Standard accounting methods and tax accounting methods have different sets of rules. If you expect to receive a payment, you may have to pay taxes on it in the current period, but not when the payment is actually received. This type of timing difference creates a deferred tax situation.

When trying to understand deferred tax assets and liabilities, it’s important to keep in mind the difference between financial reporting and tax reporting. These two forms of accounting involve different rules and calculations, and these differences can result in both deferred tax assets and deferred tax liabilities.

Financial reporting involves accounting rules, such as those set forth by the Financial Accounting Standards Board (FASB). Financial statements report pre-tax net income, income tax expense, and net income after taxes.

Tax reporting, on the other hand, calls for tax authorities to set the rules and regulations regarding the preparation and filing of tax returns. Examples of tax authorities include the IRS and local state governments.

In this article, we’ll cover everything you need to know about deferred tax assets and liabilities to give you a much better understanding of what these terms mean and why they’re important. You can jump to your preferred section below:

Overview: Deferred tax asset vs. liability

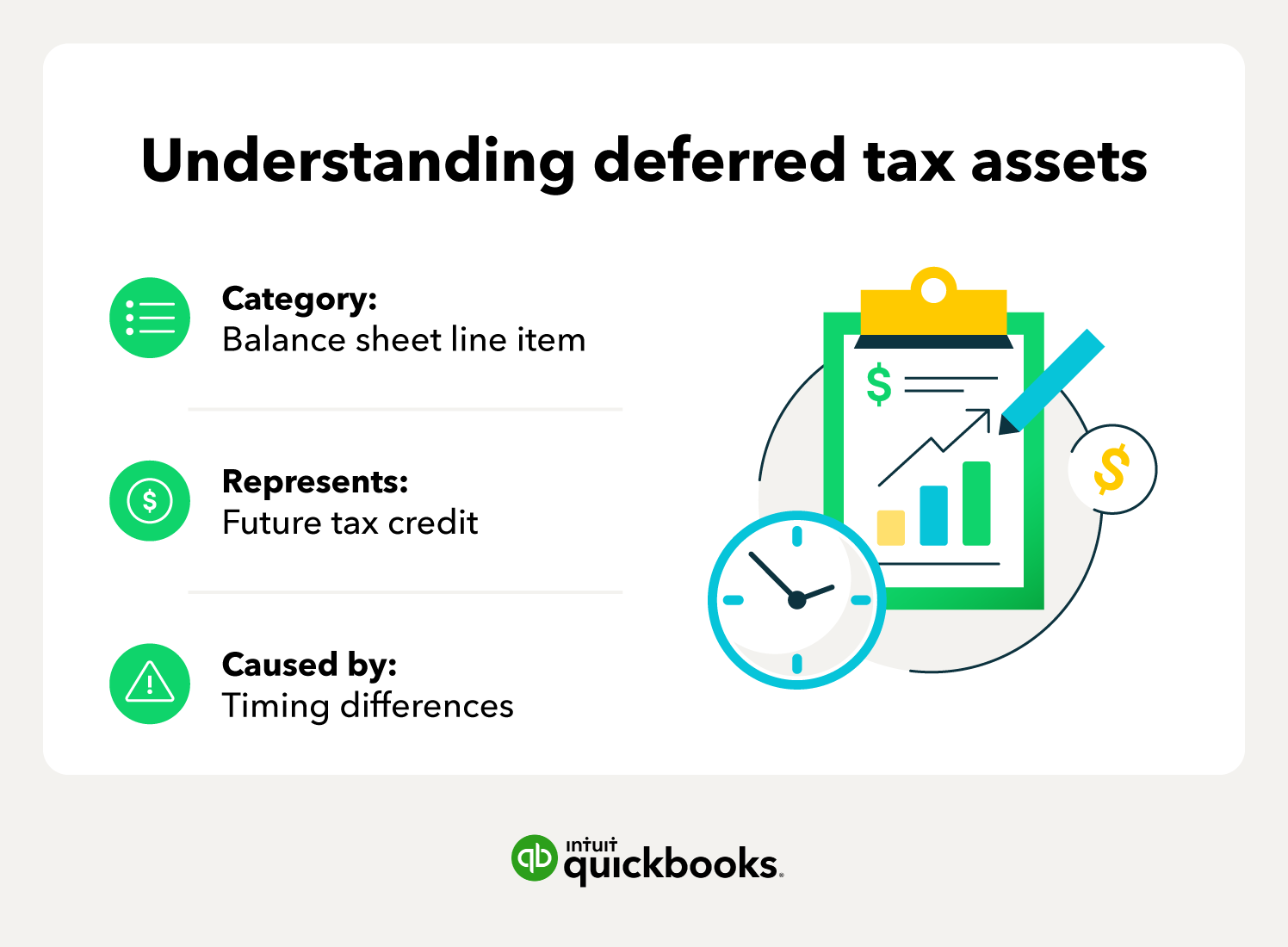

Deferred tax assets and deferred tax liabilities are the opposites of each other. A deferred tax asset is a business tax credit for future taxes, and a deferred tax liability means the business has a tax debt that will need to be paid in the future.

