Update deduction categories for STP Phase 2

by Intuit• Updated 2 days ago

With Single Touch Payroll Phase 2, there are some changes you may need to make to your leave categories to ensure you're reporting them correctly to the ATO. This article will help you make these changes in QuickBooks Payroll powered by Employment Hero.

What are the changes in STP Phase 2?

With STP Phase 2, any salary sacrifice amounts will need to be assigned their correct payment classification when recording them in payroll.

Also, STP Phase 2 has introduced the ability to report on child support garnishees and deductions through STP. Reporting through STP will remove the need for employers to provide separate remittance advice to the Child Support Registrar. However, you must still pay the required amounts directly to them by the date specified in your notice. Reporting child support through STP is voluntary.

What do I need to do for salary sacrifice changes?

There are 2 new payment classification options in the deduction category settings:

- Salary sacrifice (superannuation) - An effective salary sacrifice arrangement, entered into before the work is performed, where contributions are paid to a complying superannuation fund, whereby the sacrificed salary is permanently foregone.

- Salary sacrifice (other employee benefits) - An effective salary sacrifice arrangement, entered into before the work is performed, for benefits other than for superannuation, where the sacrificed salary is permanently foregone, e.g. novated lease, gym membership, workplace giving donations, car, property (goods, land, buildings, shares and bonds), expense payments (loans, school fees, childcare costs and home phone costs) and work-related items such as portable electronic devices and equipment.

Both deduction classifications have been automatically assigned by the system - no action needed.

If you have created custom salary sacrifice deduction categories, however, ensure that they are manually mapped to the Salary sacrifice (other employee benefits) classification:

Go to All apps ![]() , select Payroll, then select Employees (Take me there).

, select Payroll, then select Employees (Take me there).

- Select Payroll Settings.

- Select Deduction Categories under Pay Run Settings.

- Select the deduction you created manually, and change the Classification.

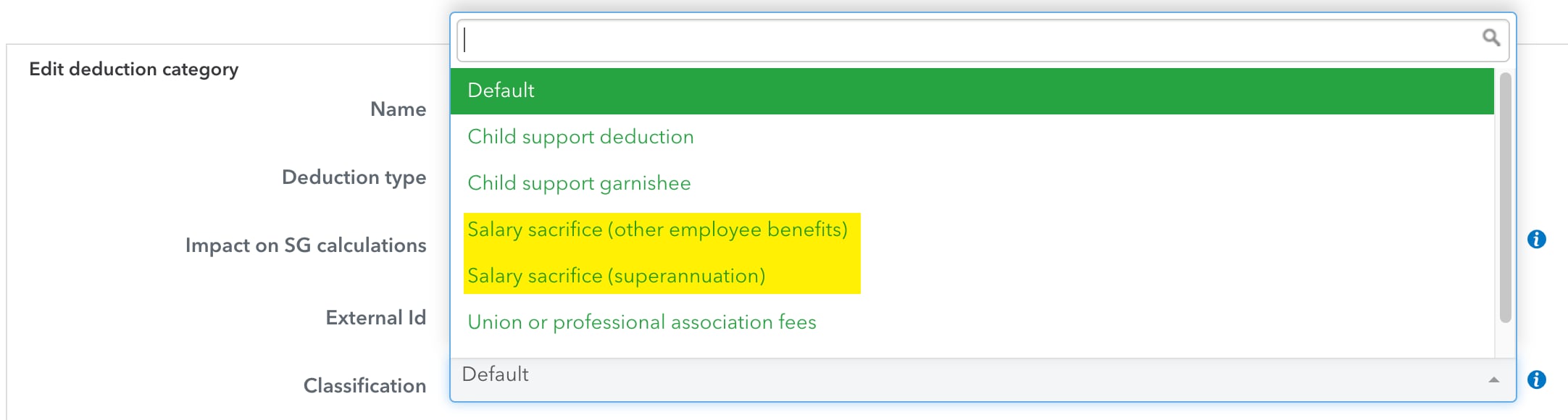

The new salary sacrifice classifications are highlighted below:

What do I need to do for child support deductions/garnishees changes?

Reporting on child support through STP is voluntary. If you choose to not report through STP then there is no preparation required to be Phase 2 ready in this area. To be clear though, employers will still need to report directly to the Child Support Registrar on an ongoing basis.

If you do choose to report child support deductions and garnishees through STP, you will need to assign the applicable child support classification against the relevant child support deduction category:

Go to All apps ![]() , select Payroll, then select Employees (Take me there).

, select Payroll, then select Employees (Take me there).

- Select Payroll Settings.

- Select Deduction Categories under Pay Run Settings.

- Select the deduction you created manually, and change the Classification.

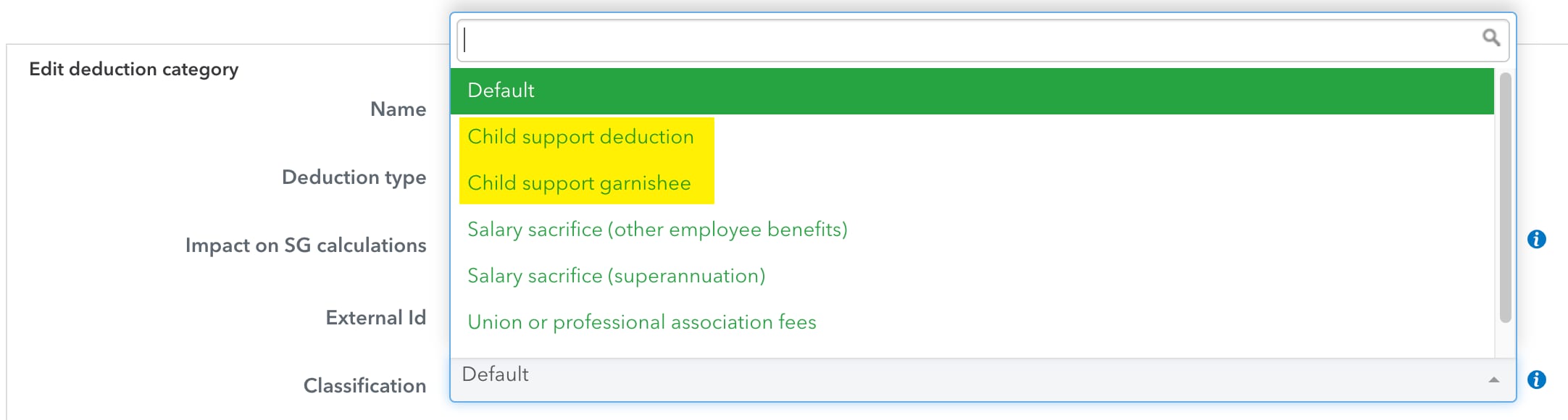

The new child support classifications are highlighted below:

I've updated my deduction categories, what's next?

Below are the changes that most businesses will need to make in preparation for STP Phase 2:

- Update pay category classifications

- Update leave category classifications

- Review employee tax file declaration information

If any of the following apply to your business, make these changes as well:

- If the business terminated an employee from 1st July 2021, provide a termination reason

- If any employee is closely held, under foreign employment, an inbound assignee to Australia, labour hire or other, update their income type in the employee's settings

- If you have working holiday maker employees, classify them correctly and state their country

- If you have employees working in another country, provide their country of work

More like this

- Update pay categories for STP Phase 2by QuickBooks

- Single Touch Payroll (STP) Phase 2 Hubby QuickBooks

- Preparing for Single Touch Payroll (STP) Phase 2by QuickBooks

- Update working holiday maker employee information for STP Phase 2by QuickBooks