Reconciliation of net book value and undepreciated capital cost in T2 for Pro Tax

by Intuit• Updated 8 months ago

About the S8 Supplementary (S8Supp) Form

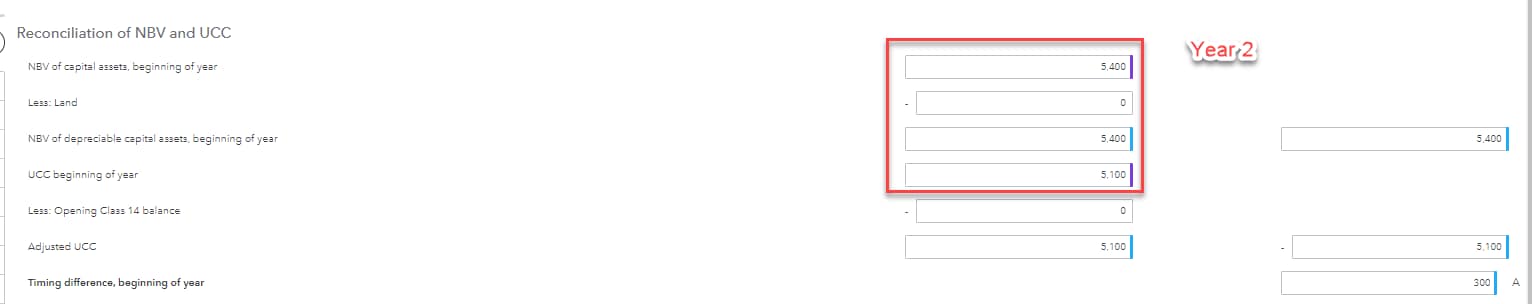

This form shows a reconciliation of net book value (NBV) with underpreciated capital cost (UCC) of capital assets.

Use the Other section on the form to include capitalized expenses that are not CCA class additions for the purpose of CCA calculations.

Amounts populating on this form originate from various forms, including:

- Carry forward from prior year tax return (in purple text)

- Schedule 100

- Schedule 125

- Schedule 8

- Schedule 6

This form does not transmit to CRA upon EFILE.

Scenario

Financial statements

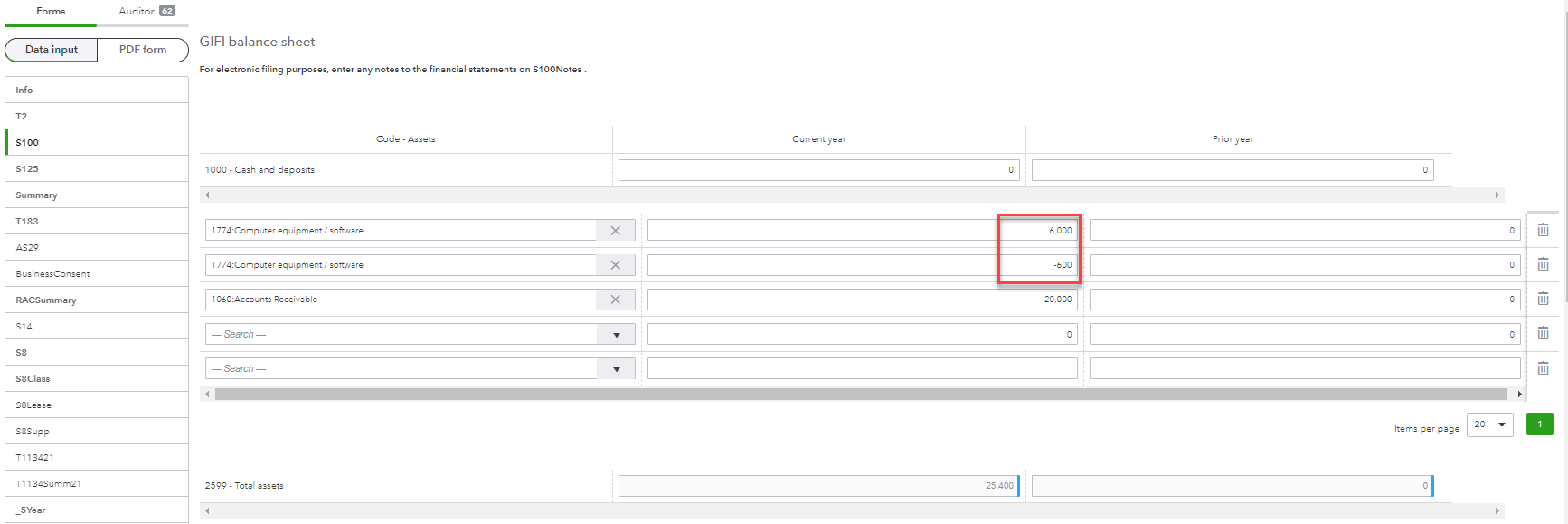

Your company decides to purchase $6000 worth of computer equipment (Schedule 100 GIFI code 1774).

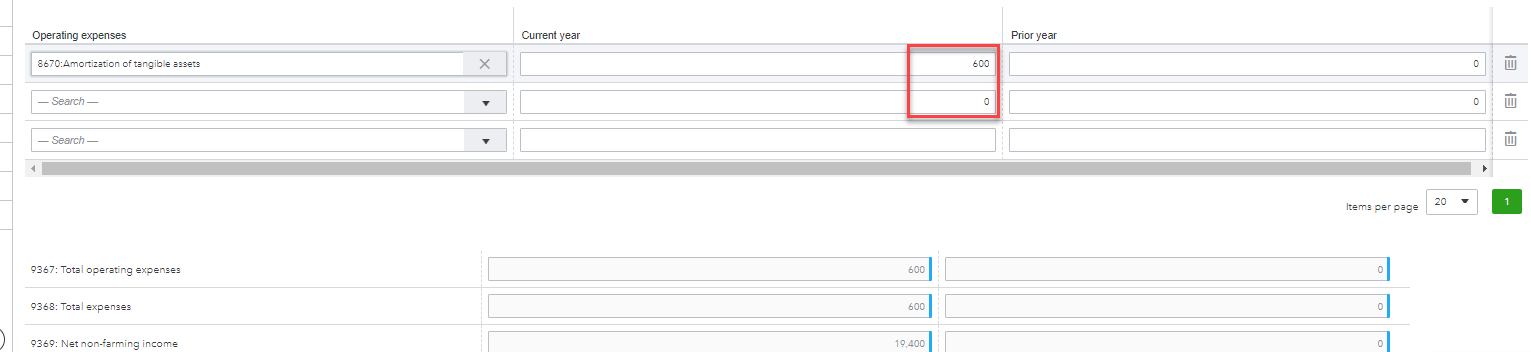

Your company decides to depreciate the purchase at 10% per year ($600 in year one - S100 GIFI code 1774 and S125 GIFI code 8670).

