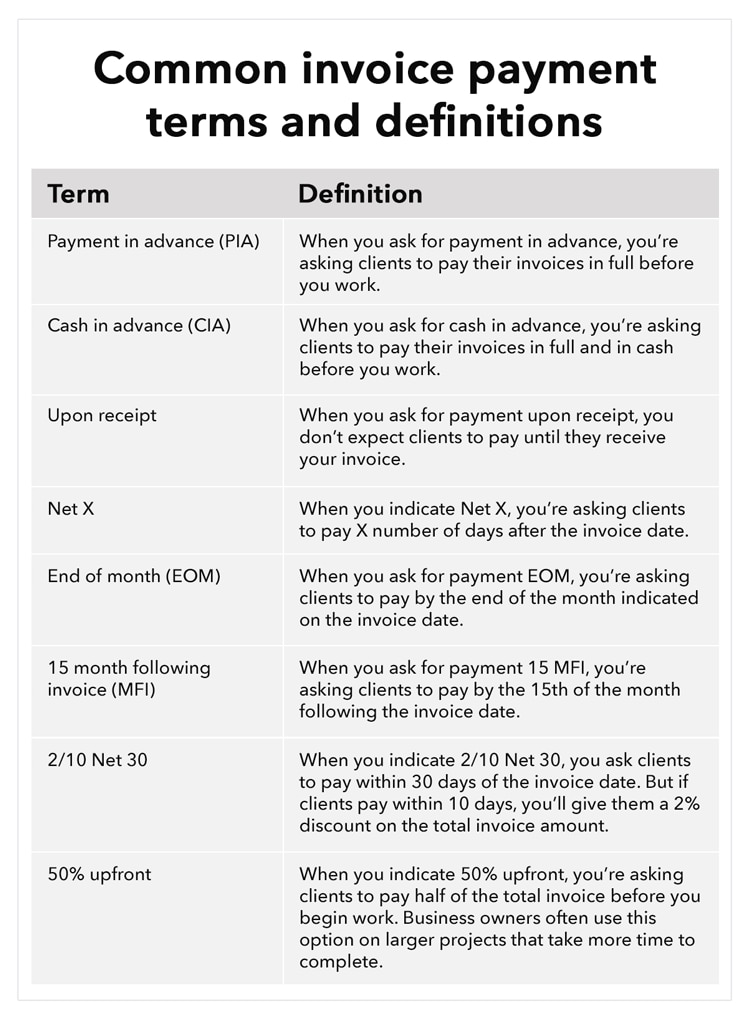

Payment terms

To increase the likelihood of receiving payment on time, provide clear details about payment expectations. Your payment terms should specify the amount of time the buyer has to pay for the agreed-upon purchase.

Choose invoicing terms that encourage early payment to maximize your cash position and the likelihood of getting paid. You may choose to collect half of the payment upfront or partial payments over time or require immediate payment upon completion.

When setting payment terms, consider how to handle late payments. You might also consider a customer’s credit history when developing payment terms, particularly for large sales.

Then you can decide how long your customer needs to settle an invoice. Net 30 days (or “N/30″) is one of the most common terms of payment. It means that a buyer must settle their account within 30 days of the invoice date.

It’s important to remember that 30 days is not equivalent to one month. If your invoice is dated March 9, clients are responsible for submitting payment on or before April 8. Businesses may also set invoice terms to Net 60 or even Net 90, depending on their preferences and needs.

There are many different invoice payment terms, so it’s important to choose the right payment terms for your business. The chart below shows some of the common payment terms you may choose.

Invoice example

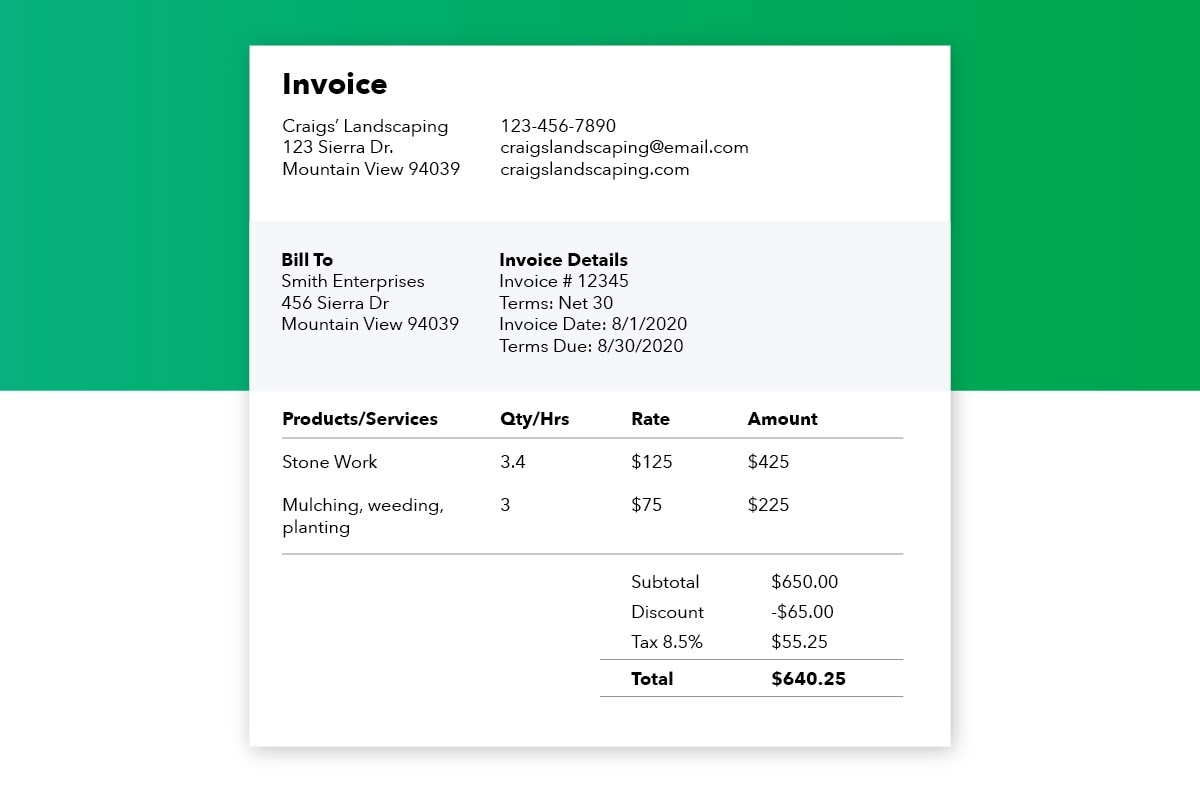

While invoices may vary by business, all typically follow the same structure. Here is how all of the above details come together into a sample invoice:

Common types of invoices

Different types of invoices can be issued to customers depending on the purpose of the invoice. Here are a few of the most common types of invoices you may use during the payment process.

Pro forma invoice

Pro forma invoices are issued to a customer before a product or service is delivered. Businesses use pro forma invoices to help customers understand the scope and cost of an upcoming project. Pro forma invoices are sent before a formal invoice is issued to give customers an estimate of how much a product or service will cost once delivered. The terms in a pro forma invoice may need to be adjusted as a project progresses, but they can be a helpful tool to ensure businesses and customers are on the same page before work begins.

Interim invoice

Interim invoices are issued when a large project is billed across multiple payments. Interim invoices are sent to customers as progress payments against a project come due. Interim invoices can help businesses manage cash flow by allowing them to collect payments throughout the course of the project. Interim invoices can help you cover the costs associated with a project as work is completed, instead of waiting until the project is done.

