Completing an early-file T1 return

by Intuit• Updated 1 year ago

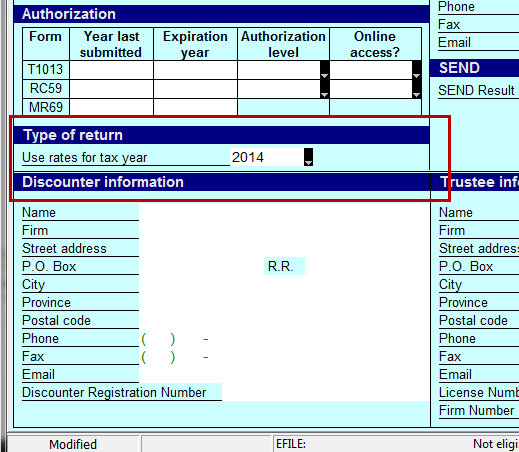

When the preceding year T1 tax forms have not yet been released by the CRA, go to the Info page of the T1 module, then to section Type of return. Use the following year's tax rate for the return.

Note: The CRA can change the tax rates at any time, as they have not yet been officially released.

The return has to be printed, the current tax year on the paper has to be crossed out and updated manually, and then paper filed. The CRA only accepts EFILE transmission of years documented in this article.

Tip: Click in the Use rates for tax year field and press F1 on the keyboard. The help menu will open displaying information for that specific field.

You must sign in to vote.

Sign in now for personalized help

Ask questions, get answers, and join our large community of Profile users.

More like this

- Manage deceased return deadlinesby Intuit

- File a deceased taxpayer's return earlyby Intuit

- Using the T1 Pre-Authorized Debit (PAD) formby Intuit

- Complete a T1 adjustmentby Intuit