Automatically match QuickBooks Online product transactions

by Intuit•19• Updated 2 weeks ago

Learn how QuickBooks Online matches Payroll and Payments.

When you download bank transactions, new ones must be matched manually. QuickBooks can do this automatically for QuickBooks Payroll and Payments transactions.

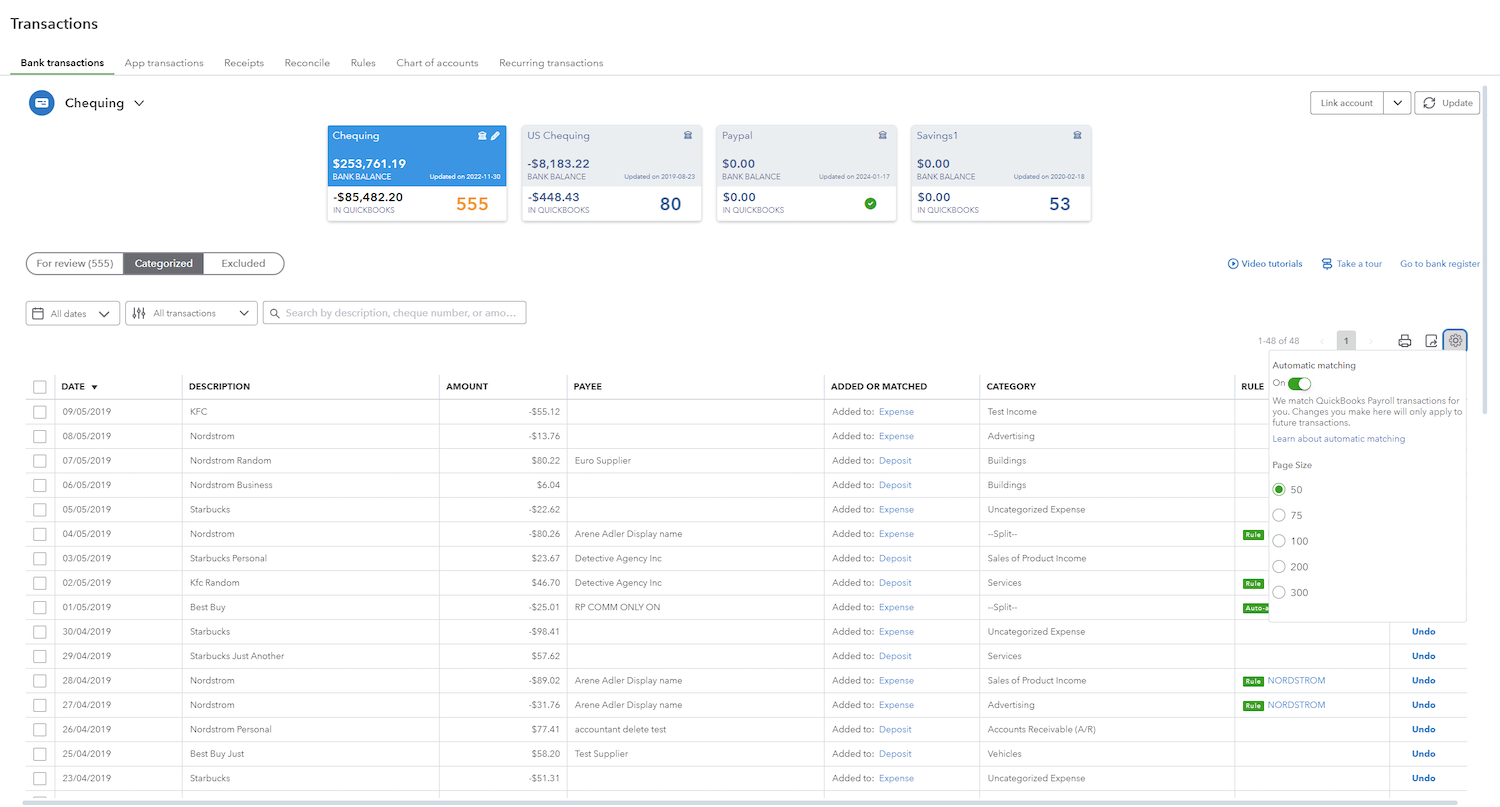

You can find and view details on automatically matched transactions in Bank transactions (Take me there) under the Categorized tab.

Automatic matching increases the accuracy of your books. We suggest leaving it on to save time, and to help avoid mistakes that can become a hassle at tax season.

Note: Automatic matching may not be available in all accounts yet.

Manage automatic matching

You can turn automatic matching off or on at any time.

- Follow this link to complete the steps in product

- Select the Categorized tab.

- Select Settings ⚙ at the top of the transaction list.

- Turn the Automatic matching switch On or Off.

When automatic matching is off, you’ll need to manually match any new transactions.

The Automatic matching setting applies to all transactions created through QuickBooks products, such as QuickBooks Payroll and Payments. Changing it will only affect future transactions.

Why can't QuickBooks automatically match all transactions

Not all transactions can be automatically matched by QuickBooks. For example, if your bank doesn't provide a unique user ID for payments, QuickBooks won't be able to match them. In these cases, you'll need to do it manually.

Disclaimers

QuickBooks Payments: QuickBooks Payments account subject to eligibility criteria, credit, and application approval. Subscription to QuickBooks Online is required.

Money movement services are provided by Intuit Canada Payments Inc.

For more information about Intuit Payments' money transmission licenses, please visit https://www.intuit.com/ca/legal/.

More like this