Managing changes to the Super Guarantee rate

by Intuit•1• Updated 1 month ago

From July 1 2013 to 2025, super guarantee rates will increase gradually from 9% to 12%.

What do I need to do?

There is nothing that needs to be done - we will automatically update all Super Rates within the system that are currently set at the default rate each time it increases.

What about rates that aren’t the default?

Some employers have higher super rates for particular employee pay rates. In that case, we will not automatically update any super guarantee rate that has manually set super rates. You can check super rates applied to pay rates in the Pay Rates section of each employee's settings.

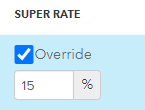

Non-default super rates are indicated by the Override box being ticked:

What if I don’t want my super rates updated automatically?

If, for some reason, you do not want to automatically update your super rates, then you can opt-out of the super rate updates by following these steps:

Follow this link to complete the steps in product

- Select the Payroll Settings tab.

- Under the Business Settings column, select Details.

- At the bottom of this page, untick Automatically update super rates.

- Select Save.

You can find out more about the changes to the super guarantee rate from the ATO website.

More like this

- Removal of $450 eligibility threshold for super guarantee in QuickBooks Onlineby QuickBooks

- Superannuation Guarantee changes in QuickBooks Onlineby QuickBooks

- Setting up Super Payments with Beam in QuickBooks Onlineby QuickBooks

- Set up employer super contributions in QuickBooks Payroll powered by Employment Heroby QuickBooks