Lodge Single Touch Payroll (STP) events for closely held employees

by Intuit•2• Updated 3 days ago

From 1 July 2021, any business with 19 or less employees that pay closely held employees are obligated to start reporting Single Touch Payroll (STP) events. Learn how to set up STP events for businesses with closely held employees in QuickBooks Payroll powered by Employment Hero.

Learn more about managing closely held employees in QuickBooks Payroll.

What must be reported for a closely held employee?

Like all STP reporting for arm's length employees, STP reporting for your closely held employees must include:

- Year-to-date amounts for each closely held employee who received a payment subject to withholding that is required to be reported via STP;

- Ordinary times earnings (OTE) or your superannuation liability for the employee

- Total gross wages for payments being reported – same as the W1 label on your BAS

- Total PAYG withholding payments (PAYGW) being reported – same as the W2 label on your BAS

You must not report on:

- Reimbursements where the amount is expected to be expended in full

- Dividends

- Trust distributions

- Loans.

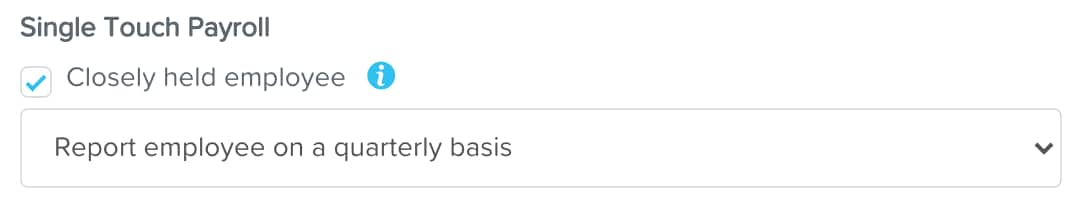

How to report STP for closely held employees

There are three options that you can choose to report STP for closely held employees:

- Report actual payments on or before the date of payment (same process as reporting STP for regular, arm’s length employees)

- Report actual payments quarterly (report payments at the same time when BAS is due)

- Report a reasonable estimate quarterly (report amounts equal to or greater than a percentage of gross payments and tax withheld from the latest year, across each quarter)

Visit the ATO website for more information on these three options and some examples that will help you decide the best way to report.

Ready to lodge quarterly STP events for your closely held employees? Learn how to create and submit a quarterly pay event to the ATO.

Content sourced from Employment Hero

More like this

- Managing Closely Held Employeesby QuickBooks

- End of Financial Year Processing using STP | FAQby QuickBooks

- Create and lodge a quarterly pay event for closely held employeesby QuickBooks

- Single Touch Payroll (STP) guideby QuickBooks