Schedule 8

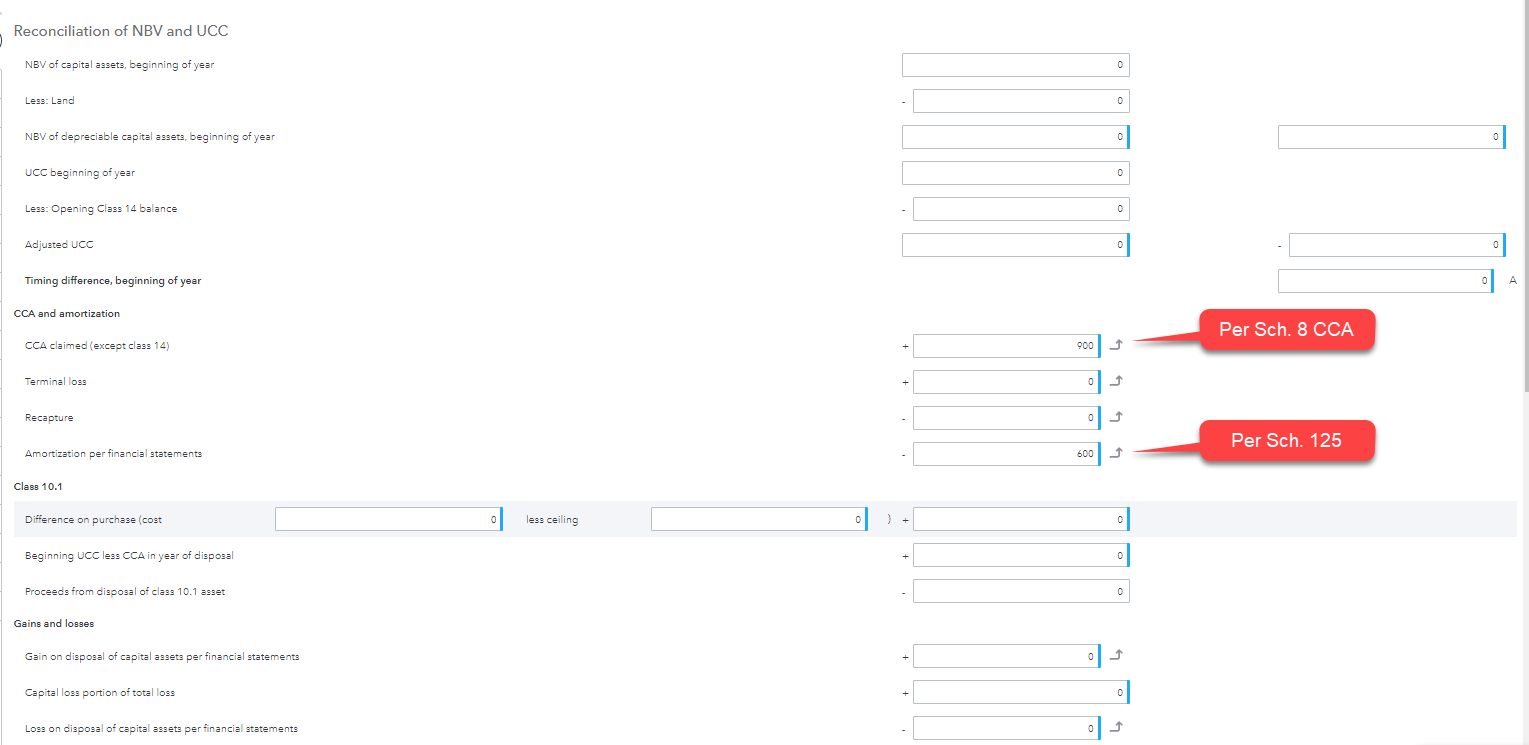

On the tax side, you have entered your asset as class 10 with the cost being $6000 and CCA for the year being $900, calculated as $6000 x 0.5 x 30%. (The 0.5 takes into account the half-year rule.)

Notice on S8supp that there is no timing difference between NBV and UCC.

Year 1:

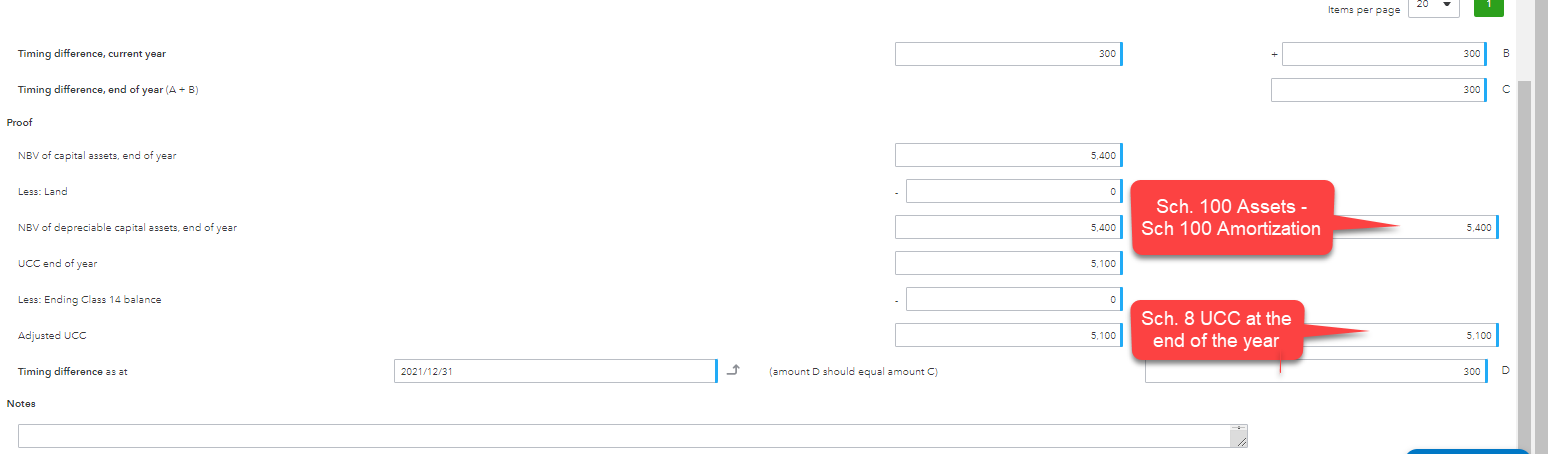

Note that the difference of Schedule 8 CCA and Schedule 125 depreciation expense (300) matches the difference between Sch. 100 Asset and Sch. 8 UCC at end of year (C=D).

When carrying forward the file, the $300 will carry forward on top of the S8Supp.

More like this

- Pro Tax release notesby QuickBooks

- QuickBooks Online Accountant Pro Tax carry forwardby QuickBooks

- Pro Tax frequently asked questionsby QuickBooks

- Introducing Pro Tax bundlesby QuickBooks