You can think of it as paying part of your taxes in advance (deferred tax asset) or paying additional taxes at a future date (deferred tax liability).

Is deferred tax an asset or a liability?

It depends. There are two types of deferred tax items—one is an asset and one is a liability. One represents money the business owes (deferred tax liability), and the other represents money that the business is owed (deferred tax asset).

What is a deferred tax asset?

A deferred tax asset (DTA) is an entry on the balance sheet that represents a difference between the company’s internal accounting and taxes owed. For example, if your company paid its taxes in full and then received a tax deduction for that period, that unused deduction can be used in future tax filings as a deferred tax asset.

In 2017, Congress passed the Tax Cuts and Jobs Act which reduced the corporate tax rate from 35% to a maximum of 21%. If a business had paid that year’s taxes in advance, they would have overpaid by 14%. This difference in tax payment and liability creates a deferred tax asset.

- What type of asset is a deferred tax asset? A deferred tax asset is considered an intangible asset because it’s not a physical object like equipment or buildings. It only exists on the balance sheet.

- Is a deferred tax asset a financial asset? Yes, a DTA is a financial asset because it represents a tax overpayment that can be redeemed in the future.

- Where are deferred tax assets listed on the balance sheet? They are listed on the balance sheet as “non-current assets.”

- When does a deferred tax asset have to be used? Deferred tax assets never expire, and can be used whenever it’s most convenient to the business.

- Note: While deferred tax assets can always be carried forward to future tax filings, they cannot be applied to tax filings in the past.

What causes a deferred tax asset?

Whenever there is a difference between the income on the tax return and the income in the company’s accounting records (income per book) a deferred tax asset is created.

How do deferred tax assets work?

As a metaphor, imagine you used a rideshare service, but the car got a flat tire and you had to walk home in the rain. As compensation, the company sent a $50 credit to your account in the app. If you had planned to spend $50 on ridesharing the next month, you can now budget that your spending will actually be $0, because the credit you have will cancel it out.

The app credit in this example represents your deferred tax asset. You haven’t used it yet, but you know that it has a future value and you can adjust your spending accordingly.

Examples of deferred tax assets

- Net operating loss: The business incurred a financial loss for that period.

- Tax overpayment: You paid too much in taxes in the previous period.

- Business expenses: When expenses are recognized in one accounting method but not the other.

- Revenue: Instances where revenue is collected during one accounting period, but recognized in another.

- Bad debt: Before an unpaid debt is written off as uncollectible, it’s reported as revenue. When the unpaid receivable is finally recognized, that bad debt becomes a deferred tax asset.

What is a deferred tax liability?

A deferred tax liability (DTL) is a tax payment that a company has listed on its balance sheet, but does not have to be paid until a future tax filing. A payroll tax holiday is a type of deferred tax liability that allows businesses to put off paying their payroll taxes until a later date. The tax holiday represents a financial benefit to the company today, but a liability to the company down the road.

Certain tax incentives will create a deferred tax liability journal entry, giving the business some temporary tax relief, but will be collected later. Depreciation expenses—like the annual devaluation of a fleet of company vehicles—can generate deferred tax liabilities.

- Is deferred tax liability a debt? A deferred tax liability journal entry represents a tax payment that, due to timing differences in accounting processes, the payment can be postponed until a later date.

- Where are deferred tax liabilities listed on the balance sheet? They are listed on the balance sheet as “non-current liabilities.”

- Are deferred tax liabilities good or bad? A deferred tax liability is neutral or good, depending on your situation. It means you owe money, but don’t have to pay it right away. The downside is that your business needs to have money set aside in order to pay this debt off in the future.

What causes a deferred tax liability?

Any temporary difference between the amount of money owed in taxes and the amount of money that is required to be paid in the current accounting cycle creates a deferred tax liability.

How do deferred tax liabilities work?

To illustrate the concept of a deferred tax liability, imagine you’re at a bar with an open tab. At the end of the night, you go to the bar to pay off your tab, but the bartender has mistakenly closed out the register and can no longer process your tab. You agree to return to the bar and pay off your tab on your next visit. You make a note to yourself of the outstanding balance, and keep cash on hand to pay it off.

This timing difference between you owing a debt and the bartender understanding that it won’t be paid until a future time, is similar to a deferred tax liability. A business has a tax balance that needs to be paid, but not until some point in the future.

Deferred tax liability examples

- Depreciation of assets: The IRS uses an advanced asset depreciation model which results in a difference between the company’s balance sheet value and the value of it for tax purposes. This is the most common example of a deferred tax liability.

- Tax underpayment: The company didn’t pay enough tax in the previous cycle, and will have to make up for it in the next cycle.

- Installment sale: When a product is paid for in installments, the company lists the full value of the sale in their balance sheet, but only pays taxes for each annual installment. The company recognizes that they have a deferred tax liability for future payments on that sale.

Evaluating deferred tax assets and liabilities

It can be tricky to determine when, and if, you’ll be able to take advantage of a deferred tax asset. The balance isn’t hidden because it’s reported in the financial statements. Analysts can take deferred tax balances into account, so there’s no distortion of the financial picture.

