For companies, close corporations, personal liability companies and those which qualify as a Small Business Corporation, your Net Profit on which your tax is payable is your total taxable income (excluding any capital proceeds) less any qualified deductions and special allowances.

Once you come to your Net Taxable Income, you will then pay your taxes based on that taxable income.

Dividends Tax

Dividends tax is a final tax on dividends at a rate of 20%, paid by resident companies and non-resident companies in respect of shares listed on the Johannesburg Stock Exchange (JSE) or other South African licensed exchange.

Dividends are tax-exempt if the beneficial owner of the dividend is a South African company, retirement fund or other exempt people. Non-resident beneficial owners of dividends may benefit from reduced tax rates in limited circumstances

Deductions

Filing a tax return is one of the many inescapable (and sometimes nasty) realities of being a working adult. More than that, it’s a legal requirement and failing to file a tax return could land you in serious legal trouble with government agencies.

However, during this process, you will also report your tax deductions, which are business expenses that can lower the amount of tax you have to pay during the fiscal year.

The SARS has a list of available tax tables to help you calculate your deductions, you can use the links below to access them:

Retirement fund contributions

Amounts contributed to a pension, provident and retirement annuity funds during a year of assessment are deductible by members of those funds.

The deduction is limited to 27.5% of the greater of the amount of remuneration for PAYE purposes or taxable income (both excluding retirement fund lump sums and severance benefits)

Medical and disability expenses

Monthly contributions to medical schemes (a tax rebate referred to as a medical scheme fees tax credit) by the individual who paid the contributions are up to R364 for each of the first two persons covered by those medical schemes, and R246 for each additional dependent.

Travel allowances

If you have to travel often for work and your employer pays a travel allowance, you can get some cash back from SARS. Make sure you keep a detailed logbook of your trips and the costs involved otherwise SARS will reject your claim. At least there is some payback for the taxing times spent on the road!

Business expenses (Self-employed)

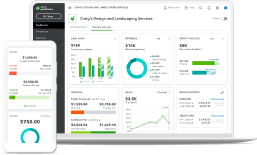

Independent contractors, freelancers and sole proprietors, take note. Whether it’s stationery, telephone or employee costs, SARS will allow you to deduct all expenses related to making your income. Make sure you are very thorough when it comes to keeping all invoices and records of these expenses. It will pay off in the end. If you use accounting software, such as QuickBooks, keeping track of invoices, expenses and receipts is a breeze.

Other deductions for Self-employed people

Other than the deductions set out above, an individual may only claim deductions against employment income or allowances in limited specified situations, e.g. bad debt in respect of salary.

Transfer Duty

Transfer duty is payable at the following rates on transactions which are not subject to VAT:

Acquisition of property by all persons: