Pro Tax T1 pension splitting

by Intuit• Updated 8 months ago

This article details how to acquire the optimum pension-split amount for a couple. Pension splitting is only supported in Pro Tax on spouse-linked returns in tax years of 2021 and later.

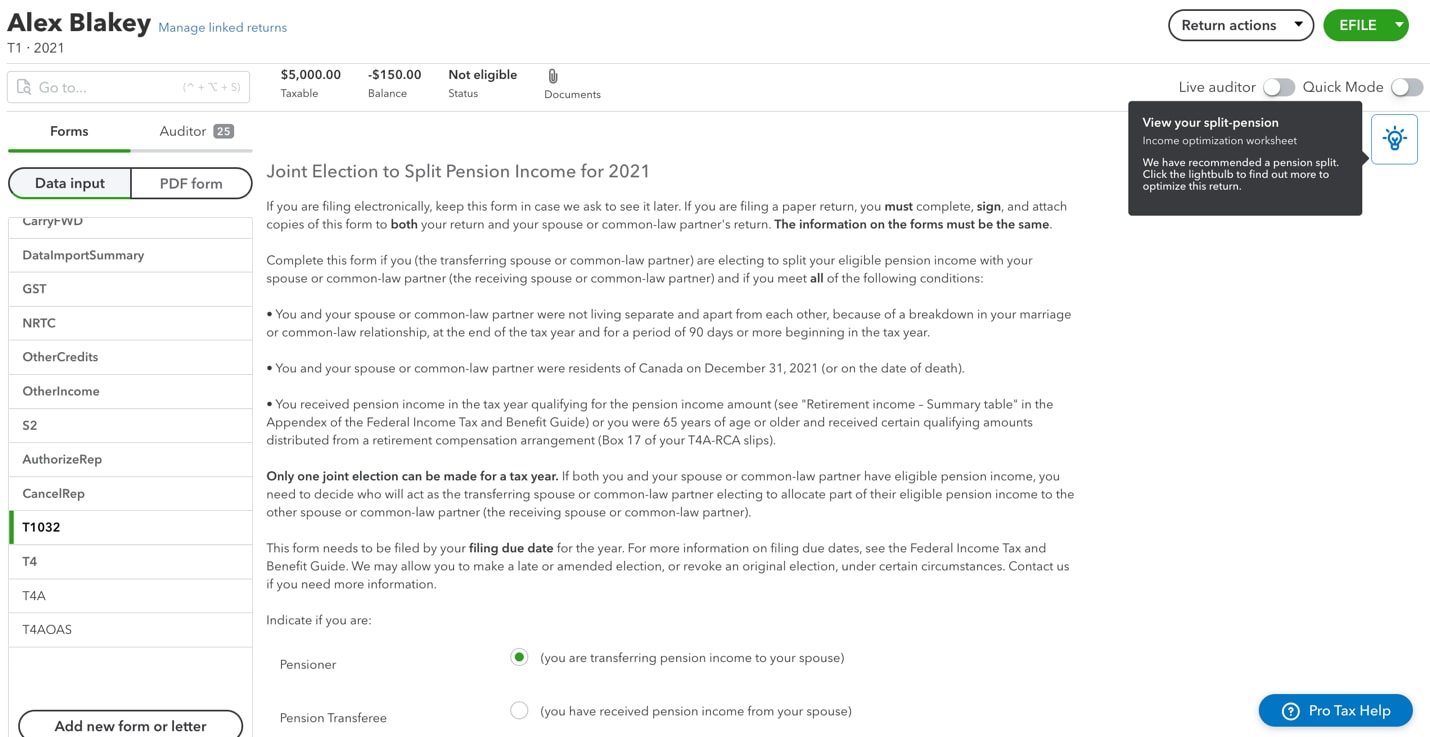

- Open the form T1032 in the return of the person transferring the pension. If it's not in the forms list, select Add new form or letter to add it.

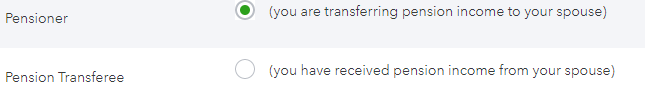

- Click the radio button indicating the person is the pensioner.

- Click on the lightbulb on the left side of the return.

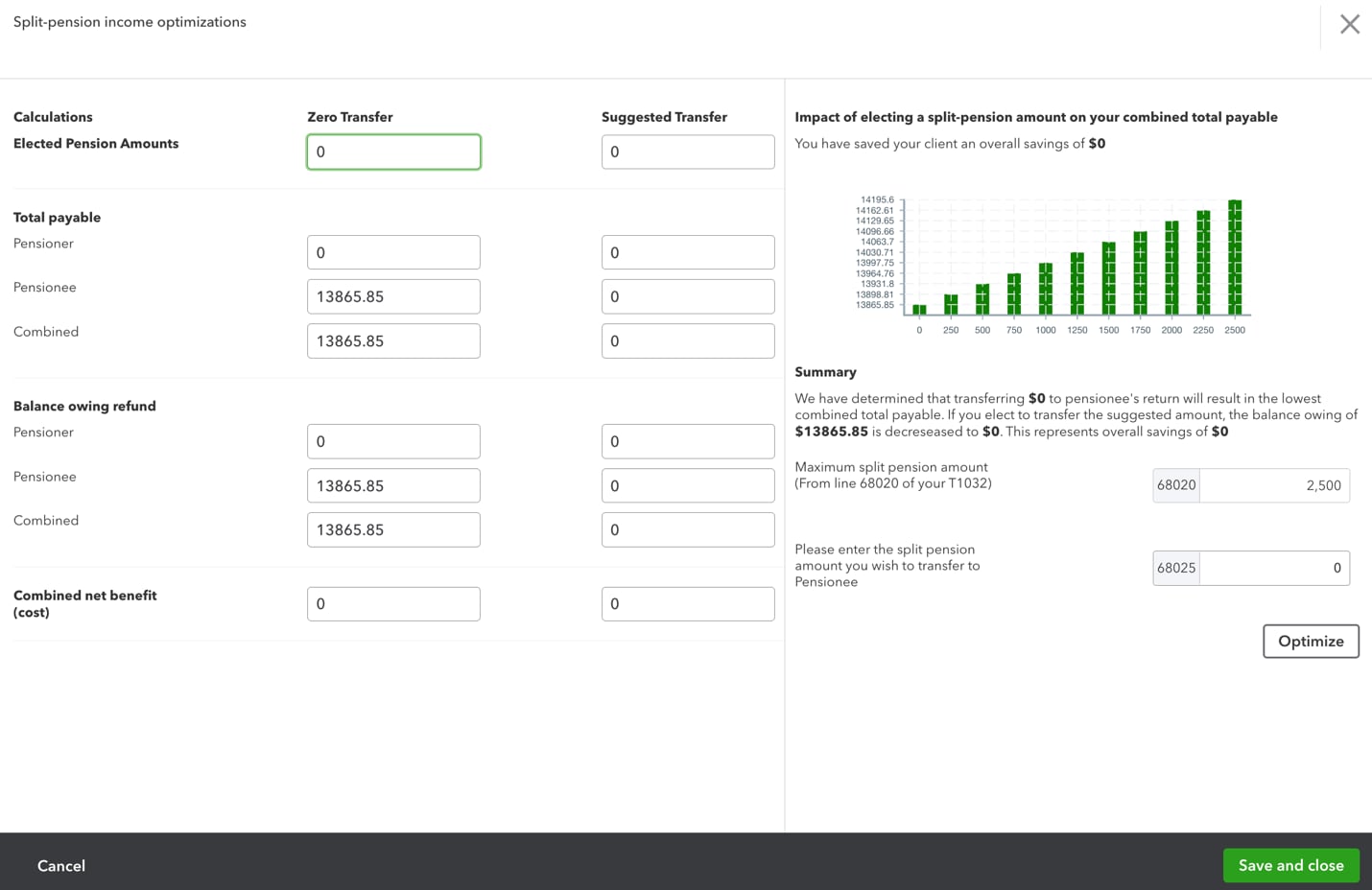

- Pro Tax will optimize the form and populate with the optimal suggested split-pension information. A graph displays various impacts on the combined refund/balance dues at various pension income-split dollar values.

- Selecting Optimize will add the suggested amount to box 68025.

- At the bottom of the optimization window, select Save and close to save the changes, or cancel to go back to the return.

More like this

- Pro Tax release notesby QuickBooks

- T1 and T2 carry forward from TaxCycle to Pro Taxby QuickBooks

- File a return in Pro Taxby QuickBooks

- How to EFILE the T1135 from the T1 module in Pro Taxby QuickBooks