Complete the S3 Principal Residence form in Pro Tax

by Intuit• Updated 1 year ago

Starting with the 2017 tax year, preparers must complete forms T2091 and/or T1255 for each real estate property disposed of by taxpayers in the year, including their principal residence.

In case of multiple properties disposed by taxpayer in the year, you should complete forms T2091 and/or T1255 for each property.

How are these forms managed?

The preparer completes S3 Principal Residence Detail Form. The information also populates in the Principal residence designation section of the Schedule 3.

The preparer completes the T2091 and/or T1255 form and sends a copy to the client for their signature. Clients sign the form and return it to the preparer.

The T1255 and T2091 forms each contain some data that transmits to CRA.

Can a preparer enter data directly into the new T1255 or T2091 forms?

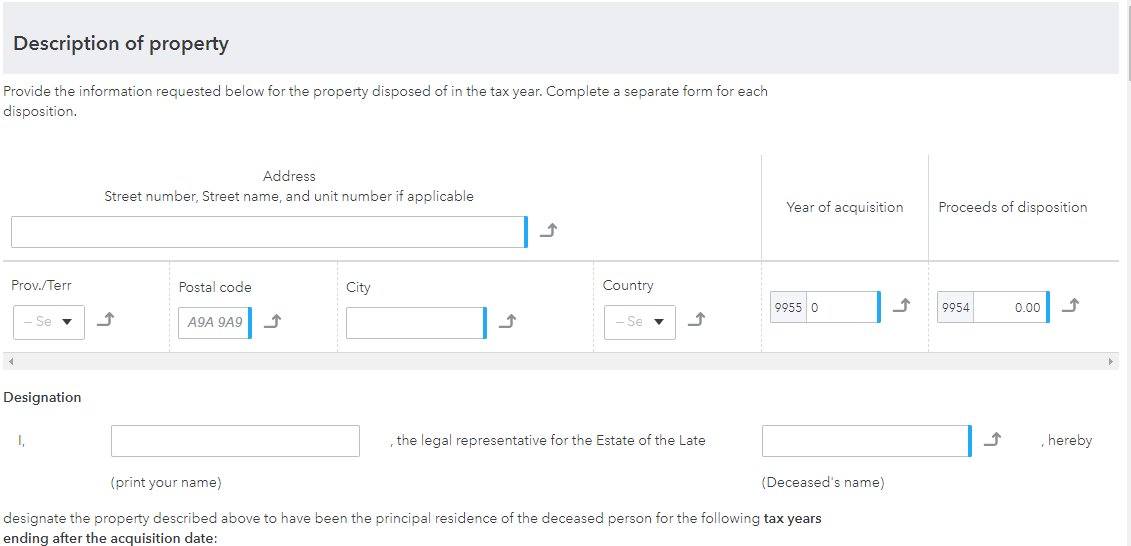

Data in the Description of property sections of the T1255 and T2091 forms flows from the client information entered on the S3 Principal Residence Detail form. Enter any remaining required data on the T1255/T2091 forms manually.

Is it necessary to retain the T1255 or T2091 forms?

A signed copy of Form T2091 - Designation of a Property as a Principal Residence by an Individual (or Form T1255 for deceased taxpayers) must be kept by the taxpayer in case the CRA asks for it.

Principal Residence Detail workflow

- Complete the individual T1 Info pages for the residence owner and spouse (if applicable).

- Answer Yes to the question Did you dispose of a property (or properties) in 2021 (or tax year being completed) for which you are claiming a principal residence exemption?

- Go to the S3PrincipalResidenceDetail in the form search. Select Add New form, click on Add and Add to return. The S3 Principal Residence Detail form opens.

- In box 17900, select a desgination and select Details.

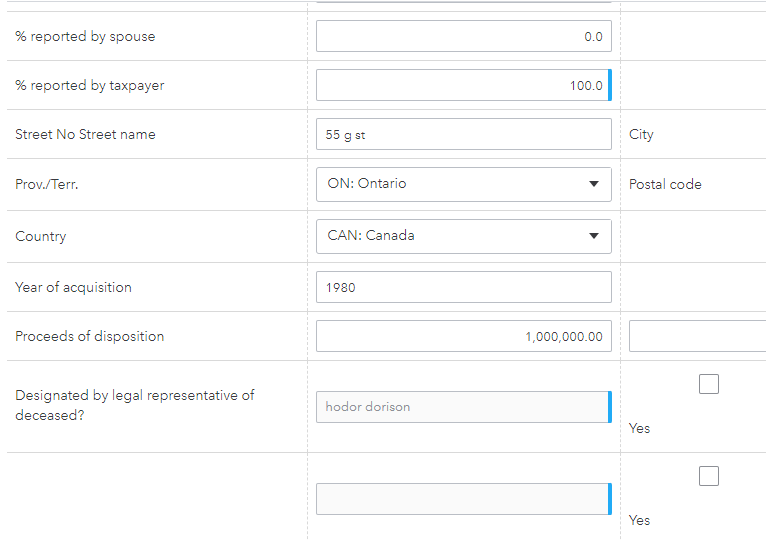

- Complete the S3 Principal Residence Detail form as required; note that the section “Designated by legal representative of deceased?” is automatically populated by the names of the residence owner and spouse (if applicable):

- Click Back when completed. Filling out will automatically populate the Schedule 3 Principal residence designation section as well as the main S3 Principal Residence Detail form.

Note: Each property that is disposed of automatically links to a T2091 form. Each property disposed of by the designated legal representative of a deceased taxpayer automatically links to a T1255 form.

If the Designated by legal representative of deceased option is not selected, the Description of property section of the T2091 form populates:

Go to Form, add the T1255. The form opens and select Details.

Complete the T2091 and/or T1255 Form

If the residence was owned 100% by an individual in the relationship, the non-owner spouse does not complete a T2091 or T1255 form.

If the residence was owned in a 50/50 split, a T2091 or T1255 form must be completed for each spouse as follows:

- If option 1 in Line 17900 of Schedule 3 was selected, complete only the first page elements of the T2091 form that were not automatically calculated. If options 2 or 3 in Line 17900 of Schedule 3 were selected, it is necessary to complete the remaining elements of the form applicable to the specific situation, or:

- If option 1 in Line 17900 of Schedule 3 was selected, complete only the first page elements of the T1255 form that were not automatically calculated. If options 2 or 3 in Line 17900 of Schedule 3 were selected, it is necessary to complete the remaining elements of the form applicable to the specific situation.

Sign in now for personalized help

See articles customized for your product and join our large community of QuickBooks users.

More like this

- Pro Tax release notesby QuickBooks

- Pro Tax forms and schedules available in the T3 moduleby QuickBooks

- Transferring tuition from a dependent in Pro Taxby QuickBooks

- Determining a Client's Residency status in ProTaxby QuickBooks