QuickBooks Online Accountant Pro Tax permissions

by Intuit•4• Updated 3 months ago

What’s new?

We’ve added more flexibility to the Roles & Permissions feature in QuickBooks Online Accountant!

Company Admin and Primary Admin can now adjust Pro Tax user roles and permissions, giving them more control over who can access tax documents at a firm. They can also customize ProTax permissions to better fit specific roles.

The added permission sections are:

Why are we making changes to QuickBooks Online Accountants ProTax roles and permissions?

Pro Tax customers have been asking for greater control over who has access to tax documents in a firm. With this change, Pro Tax ensures that your data is safeguarded, and any potential risk associated with access is avoided.

Impacts

The following roles will no longer have default access to QuickBooks Online Accountants Pro Tax:

• Standard limited customers and suppliers

• Standard limited customers only

• Standard limited suppliers only

• Standard no access

• Standard no access with account management.

Note: Each of these roles can be assigned access to QuickBooks Online Accountants Pro Tax by changing the permissions for a user.

The following QuickBooks Online roles will have default access to QuickBooks Online Accountants ProTax:

• Primary Admin

• Company Admin

• Standard all access

• Standard all access without payroll

These additional permissions for Pro Tax can be assigned to any role.

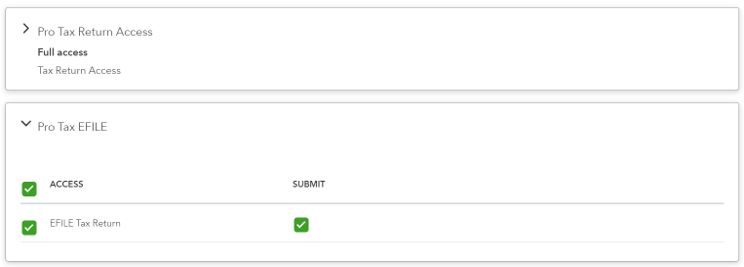

The following is the QuickBooks Online Accountant Pro Tax view for the Pro Tax EFILE:

Note: Assigning access to Pro Tax EFILE assigns Full access for the Pro Tax Return Access.

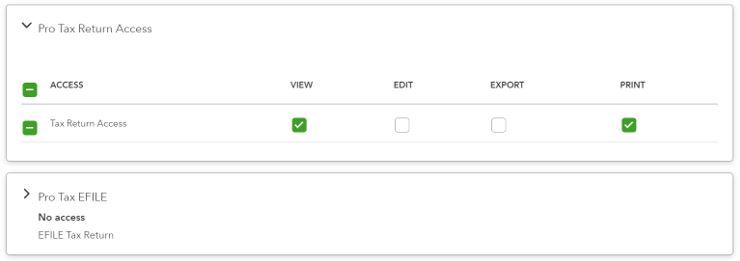

Pro Tax Return Access

The permissions for Return Access include four check boxes, any of which can be selected or full access granted.

The boxes are:

• VIEW

• EDIT

• EXPORT

• PRINT

When expanded, the tab appears as follows:

Note: Pro Tax EFILE is not set by default when full Pro Tax Return Access is granted.

Frequently asked questions

Can I assign permissions to Pro Tax on the module level?

No, the Pro Tax permissions affect all modules. They cannot be set at the module level.

What does the EFILE permission control?

EFILE permissions manage the ability to EFILE any returns. This applies to all EFILE functions.

How do I get access to QuickBooks Online Accountant Pro Tax if needed?

Users need to contact the person who controls user rights. This is either the Company or Primary Admin within your firm They will be able to provide you with access to QuickBooks Online Accountant ProTax.

How will I know if I have access to QuickBooks Online Accountant Pro Tax?

If a user doesn't have permission to access a Pro Tax or a Pro Tax capability (for example, Print), a warning message is displayed informing them that they don't have access to Pro Tax or a capability (for example, Print). Users will be asked to contact their Company or Primary admin.

How do I know what my roles and permissions are?

If you have questions, contact your Company or Primary Admin.

If I have access to Pro Tax, why won’t my edits save?

If your edits to a tax return don't save, but you can access Pro Tax, your Admin has likely granted you view-only access to ProTax. Contact your Company or Primary admin if an adjustment is required.

I’ve changed the permissions for a role, why don’t they seem to be saving?

You may need to log out and log back into QuickBooks Online Accountant Pro Tax for changes to roles and permissions to be saved.

Additional Resources

You can review our support article on adding and managing users.

You can review our support article on changing the primary admin user.

More like this

- Pro Tax release notesby QuickBooks

- Getting started with Pro Taxby QuickBooks

- QuickBooks Online Accountant Pro Tax Billing FAQby QuickBooks

- Create new T1, T2, T3, and FX returns in Pro Taxby QuickBooks