What does "Limit expenses to commission income?" mean in ProTax?

by Intuit• Updated 10 months ago

Issue

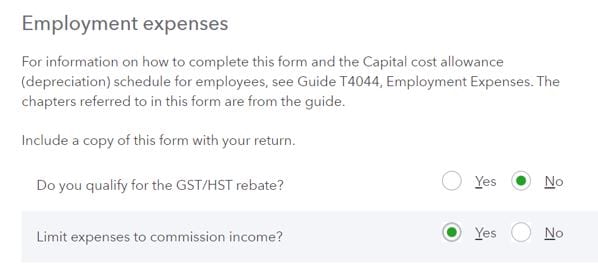

You have selected Yes to the question Limit expenses to commission income? but the amount from the Commission income section is not going to T777:

Limit expenses to commission income? means Are you claiming employment expenses as a salaried employee or commission employee?

What next?

If the answer is No, then you are claiming employment expenses as salaried employee and should use amounts from the Salary section of T777 details.

If the answer is Yes then use the greater of the Commission or Salary sections, as its more beneficial.

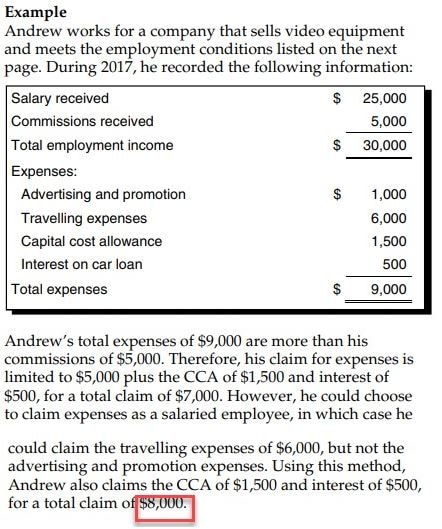

In some cases, the Commission section amount will be greater. In other cases, the Salary section amount will be greater. ProFile puts the higher amount in T777, as per example in the CRA - T4044 Employment Expenses guide.

Example

As an example, review the "Andrew" case from the CRA T777 guide:

Sign in now for personalized help

See articles customized for your product and join our large community of QuickBooks users.

More like this

- Pro Tax CRA resourcesby QuickBooks•1•Updated January 29, 2024

- QuickBooks Online Accountant Pro Tax permissionsby QuickBooks•Updated September 24, 2024

- Manage business statements in Pro Taxby QuickBooks•Updated January 29, 2024

- Get a snapshot of your business finances in QuickBooks Onlineby QuickBooks•43•Updated June 05, 2024