Example in context

Net operating loss carryforwards are a significant type of deferred tax. These occur when your business has a net loss but isn’t able to deduct all of the loss in the current year. The remaining balance of the loss is carried forward until you have a high enough net income to post the loss on a tax return.

But, of course, you can’t predict the future. You don’t know what years you’ll be eligible to use the carryforwards or whether you can use them all before the tax law prevents you from carrying the loss forward into future years.

Tax expense calculation

You’ll always want to consider the following equation when evaluating deferrals:

- Income tax expense = taxes payable + deferred tax liability – deferred tax asset

Understanding this equation can help you better understand your income statement.

Questions to ask your accountant

If you have deferred tax assets and liabilities, there’s a good chance that lenders, investors, or potential buyers will want to know about them. Before you meet with essential stakeholders about financial matters, ask your CPA these types of questions:

- Of the netted figure on the balance sheet, what is the breakdown between deferred tax assets and deferred tax liabilities?

- What comprises the assets and liabilities? What events caused them?

- When do you expect the business to realize the tax assets and liabilities?

- How likely do you think it is that the business will be able to recognize the tax assets and liabilities? Is it inevitable, very likely, or only somewhat likely?

The FASB requires disclosure of deferred tax balances in the financial statements, found here.

Additional Considerations

The revenue and expenses you report on your income statement don’t always translate into income and deductions for tax purposes. Tax accounting and financial accounting have slightly different rules, which is why your business’s taxable income isn’t always the same as the net income on your financial statements.

Temporary versus permanent tax differences

Some of these instances result in permanent tax differences. For example, interest income from municipal bonds may be excluded from taxable income on the tax return, but included in accounting (book) income.

Other differences are temporary. These differences have to do with timing. You’ll end up recognizing the income and expenses eventually, but you just may realize them sooner under one system than you do under the other.

Temporary timing differences create deferred tax assets and liabilities. Deferred tax assets indicate that you’ve accumulated future deductions—in other words, a positive cash flow—while deferred tax liabilities indicate a future tax liability.

Difference in depreciation methods

Differences in depreciation methods for book income and taxable income generate temporary differences. The IRS may allow a firm to use an accelerated method of depreciation, which generates more tax expense in the early years of an asset’s life and less expense in later years.

The difference between depreciation expense in the accounting records and the tax return is only temporary. The total amount depreciated for a particular asset is the same over the life of the asset. The differences are due to the timing of the expense each year.

Consider the following example for deferred tax assets. Let’s say that a business incurs a loss on the sale of an asset. If the firm can recognize the loss on a future tax return, the loss is a deferred tax asset.

For corporations, deferred tax liabilities are netted against deferred tax assets and reported on the balance sheet. For pass-through entities like S corporations, partnerships, and sole proprietorships, the net appears on a supporting schedule on your business tax return.

Accelerated asset depreciation

To encourage capital investment, the IRS uses an advanced depreciation model that allows companies to assess greater depreciation of assets sooner, so they can receive an increased tax deduction right away. This difference in depreciation models results in a deferred tax liability.

That’s because while you take a greater deduction at the outset, the difference in depreciation schedules will adjust over time, and in later years the business essentially “pays back” the initial tax deductions until the difference between depreciation models evens out.

How it works

To illustrate this concept, consider the classic coupons from Bed Bath & Beyond. Imagine that instead of sending you a 20% off coupon each month, Bed Bath & Beyond sends you a 50% off coupon, then a 40% off coupon, then a 30% off coupon, and keeps reducing the discount until eventually, they send you a coupon that increases prices by 30%.

Ultimately, you’ll still have received an average of 20% off for each coupon, but they gave you a much larger discount up-front that you slowly paid back over time.

To anticipate the month that you’ll pay 30% more on your shopping trip to Bed Bath & Beyond, you’d want to set aside extra money for this expected price increase. That’s the deferred tax liability for accelerated depreciation schedules in a nutshell—you get a big discount at the start, which is gradually reduced over time, until eventually you owe money.

Accelerated asset depreciation example

A common example of tax-deferred liabilities for individuals is a 401(k). A 401(k)s is a deferred tax retirement plan. You pay no taxes on contributions to the 401(k) until years or decades later when you make a withdrawal. A business anticipates these types of future costs and maintains a reserve of cash to address them.

Make sense of your deferred tax assets and liabilities

After learning the definitions and examples of deferred tax assets and deferred tax liabilities, we can better understand our balance sheet with regard to these future tax credits or debits. To avoid tax filing errors related to these topics, use reliable accounting software, and discuss any deferred tax balances with a tax preparer.

As a new small business owner, deferred tax assets and expenses are one example of a complex subject that could easily confuse business owners, complicating matters in future periods.

If you would like to know more about how deferred assets and liabilities impact your small business, be sure to contact your trusted accountant or tax professional. Doing so will help ensure you follow proper accounting standards while receiving the maximum tax benefit.

Chris Scott is a finance expert, consultant, and writer. He graduated from the University of Maryland with a degree in Finance and currently resides in Boston, MA.