About accelerated CCA calculations / Accelerated Investment Incentive (AIIP) in Pro Tax

by Intuit• Updated 3 months ago

What are accelerated CCA calculations for?

In the 2018 Federal Fall Economic Statement the federal Minister of Finance introduced the Accelerated Investment Incentive (AIIP). This measure allows Canadian businesses to write off a larger share of the cost of newly-acquired depreciable assets (tangible and intangible) in the year the investment is made.

Only assets acquired and available for use after November 20, 2018 may qualify as AIIP.

Which modules include accelerated CCA calculations?

T1, T2, and T3 modules.

Which forms include accelerated CCA calculations?

• T2125

• T2042

• T1163-T1273

• T776

• T1163

• T2121

• T776 and Resource

• s8class

• s8lease

What do preparers need to do?

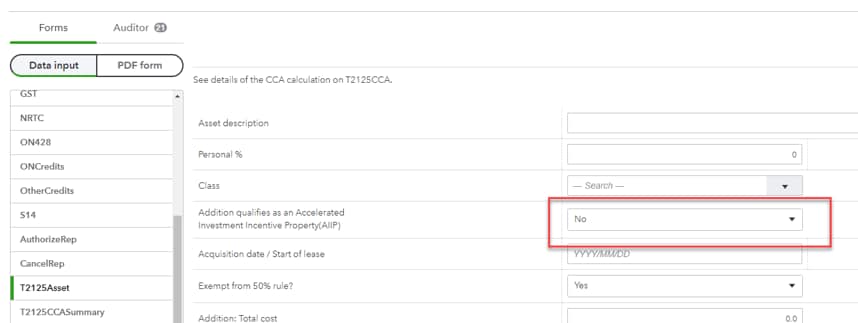

The preparer answers Yes or No to the question Addition qualifies as an Accelerated Investment Incentive Property (AIIP) on the form and inputs the acquisition date.

Pro Tax calculates the CCA for AIIP for acquisitions after November 20, 2018 or, for non-AIIP acquisitions, acquisitions on or prior to November 20, 2018.

Example

The following example features the T2125 form.

The question Addition qualifies as an Accelerated Investment Incentive Property (AIIP) defaults to the No response on the form:

- Select Yes from the drop-down menu.

- Enter the Acquisition date/Start of lease information.

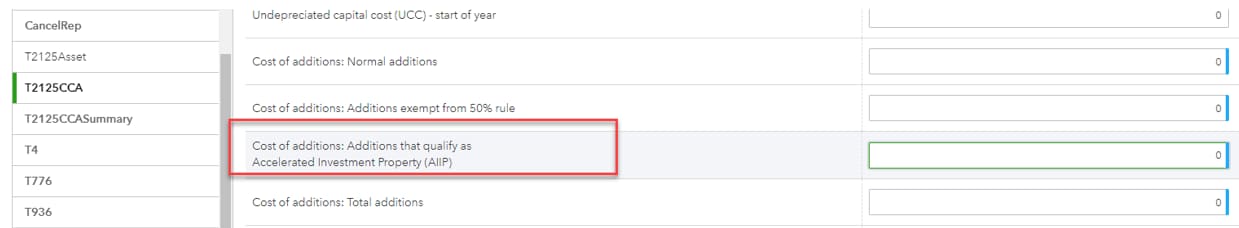

In this example, the information transfers to the T2125 CCA form as its own line:

Pro Tax grosses the amount on the new line in order to start the calculations.

More like this

- Pro Tax release notesby QuickBooks

- Pro Tax forms and schedules available in the T3 moduleby QuickBooks

- Add and manage fixed assets in QuickBooks Online Advancedby QuickBooks

- Learn more about Client Insights in Intuit Accountant Suiteby QuickBooks