How to calculate Canada Pension Plan when employee moves from Quebec to any other Canadian province during a tax year

by Intuit• Updated 4 months ago

Under the current provisions of the Regulations, when an employee who works in Quebec (and therefore contributes to the Quebec Pension Plan at a higher rate than that of the CPP) is transferred by their employer before the end of the calendar year to a location outside of Quebec, an insufficient amount of total CPP and QPP contributions may have been made which, in turn, may impact future benefits. The new regulation introduced in 2021 helps address this.

When an employee moves to a province outside of Quebec in a calendar year, a new Canada Revenue Agency (CRA) requirement ensures sufficient contributions to CPP are withheld for employees.

This differs from the usual CPP, which is 5.25% of the pensionable income.

Example: An employee works in Quebec from January 2021 to March 2021. In Quebec, the employee and employer were contributing Quebec Pension Plan (QPP) in the amount of 5.70%. If the employee moves to Ontario in April 2021, the employee and employer have to contribute an adjusted CPP determined by formula below. The CPP needs to be adjusted for the higher QPP collected during stay in Quebec:

C = The lesser of:

(i) $2,898.00 – [(DQ x (0.0525/0.0570)*) + D]; and

(ii) 0.0525 × [PI –($3,500 / P)]

If the result is negative, C = $0.

* No rounding required for this factor.

If an employee's annual income exceeds the Year’s Maximum Pensionable Earnings (YMPE), which is the initial earnings ceiling, they will begin making these second-level contributions, referred to as CPP2 or QPP2 contributions.

Employers will be required to match the CPP2 or QPP2 contributions. Pensionable earnings (PI) between $68,500 and $73,200 are now subject to CPP2 or QPP2 contributions.

Pensionable Income YTD: Total Pensionable Income of the current tax year prior to the move to the current province.

There will be a new field named "contribution field" added to tax computations to capture Pensionable income YTD whenever an employee moves from Quebec to Non-Quebec provinces/territories. Employers will now be able to fill out the Pensionable income YTD at the Employee centre via the employee setup screen.

For a non-Quebec province

C2 = The lesser of:

(i) $188.00 × (PM/12) – [(D2 × (0.04/0.04)) + D2Q];

(ii) (PIYTD + PI – W) × 0.04 If the result is negative, C2 = $0.

For Quebec as the province

C2 = The lesser of:

(i) $188.00 × (PM/12) – [(D2Q × (0.04/0.04)) + D2];

(ii) (PIYTD + PI – W ) × 0.04 If the result is negative, C2 = $0.

Making the adjustment in QuickBooks Desktop Payroll

We will use the example of an employee ("John Doe") who follows the scenario laid out above.

