Update pay categories for STP Phase 2

by Intuit• Updated 7 months ago

With Single Touch Payroll Phase 2, there are some changes you may need to make to your pay categories to ensure you're reporting them correctly to the ATO. This article will help you make these changes in QuickBooks Payroll powered by Employment Hero.

What are the changes in STP Phase 2?

In Phase 1 of STP, Year-to-date gross income amounts were reported to the ATO via pay and update events. Phase 2 extends the use of this data to other government agencies such as the Department of Social Services, Services Australia (Child Support and Centrelink), and the Department of Veterans' Affairs.

These government agencies record data differently. With STP Phase 2, the data that they require to assess employment income information needs to be separately classified. The following categories will be affected:

- Allowances

- Bonuses and commissions

- Directors' fees

- Overtime

- Paid leave

- Salary sacrifice - In Phase 1, salary sacrifice amounts were not required to be reported. Now in Phase 2, it is a requirement, and the gross amount reported will be the pre-sacrificed amount.

What do I need to do?

Most of the common pay categories in the system have been updated with Payment Classification information, so you don't need to update the following categories:

- Annual Leave Taken -> mapped to Leave - other paid leave

- Bonus -> mapped to Bonuses and commissions

- Casual - Overtime x 125% -> mapped to Overtime

- Casual - Overtime x 75% -> mapped to Overtime

- Community Service Leave Taken > mapped to Leave - ancillary and defence leave

- Compassionate Leave Taken -> mapped to Leave - other paid leave

- Long Service Leave Taken -> mapped to Leave - other paid leave

- Permanent - Overtime x 100% -> mapped to Overtime

- Permanent - Overtime x 50% -> mapped to Overtime

- Personal/Carer's Leave Taken -> mapped to Leave - other paid leave

| For QuickBooks Online Advanced Payroll users: If you have installed a pre-built Award, download the newest update from the Manage Awards section in Payroll Settings to get the classification applied to the Award pay categories. |

If you DON'T use any of the above pay categories in payroll for allowances, bonuses/commissions, directors' fees, overtime, paid leave and salary sacrifice, you'll need to update your categories manually with payment classification information. To do this:

- Select the

icon, then select Payroll Settings.

icon, then select Payroll Settings. - Select Pay Categories under Pay Run Settings.

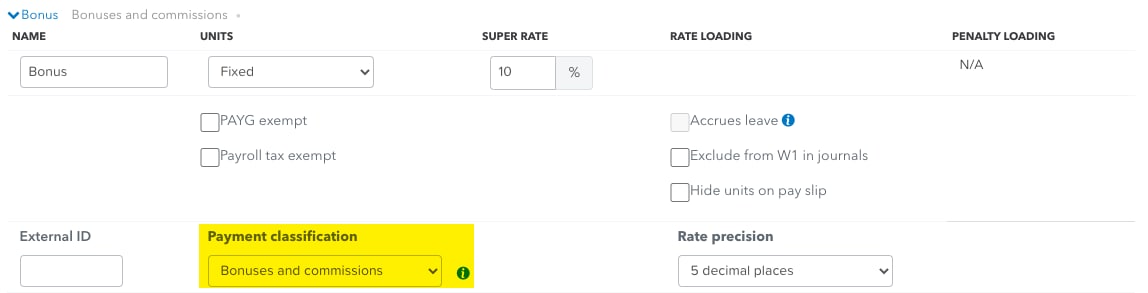

- Select the pay category to update, then navigate to the Payment classification dropdown menu and select the relevant payment classification.

Here's an example of a manually created 'Bonus' pay category. Update the highlighted section:

Here's a list of STP Phase 2 payment classifications and codes to give you a clearer picture.

I've updated my pay categories, what's next?

Below are the changes that most businesses will need to make in preparation for STP Phase 2:

- Update leave category classifications

- Update deduction category classifications

- Review employee tax file declaration information

If any of the following apply to your business, make these changes as well:

- If the business terminated an employee from 1st July 2021, provide a termination reason

- If any employee is closely held, under foreign employment, an inbound assignee to Australia, labour hire or other, update their income type in the employee's settings

- If you have working holiday maker employees, classify them correctly and state their country

- If you have employees working in another country, provide their country of work

More like this

- Single Touch Payroll (STP) Phase 2 Hubby QuickBooks

- Preparing for Single Touch Payroll (STP) Phase 2by QuickBooks

- Update employee income types for STP Phase 2by QuickBooks

- Update deduction categories for STP Phase 2by QuickBooks