T776 not splitting income and expenses between spouses

by Intuit• Updated 1 year ago

Issue

For most cases in Form T776 with co-ownership, the taxpayers will split equally at 50% each.

You may come across an exception on line 9936 of the T776, which is the capital cost allowance (CCA) for the year. In this case, ProFile allocates 100% of the CCA to one of the taxpayers and 0% to the other.

Solution

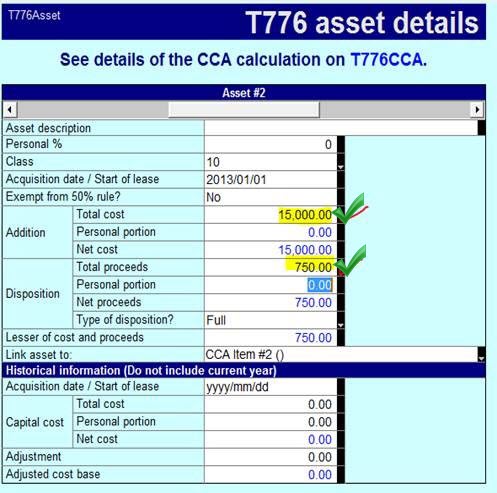

- Navigate to the T776 Asset and T776CCA forms.

- Split all amounts by 50%, or the percentage each taxpayer has in the co-ownership.

Following the split, the T776 Asset and T776CCA display as follows:

3. With the T776Asset open, select Intuitive copy from the Edit drop-down menu in the top toolbar.

4. Navigate to the spouse's T776 Asset and select Intuitive paste from the Edit dropdown menu in the top toolbar.

The T776Asset and T776CCA forms copy from one taxpayer to the other.

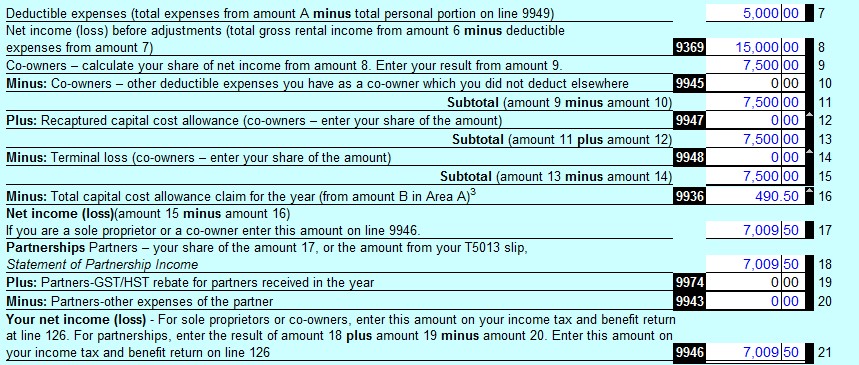

5. Navigate to the line 9936 of the T776.

The correct amount displays in both returns.

You must sign in to vote.

Sign in now for personalized help

Ask questions, get answers, and join our large community of Profile users.