Recurring invoice

Recurring invoices are issued to collect recurring payments from customers. Typically, recurring invoices are issued throughout the course of an ongoing project. As an example, a marketing agency may issue recurring invoices to clients on a monthly basis to bill for services provided. If a business bills a client for the same amount on a recurring basis, it can be helpful to automate invoicing to reduce some of the work associated with creating and sending invoices.

Credit invoice

A credit invoice is issued when a business needs to provide a customer with a refund or discount. The invoice will include a negative amount to cover the cost of the amount returned to the customer. For example, if you accidentally overbilled a client for services, you can issue a credit invoice for the amount overbilled to provide documentation of the amount you’re refunding to the customer.

Debit invoice

A debit invoice is issued when a business needs to increase the amount a client owes for a service or product. For example, if you underbilled a client for services, the scope of a project increased, or you worked additional hours on a project after sending an invoice, you can issue a debit invoice to account for the difference.

Past due invoice

A past due invoice is an unpaid invoice that is past its due date. When an invoice is past due, it means your customer or client hasn’t paid you according to the agreed payment terms. Past due invoices can impact cash flow, and collecting overdue invoices can cost business owners time and energy. Writing clear invoices that are easy to understand may help reduce the risk of an invoice being past due. Offering a variety of payment options may also help reduce past due invoices. For example, business owners may consider using pay-enabled invoices that allow customers to pay their bills right from the online invoice.

Commercial invoice

Commercial invoices are customs documents used when a person or business is exporting goods internationally. The information included in commercial invoices is used to calculate tariffs.

There is not a standard format for commercial invoices, but some specific pieces of information are required:

- The name, address, and phone number of both parties involved in the transaction

- The goods being exported and reason for export

- A description of the goods being shipped, including what the item is used for, the number of units being shipped, and the value of the units

- The country or territory of origin

- The Harmonized System code assigned to the goods being shipped

- The number of packages being shipped and their total weight

- The shipper’s dated signature

Invoice templates

If you’re ready to create an invoice, QuickBooks offers many free, customizable invoice templates to help you create different types of invoices in a variety of file formats. Options include templates for pro forma invoices, freelancer invoices, service provider invoices, and more. Find a free invoice template that’s right for your business on our free invoice templates resource page.

You can also use our free invoice generator tool to make and download custom invoices online.

Best practices for writing an invoice

As you create an invoice, keep these tips in mind to ensure both parties are clear on payment expectations.

1. Write clear product descriptions

If you own a service-based business, include the title of your project, as well as a description of the activities you perform. If you’re selling a range of products, include your SKU or product ID in the itemized list on your invoice.

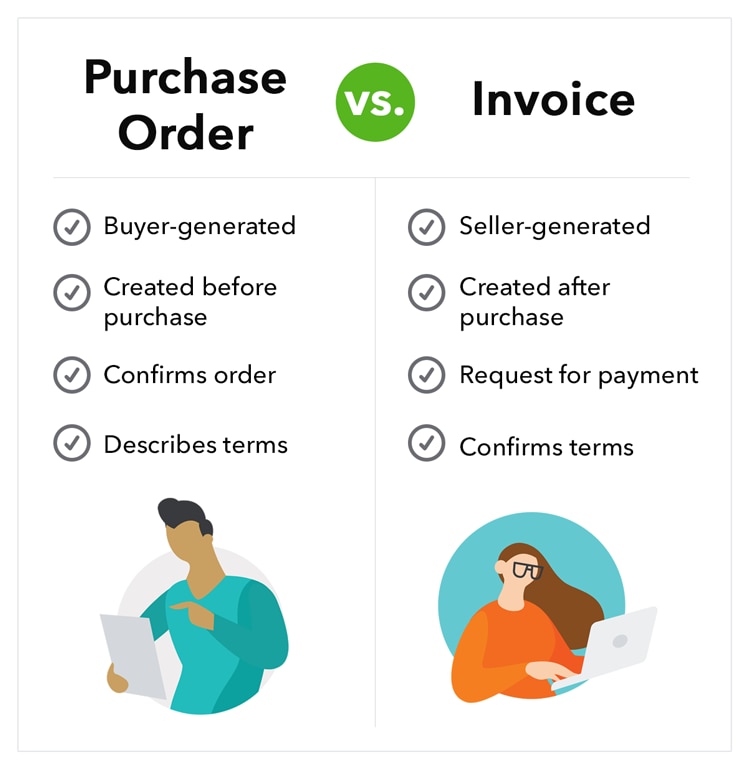

2. Differentiate purchase orders and invoices

Invoices are sometimes confused with purchase orders, but these documents serve different purposes.

In general, sellers issue invoices, and buyers issue purchase orders (PO). A purchase order is a purchase contract between a buyer and a seller.

For example, a local coffee shop wants to buy five cases of espresso from their favorite distributor. The coffee shop owner might sign a purchase order when they buy the product. The distributor will issue an invoice upon receipt of the coffee.

3. Offer online payment options

To streamline your invoicing efforts, make the payment process easy. Provide customers with an easy way to pay your invoice to encourage on-time payments and improve their experience with your company. Using QuickBooks, you can create electronic invoices and accept payments from one location, improving the overall transaction for your team and your clients.

When should invoices be issued?

Create and send an invoice as soon as you complete an order or service. Failing to invoice clients quickly can lead to delayed payments, and timely invoicing can help you improve cash flow. Using metrics like days sales outstanding (DSO) and the accounts receivable turnover ratio can help you keep track of payment speed and your accounts receivable efficiency.

How long should you give someone to pay an invoice?

Define clear payment terms that outline how long customers have to pay their invoices during the sales process. Net 30, or 30 days, is a common amount of time given to pay invoices, but choose payment terms that make sense for your business, your customer, and the transaction. Options range from requiring payment in advance, to net 90 terms which give customers 90 days to pay outstanding invoices. The cost and complexity of a project may factor into the payment terms you choose.

Are invoices legal documents?

No, invoices are not legally binding documents on their own. Invoices do not contain proof that a business and its customer have agreed on the terms of payment outlined in the invoice. To reduce the chances of a disputed invoice, businesses may create contracts that outline the details of a transaction. Contracts signed by both parties can act as legal documents, reduce the chance of misunderstandings about transactions, and may help speed up the payment process.

What happens when a customer refuses to pay an invoice?

Sometimes customers may disagree with an invoice they’ve been issued. When this happens you’ll need to begin the process of resolving the invoice dispute. This starts with a conversation between you and the customer to determine which elements of the invoice the customer disagrees with. Some disputes can be resolved through discussion, but you may need to escalate to taking legal action to collect payments if you and your customer can’t reach an agreement about the disputed elements of the invoice.

In other cases, customers may not have an issue with the invoice, but rather simply haven’t paid the invoice according to the agreed payment terms. In this situation, contact your customer about the unpaid invoice as soon as possible. If your attempts to collect payment aren’t successful, you have a few options, such as invoice factoring or taking legal action. Letting customers know you offer discounts for early payments or charge late fees on overdue invoices may encourage them to make timely payments.

Using accounting software to automate invoicing and accept payments

QuickBooks Payments makes it easy to create professional invoices and accept payments in one place, improving the overall transaction process for your team and your clients.

With QuickBooks Payments invoicing features, you can accept payments, send custom invoices, and take advantage of automatic matching to streamline your bookkeeping. Financial statements update in real time, immediately reflecting shifts in your accounts receivable and bank account balances.

Key takeaways

Invoices are an essential tool that business owners can use to keep records of sales. By crafting clear, informative invoices and following an invoicing process, you can appropriately represent yourself to the IRS in the event of an audit. And you can increase the likelihood of getting paid on time, every time.

Whether you've started a small business or are self-employed, bring your work to life with our helpful advice, tips and strategies.