Completely reimagined for one-person businesses like yours, QuickBooks Solopreneur features easy-to-use tools to help you drive growth and financial stability.

Designed with your one-person business in mind

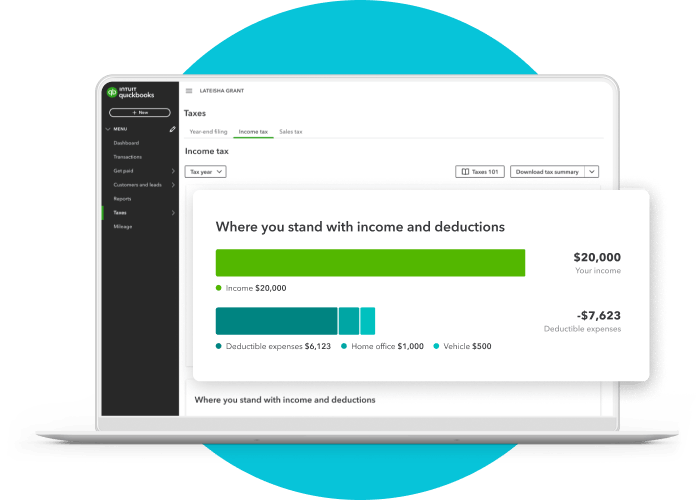

See where you’re at. Plan for what’s ahead.

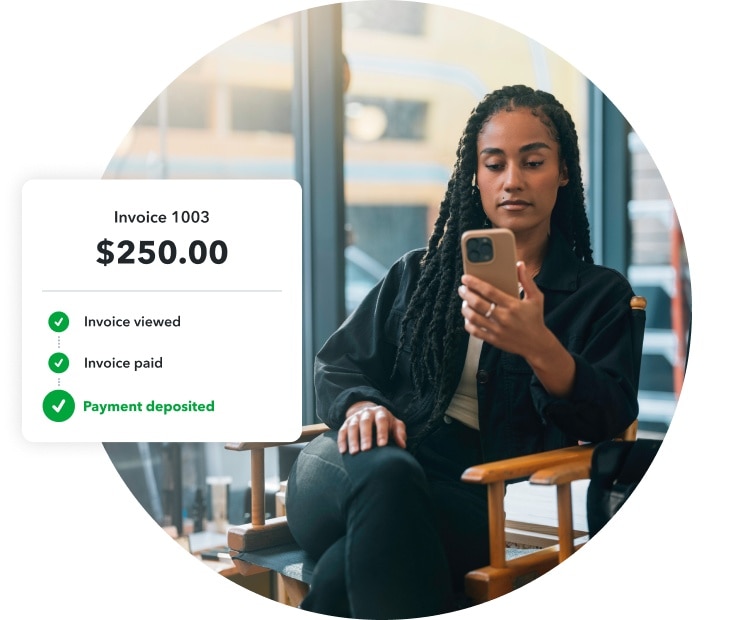

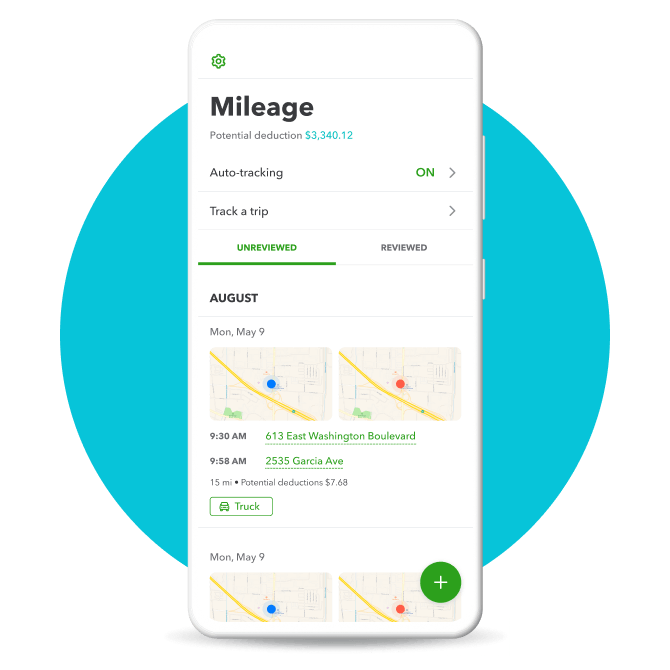

Get a clear view of your business performance, with simple tools to help you succeed.