Set up GST and BAS in QuickBooks Online

by Intuit•18• Updated 1 month ago

Learn how to enable GST in QuickBooks Online to lodge your business activity statement (BAS).

What is a BAS?

A BAS is a statement that is lodged to the ATO on a particular frequency which contains the following figures collected during a certain period:

- Goods and services tax (GST)

- Pay as you go (PAYG) instalments

- PAYG withholding tax

- Other taxes

To learn more about BAS, visit the ATO website. If you're unsure of your BAS obligations and how frequently you should be lodging your BAS, reach out to a certified accountant or bookkeeper for advice.

Enable GST in QuickBooks Online

- Follow this link to complete the steps in product

- Select Get started.

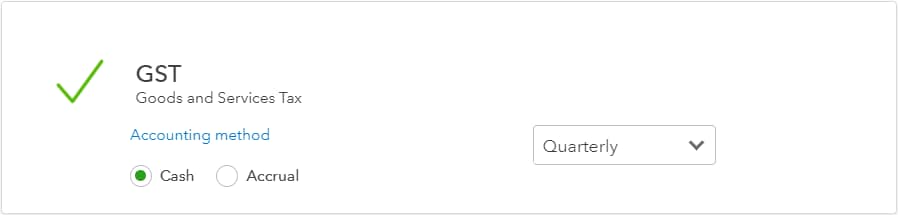

- In the GST section, select the accounting method and BAS lodgement frequency (monthly, quarterly, annually) that applies to your business. Not sure which option to choose? Get in touch with your accountant or bookkeeper, or contact the ATO.

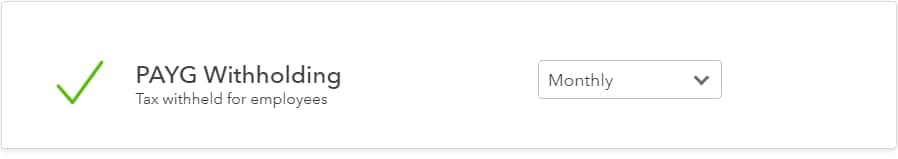

- If your business is obligated to report Pay-as-you-go Withholding, select the PAYG Withholding box to "tick" it, then select your reporting frequency (monthly, quarterly).

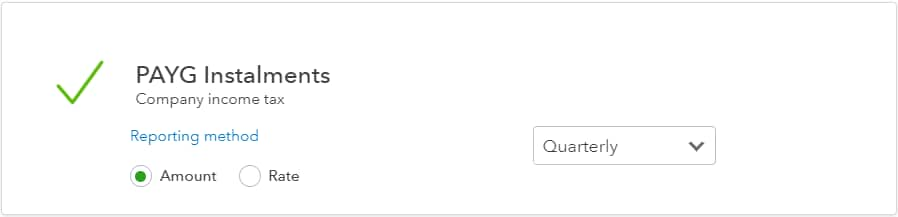

- If your business is obligated to report PAYG Instalments, select the PAYG Instalments box to "tick it, then select your reporting method (instalment amount or instalment rate method) and reporting frequency (monthly, quarterly, annually). Visit the ATO website for more information about the reporting method.

- If you report any of the following taxes, select Other taxes and tick the ones that apply to your business:

- Fringe Benefits Tax

- Fuel Tax Credits

- Wine Equalisation Tax

- Luxury Car Tax

- Select Save and finish.

Now that you're set up for BAS and GST, you can start recording transactions with GST in QuickBooks Online.

Most transactions in QuickBooks will allow you to enter a GST code, or classify it as Out of Scope of GST. Using this data, QuickBooks automatically calculates how much GST on sales and purchases have been collected over your BAS period, so you won't need to manually enter GST amounts in the BAS.

If you also use QuickBooks Payroll powered by Employment Hero, in the Employees tab, any pay run you finalise for your employees will have the appropriate Wage expense and PAYG Withholding amounts calculated automatically and sent back to your books through a journal entry, so you also won't need to manually enter these amounts in the BAS or IAS.

For more information and next steps on lodging GST and BAS, check out our GST Central.

More like this

- GST Overview for QuickBooks Onlineby QuickBooks

- Edit GST settings in QuickBooks Onlineby QuickBooks

- Review your BAS return with the GST AI Agent (Beta) in QuickBooksby QuickBooks

- Recording a GST payment (BAS Payment) in QuickBooks Onlineby QuickBooks