Update working holiday maker employee information for STP Phase 2

by Intuit•1• Updated 2 years ago

With STP Phase 2, working holiday maker employees must be classified as such and their visa country must be specified.

What do I need to do?

When reporting working holiday makers through STP Phase 2, the status and visa country of the working holiday maker will need to be reported:

- Select Employees, then select the employee's name.

- Select Tax File Declaration

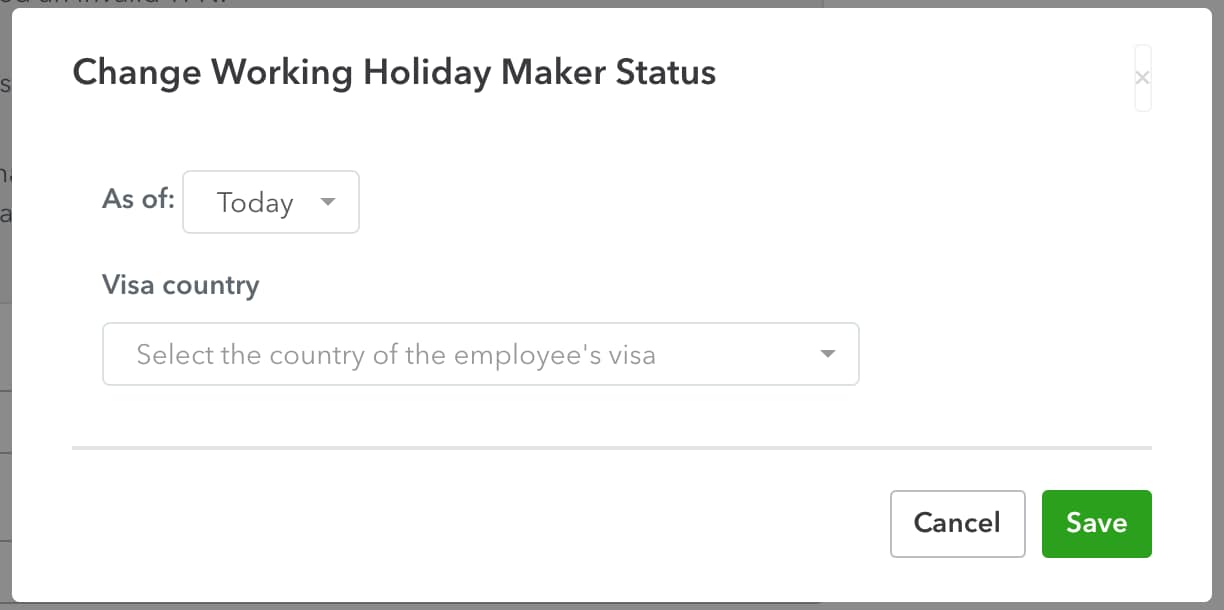

- Untick the Is approved working holiday maker box, then re-tick it. It will ask you to update the employee's working holiday maker status and to select the Visa country of the employee's visa.

- Select Save.

I've updated my employee's status, what's next?

Below are the changes that most businesses will need to make in preparation for STP Phase 2:

- Update pay category classifications

- Update leave category classifications

- Update deduction category classifications

- Review employee tax file declaration information

If any of the following apply to your business, make these changes as well:

- If any employee is closely held, under foreign employment, an inbound assignee to Australia, labour hire or other, update their income type in the employee's settings

- If the business terminated an employee from 1st July 2021, provide a termination reason

- If you have employees working in another country, provide their country of work

More like this

- Single Touch Payroll (STP) Phase 2 Hubby QuickBooks

- Preparing for Single Touch Payroll (STP) Phase 2by QuickBooks

- Update employee tax file declaration information for STP Phase 2by QuickBooks

- Update employee income types for STP Phase 2by QuickBooks