Types of small business 1099 forms

There are over 20 types of 1099 forms. Many small businesses will only come in contact with a handful. There is the 1099-NEC, but also the likes of the 1099-MISC form, which allows businesses to report miscellaneous income and expenses.

Five of the more common 1099 forms small businesses send or receive are:

- Form 1099-MISC: This form is for reporting miscellaneous income, such as prizes and attorney fees. Small businesses may both send and receive this form.

- Form 1099-NEC: This form is similar to the 1099-MISC, but it specifically reports nonemployee compensation of over $600. You’ll use it to report payments to independent contractors who are not employees.

- Form 1099-K: This form reports payments via third-party payment applications, such as PayPal and Venmo. If you process over $600 on one of these apps or marketplaces like eBay, you’ll receive one of these forms.

- Form 1099-INT: This form reports interest income, such as from bank accounts. Small businesses may receive this form if they have interest-bearing accounts or investments and generate over $10 in interest during the year.

- Form 1099-DIV: This form reports dividend income, such as from stocks and mutual funds. Small businesses may receive this form if they own investments that pay dividends and collect over $10 in dividend income during the year.

The specific 1099 forms that a small business receives will depend on the type of income it generates and the payments it makes to others.

When do you need to send 1099-NEC forms?

When it comes to issuing 1099-NEC forms in particular, if you pay any freelancer or contractor over $600 for the calendar year, you’ll need to send them one. In other words, you send a 1099-NEC to each contractor you pay over $600.

1099-NEC forms serve two purposes:

- Reports nonemployee compensation payments to the IRS

- Allows your contractor or freelancer to do their taxes

If you are a small business with employees that you issue a paycheck to and withhold payroll taxes, you won’t issue a 1099-NEC to them. Instead, you issue employees a W-2 tax form. However, there are other 1099 forms your small business may need to send or receive that have nothing to do with your workers.

Note that Form 1099-NEC is for nonemployee compensation. If you need to report payments of over $600 for other things, such as rent, prizes and rewards, attorney fees, and medical and health care payments, you’ll use Form 1099-MISC.

Where can you get 1099 forms?

If you are filing by paper, you can find blank informational copies on the IRS website, such as the 1099-NEC. However, you’ll need to order blank pre-printed 1099s that you can use.

Note that before preparing your 1099 forms, you’ll need to collect W-9 tax forms from those you need to send 1099 forms to. The W-9 form is the equivalent of the W-4 form that employees complete. It contains key information, such as Social Security or tax identification number.

If you use accounting software like QuickBooks, you can simply electronically file your 1099s.

Small business 1099 filing requirements

For filling out your 1099 forms, the process is similar no matter which form you need. You’ll find that there are several copies:

- Copy A you’ll send to the IRS and

- Copy 1 you’ll send to your state tax department (if required)

- Copy B and Copy 2 go to the recipient, such as your independent contractor

- Copy C is for your records

The recipient will use their copies to file their federal and state tax returns. The due date for filing 1099 forms is March 31 if done electronically (or Feb 28 if by paper).

However, the recipients of 1099 forms, such as 1099-NEC and 1099-MISC forms, must get their copy by Jan 31.

1099 filing tips for small businesses

Small businesses can make filing small business 1099 forms easier with a few best practices.

To ensure a smooth 1099 filing process, follow these steps:

- Gather necessary information: Collect the information you’ll need from your small business tax prep checklist. This includes info from each payee or independent contractor. It’s best to have them complete a Form W-9 to get their info before doing business together.

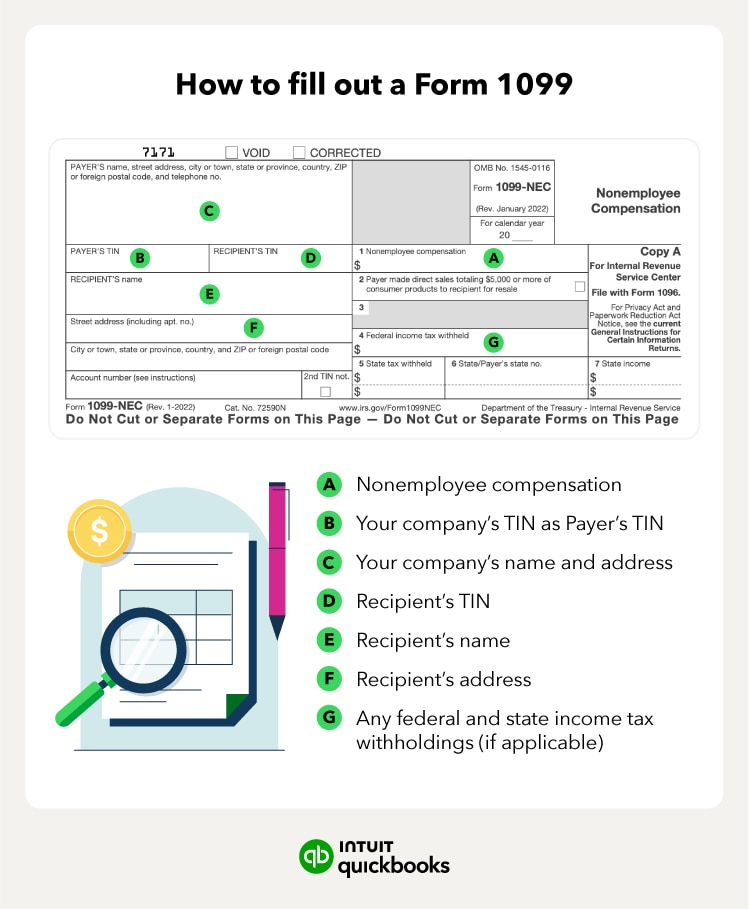

- Complete your forms correctly: Use the appropriate 1099 form, such as the 1099-MISC or the 1099-NEC, for nonemployee compensation. Fill in the required information for each contractor, including the amounts paid.

- Submit to agencies: Send a copy of each completed form to both the contractor and the appropriate agency. This will be the IRS for most small businesses, but you may also need to send copies to your state tax department.

- Be aware of deadlines: The deadline for many 1099 forms is March 31 if you e-file, but deadlines are usually sooner if you paper file. Also, the deadline for Form 1099-NEC is much earlier than others—on Jan 31.

- Keep records: Maintain copies of the 1099 forms and any supporting documentation for at least three years. These records can help with tax audits or other purposes.

When filing your 1099 form, here are some of the key sections you’ll need to fill out: