Using Intuit Sign in Pro Tax for electronic signatures

by Intuit•2• Updated 2 months ago

Electronic signatures (or eSignatures) let accountants ask their clients for signatures and other inputs on forms and documents in Pro Tax.

Pro Tax customers can see requests that have been completed and ones that are still missing in one easy-to-use dashboard, after requests have been sent.

Intuit has a proprietary eSignature solution called Intuit Sign. An Intuit Sign license lets you ask for signatures directly from Pro Tax without having to track individual emails or files. To use Intuit Sign, you will need a T1, T2/CO-17,T3, or Federal Tax Suite ProFile license, as well as the Intuit Sign license.

Features of Intuit Sign include:

- Signed signatures with time stamps and authentication certificates to ensure compliance.

- Multiple signers on multiple documents (spousal).

- Ability to drag and drop signatures onto any PDF that has been uploaded.

- Seven years of online cloud storage.

- Ability to store, track, and download client documents.

- Set reminders and expiry for documents to be signed.

- No account creation for your clients, just a one-time access code for your clients.

- Track client requests status in a dashboard.

Note: Intuit Sign for Pro Tax doesn't work with trial, OnePay, or ProFile 20 licenses.

Table of contents:

Using Intuit Sign

- Open Pro Tax and toggle/select Pro Tax.

- Select the form type you wish to get a signature on (T1, T2. T3, FX, etc.)

- Select View return when you have decided which form you want to work on.

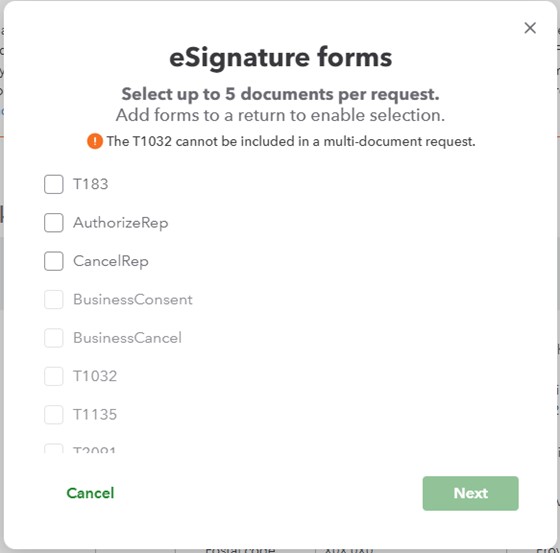

- Next, select Request eSignature. An eSignature forms window will appear.

Note: You can select up to five documents at this point, except T1032 that can only be selected by itself.

Collecting signatures

After completing the steps above, the eSignature forms window will display.

You are able to choose which documents will be sent to the client from this list.

Note: Currently you can select and send five forms at a time from the form list. The one exception is for the T1032: If you select this form, it's the only one that can be sent with that submission.

- Select the form(s) that require a client signature.

- Select Next.

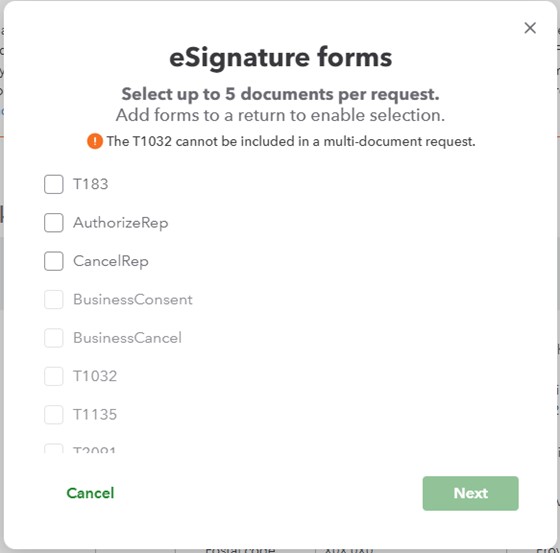

- A Signature request window will appear.

- At this point, you can select the Upload Documents button.

If your documents were printed from Pro Tax avoid using Miscroft Print to PDF as there may be some issues with how these signatures appear.

You can only have a combined maximum of five documents included in a request (Preselected and Uploaded).

There are four collapsible components on this screen:

- Documents

- You can upload, re-order, and, or delete documents

- Recipients

- You can choose from two verification methods, Access code or Mobile OTP that is auto-generated, or manually inputted. An access code must be 6 to 9 digits and will need to be shared with the recipient via Mobile or SMS.

- Message

- This is the section where an auto-generated template email will be populated. You can manually edit this email.

- Reminders and Expiration

- You can choose an expiration date for the signature request (maximum 60 days), as well as when you want to schedule any follow-up reminders.

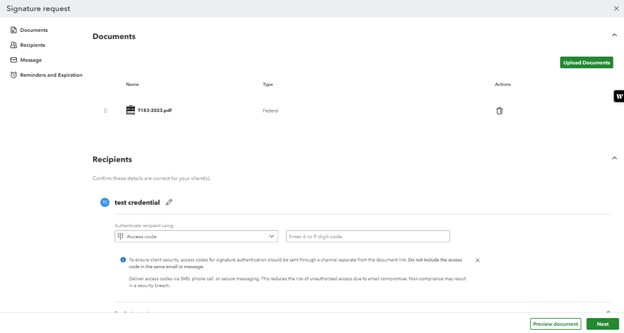

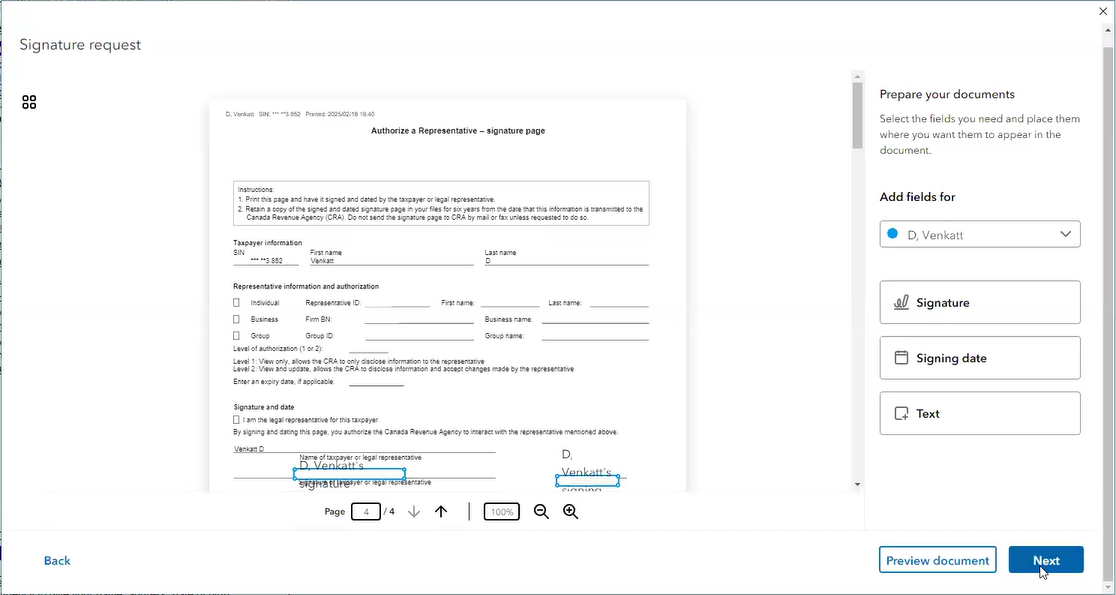

- Select Next, a preview screen will appear showing you where on the documents the client would need to sign.

Optional: If you uploaded a PDF document, you can add a Signature, Signing date, or a Text box by dragging and dropping it onto the form.

- Select Next, a Review page will appear.

- Select Send, if you're satisfied with how the Review page looks.

A signature request notification will appear.

Verification methods for Intuit Sign

There are two verification options for Intuit Sign, Access codes, and Mobile OTP. We recommend using Access codes because they are more reliable and have less restrictions.

Access codes

An access code can be auto-generated, or manually inputted. An access code must be 6 to 9 digits.

Once the access code is created, it'll need to be shared with recipient, preferably via Mobile or SMS.

Canadian mobile carriers supported with verification for Intuit Sign

We support three major mobile carriers and their subsidiaries, including Bell, Rogers, and Telus.

This section will be updated when more subsidiaries and carriers are made sure to work with Intuit Sign:

| Wireless Carrier | Accepted Subsidary |

| Bell Mobility | • Virgin Plus • Lucky Mobile • Bell MTS • Bell Aliant • Northwestel |

| Rogers Wireless | • Fido Mobile • Chatr Mobile • Cityfone • Primus Wireless • Zoomer Wireless • SimplyConnect • Shaw Mobile |

| Telus Mobility | • Koodo Mobile • Public Mobile • DCI Wireless |

Note: Freedom Mobile, SaskTel, and Vidéotron are not currently supported carriers.

Collecting T1032 signatures

Note: When collecting the T1032 signatures, you cannot collect any other signature from the return at the same time. Complete the T1032 before requesting more signatures.

- Create a coupled T1 return.

- Enter the taxpayer's information.

- Complete the T1032 form.

- Select who is transferring the pension on the T1032.

The transferring taxpayer becomes the primary and Pro Tax will transmit the request for eSignature to this taxpayer first. Once they have signed it and sent the document back to the preparer, Pro Tax will automatically send a copy to the taxpayer receiving the transfer to sign and return to the preparer.

Gathering client signatures: the client's experience

For access code authentication: enter the code.

For mobile authentication: The client's name and address used in the request must match the name and address found on the client's mobile carrier's billing statement.

Once you have submitted your request, your client receives an email from Intuit Sign notifying them that they need to electronically sign the document.

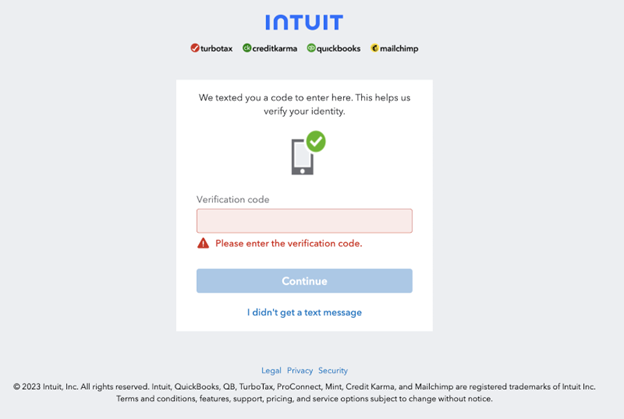

- Once they select Review and eSign, the client is taken to Intuit’s secure portal. A one-time passcode is sent to their mobile device number, which the client enters in the Verification code field and then selects Continue.

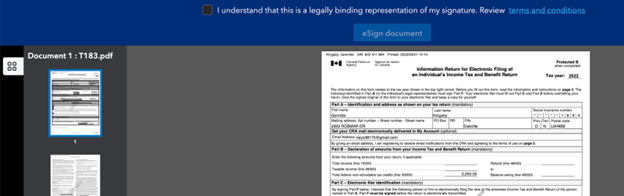

- The client is prompted to acknowledge that this is a binding document.

- The client selects the acknowledgement checkbox and selects eSign document.

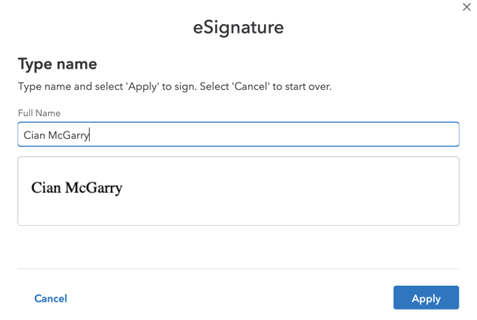

- The client enters their name and selects Apply. The signature is displayed on the document.

- The client selects Send.

- After the client submits the return, the status in the dashboard automatically updates.

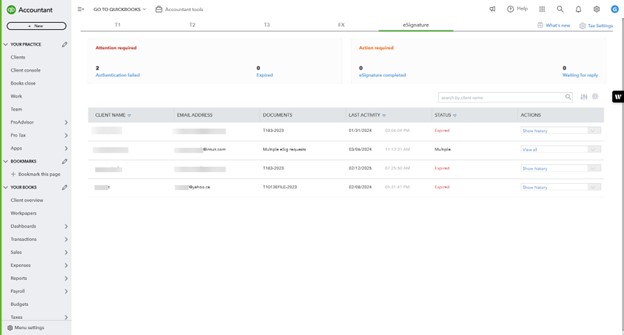

Using the eSignature dashboard

The eSignature dashboard contains all the information you need to track the progress of your requests.

- Select Pro Tax.

Note: eSignature isn't available as a dropdown option. You need to choose Pro Tax to open a new screen that will show you eSignature.

The following values are displayed in the dashboard:

- Displays requests that failed to authenticate on the dashboard.

- Displays expired requests on the dashboard.

- Displays completed requests on the dashboard.

- Displays requests waiting for signature on the dashboard.

- Customizable filter and column configuration.

- Actions: view or select the request status.

- View all indicates multiple eSignature requests. Select this to expand and display all requests.

- Download downloads a PDF copy of the signed form and Summary - Electronic Signature Certificate.

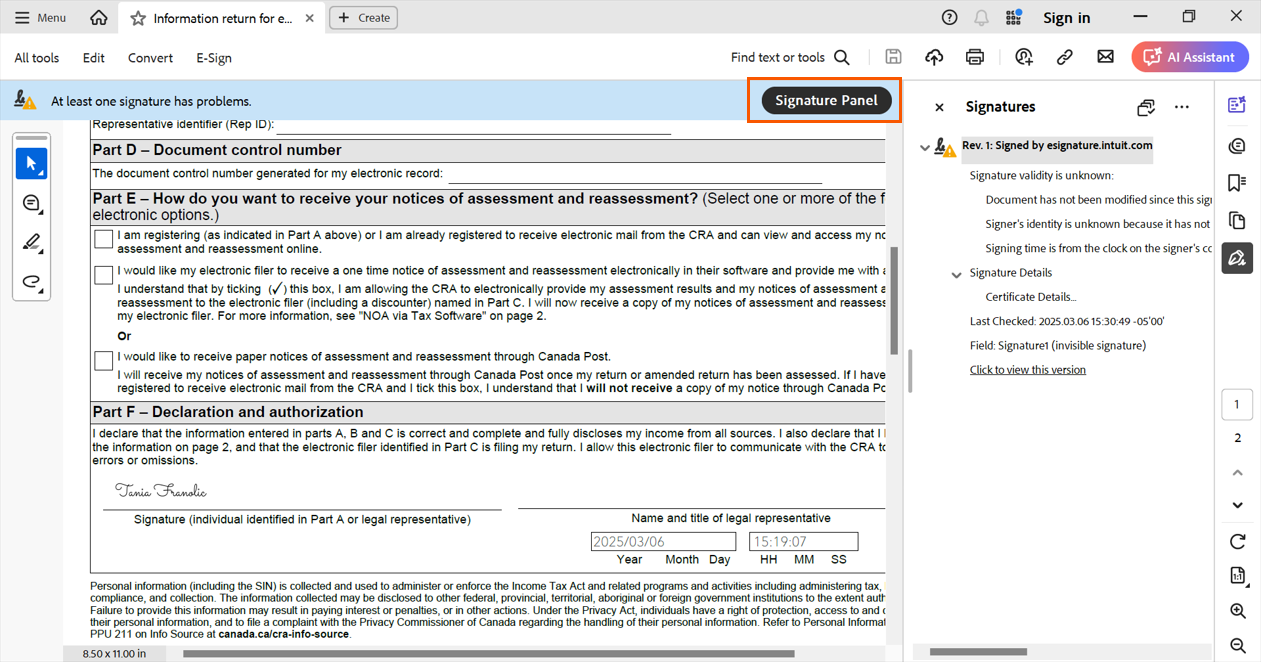

If you're opening your downloaded, and signed documents you may see a message that says 'At least one signature has problems.' To solution this problem, see the section below.

- Collapse all hides all requests associated with the document.

- Send reminder sends an email reminder to your client.

Once your client has signed the documents, you will need to enter the date and time (where applicable) on the corresponding form in Pro Tax.

Resolving the 'At least one signature has problems' error

Note: These steps will only need to be done once to resolve the issue for all signed PDFs.

- You can resolve this by selecting the Signature Panel button. This will open a drawer on the right-side, expand the message in the panel.

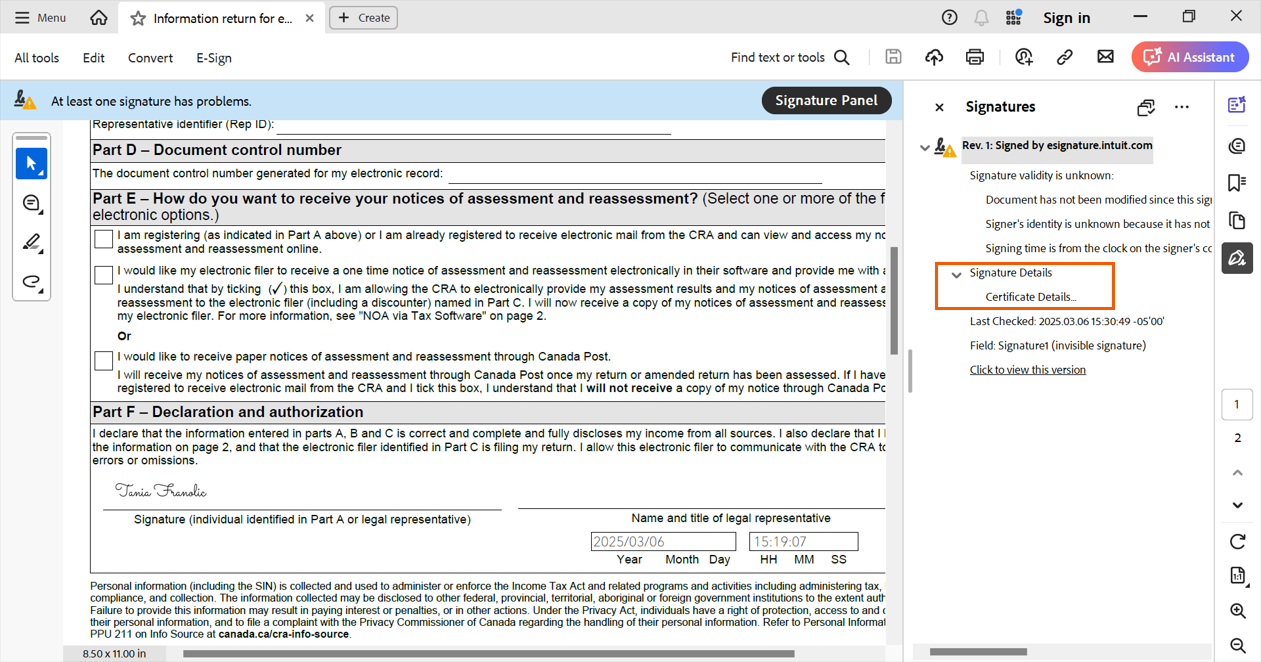

- The second section, titled Signature Details, needs to be expanded. Select Certificate Details

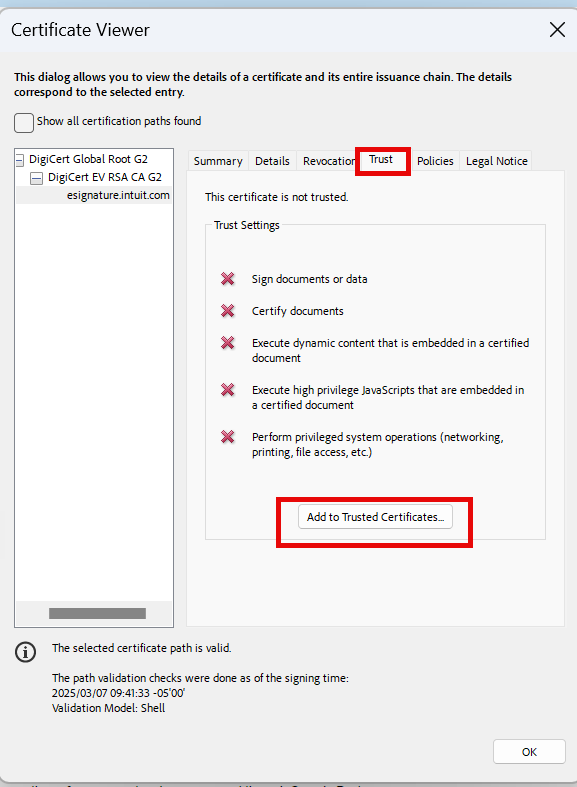

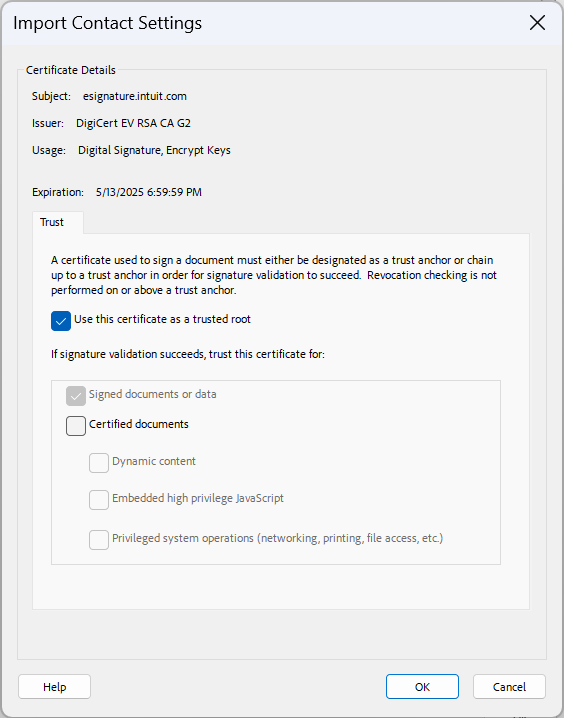

- A new window will appear called Certificate Viewer. In this window, select the Trust tab. Next, select Add to Trusted Certificates...

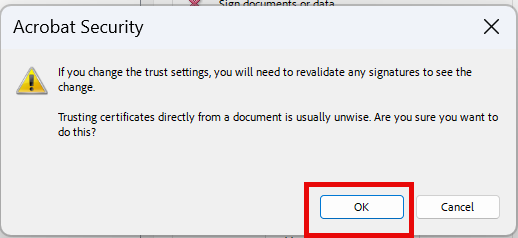

- An Acrobat Security window will appear. Select OK.

- Finally, an Import Contact Settings window will appear. No adjustments or modifications are required. Select OK.

You should now see a success banner that says 'Signed and all signatures are valid'.

Frequently Asked Questions about Intuit Sign

More like this

- QuickBooks Online Accountant Pro Tax electronic signaturesby QuickBooks

- Registering for electronic filing (EFILE) and entering EFILE credentials in a returnby QuickBooks

- Pro Tax Labsby QuickBooks

- Create new returns in Pro Tax T1by QuickBooks