While small business owners are busy running the business and managing cash flow, it’s important to carve out a little time to ensure you keep as much money as possible in your pocket.

There are many tax breaks for small businesses—and you probably want to know all of them to help reduce your tax liability and keep more money in your small business.

We’ve pared down 23 of the highest impact and most generous tax deductions and write-offs available to small businesses in 2024, examples of each, and how much you can deduct. These tax breaks include:

- Startup costs

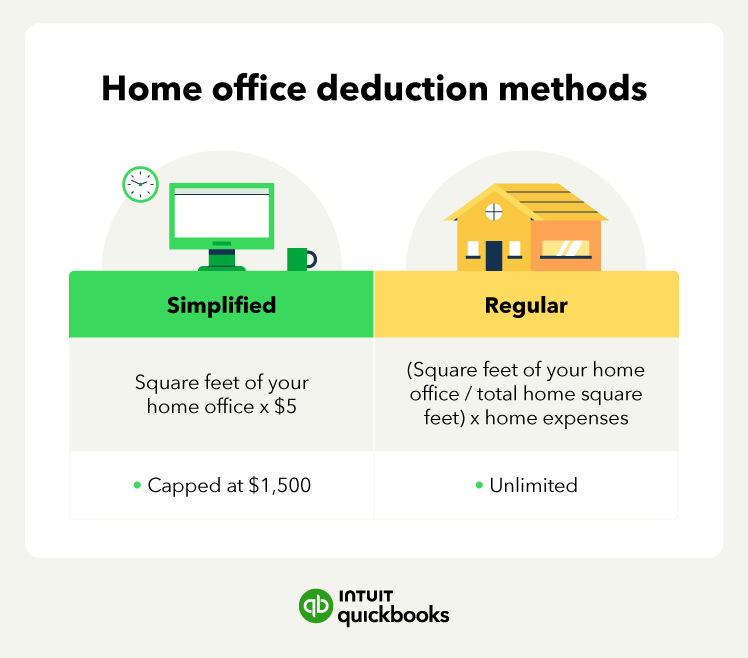

- Home office

- Retirement plan contributions

- Depreciation

- Health insurance

- Meals

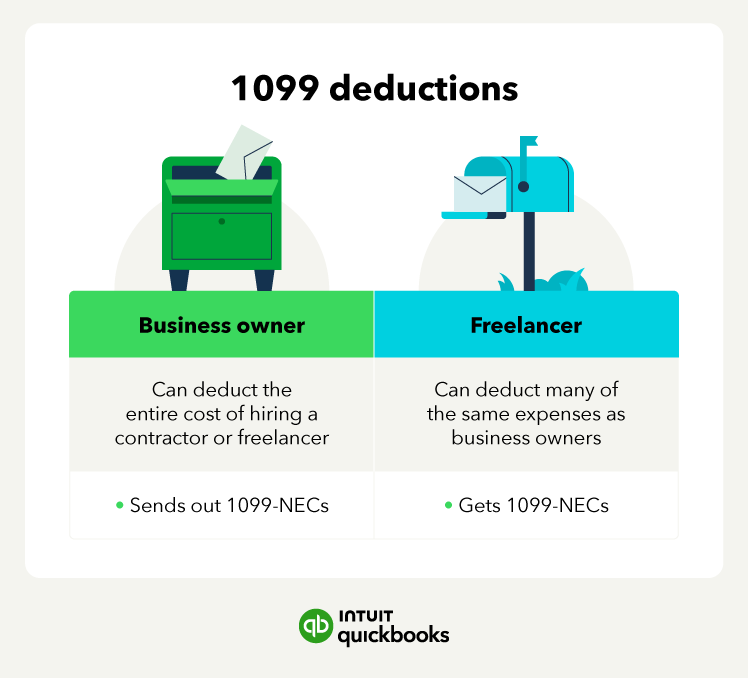

- 1099 deductions

- Travel

- Gifts

- Bad debt

- Education

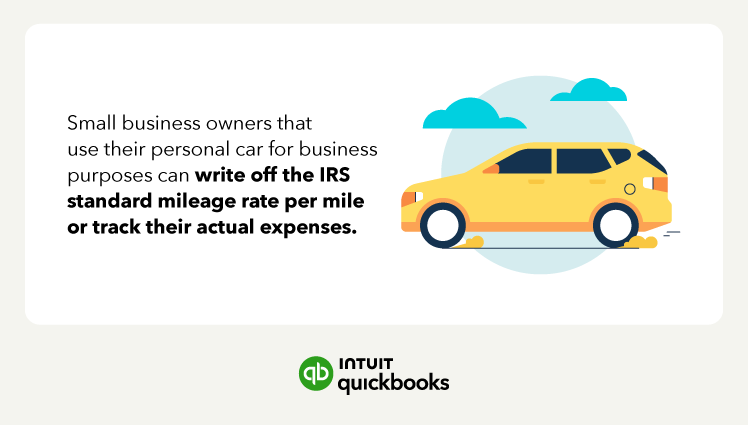

- Auto expenses

- Taxes

- Child care

- Charitable contributions

- Marketing and advertising

- Rent and utilities

- Subscriptions

- Interest

- Salaries and wages

- Legal and professional fees

- Internet and phone

- Business insurance