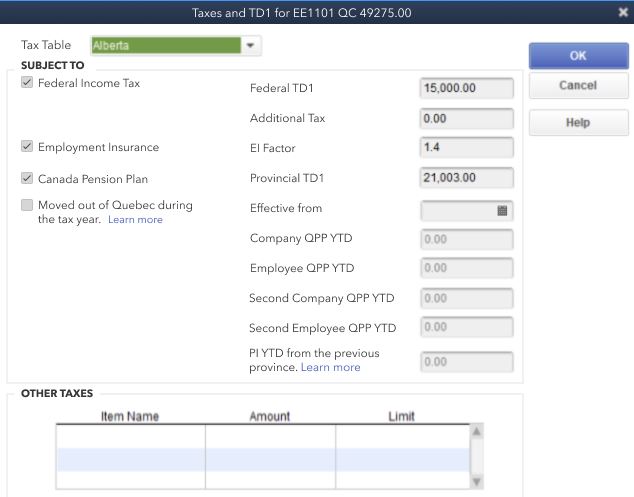

1. In Quickbooks Desktop, navigate to Employees, then Tax table.

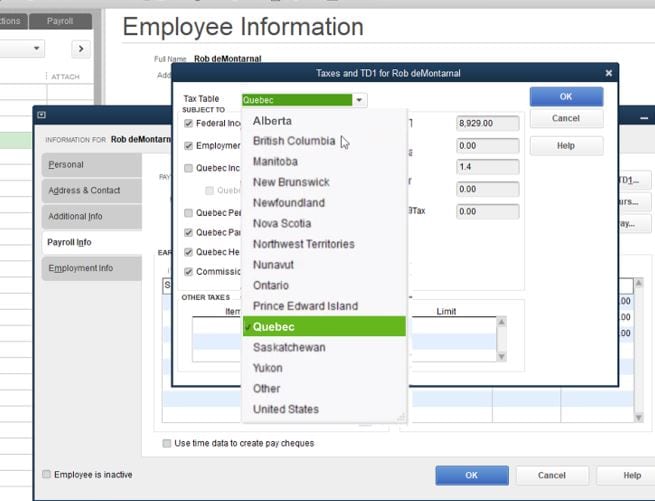

2. Change the province from Quebec to Ontario in the drop-down menu.

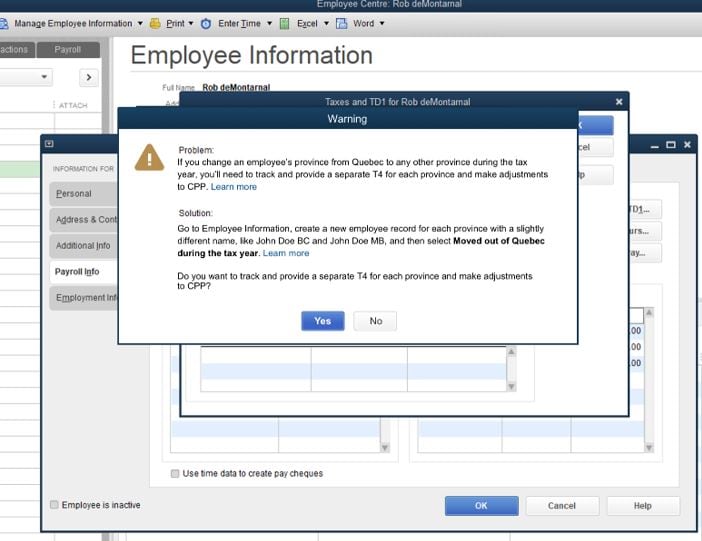

A warning screen displays:

3. Select Yes to proceed.

4. It is necessary to provide a T4 for both Quebec and Ontario. Create a new employee entry for the same employee with minor name variation. For example, create a new entry for "John Doe" as “John M. Doe”, adding the middle name or an initial.

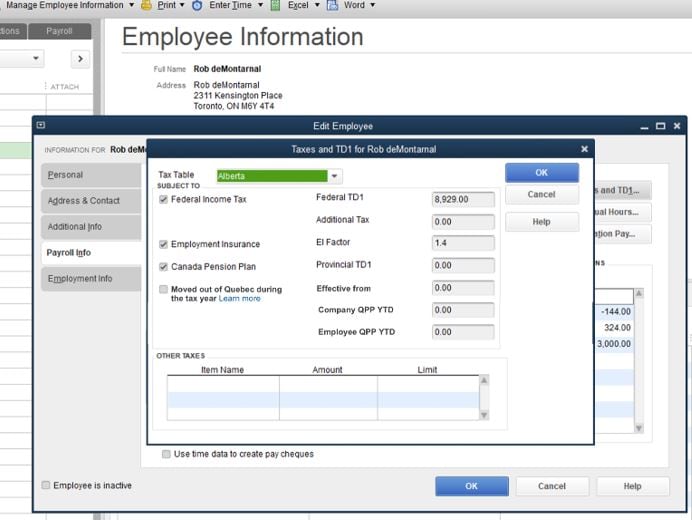

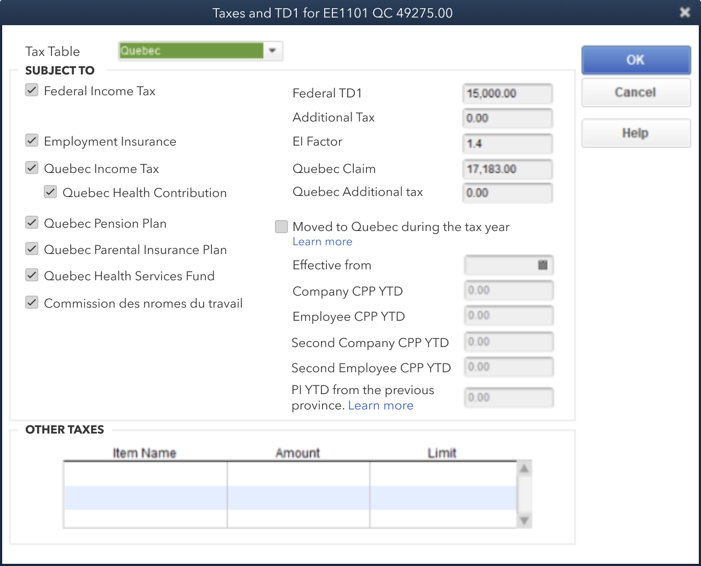

5. For the new employee just created, assign the new province and select the box Moved out of Quebec during this tax year in the tax table window.

6. Complete the Effective date, Company Quebec Pension Plan, and Employee Pension Plan fields.

7. Select OK.

The CPP will be adjusted in the paycheques.

Sign in now for personalized help

See articles customized for your product and join our large community of QuickBooks users.

More like this

- How to calculate Canada Pension Plan in QuickBooks Online Payrollby QuickBooks

- Edit employee and employer payroll taxes in QuickBooks Online Accountantby QuickBooks

- Troubleshoot CPP or EI paycheque deduction errorsby QuickBooks

- Download the latest payroll tax table update for QuickBooks Desktopby QuickBooks