Using the Record Bounced Check feature in QuickBooks Desktop to record a bounced check

by Intuit•36• Updated 1 month ago

Recording a Non-Sufficient Funds (NSF) or bounced check ensures your bank account balance and accounts receivable remain accurate in QuickBooks Desktop. You can record these transactions using the automated Record Bounced Check feature or by manually adjusting your entries to mark invoices as unpaid and log bank fees.

QuickBooks for Windows

You can manage bounced checks in Windows using the automated feature or a manual process if specific conditions apply.

Option 1: Use the Record Bounced Check feature

The Record Bounced Check feature automates the necessary adjustments to your accounts.

Prerequisites

- You must be in single-user mode.

- The payment method must be set to Check. If you have a returned ACH item, switch the payment type to Check before proceeding.

- The check must not be waiting to clear in the Undeposited Funds account; it must have cleared the bank to bounce.

Instructions

- Go to Customers and select Customer Center.

- Select Transactions tab, then select Received Payments.

- Double-click the payment you want to record as NSF.

- On the receive payments window, select the Record Bounced Check icon on the Main tab.

- In the Manage Bounced Check window, enter the following information, then select Next.

Note: These fields are optional. You can leave them blank if there were no additional charges from the bank or if you don’t want to charge your customer for it:- Bank Fee and Date

- Expense Account for the Bank Fee

- Class

- Customer Fee (enter how much you will charge the customer)

- Select Next.

- Review the Bounced Check Summary. QuickBooks will indicate that:

- The following invoices will be marked unpaid.

- These fees will be deducted from your bank account.

- This invoice will be created for the fee you want to charge your customer.

- Select Finish.

Option 2: Manually record bounced check

Use this manual process if the payment method is grayed out or if you are unable to use the automated feature.

Step 1: Create an income account and item

You only need to perform this setup once. If you have already created these, proceed to Step 2.

Create an income account:

- Type: Income Account

- Account Name: Bounced Checks Income

Create a Bad Check Charge item:

- Type: Other Charge

- Item Name: Bad Check Charge

- Amount or %: Leave at 0.00

- Tax Code: Non-taxable

- Account: Select Bounced Checks Income (the account created above).

Step 2: Create a journal entry to reverse the original payment

- From the Company menu, select Make General Journal Entries.

- Debit your account receivables for the same amount as the NSF check.

- Enter a note in the Memo column describing the transaction (for example, Bounced check #123 - NSF).

- Select the name of the customer or job associated with the NSF check under the Name column.

- Credit the checking or bank account that received the original deposit.

- Select Save & Close.

Step 3: Switch the payment to the reversing journal entry

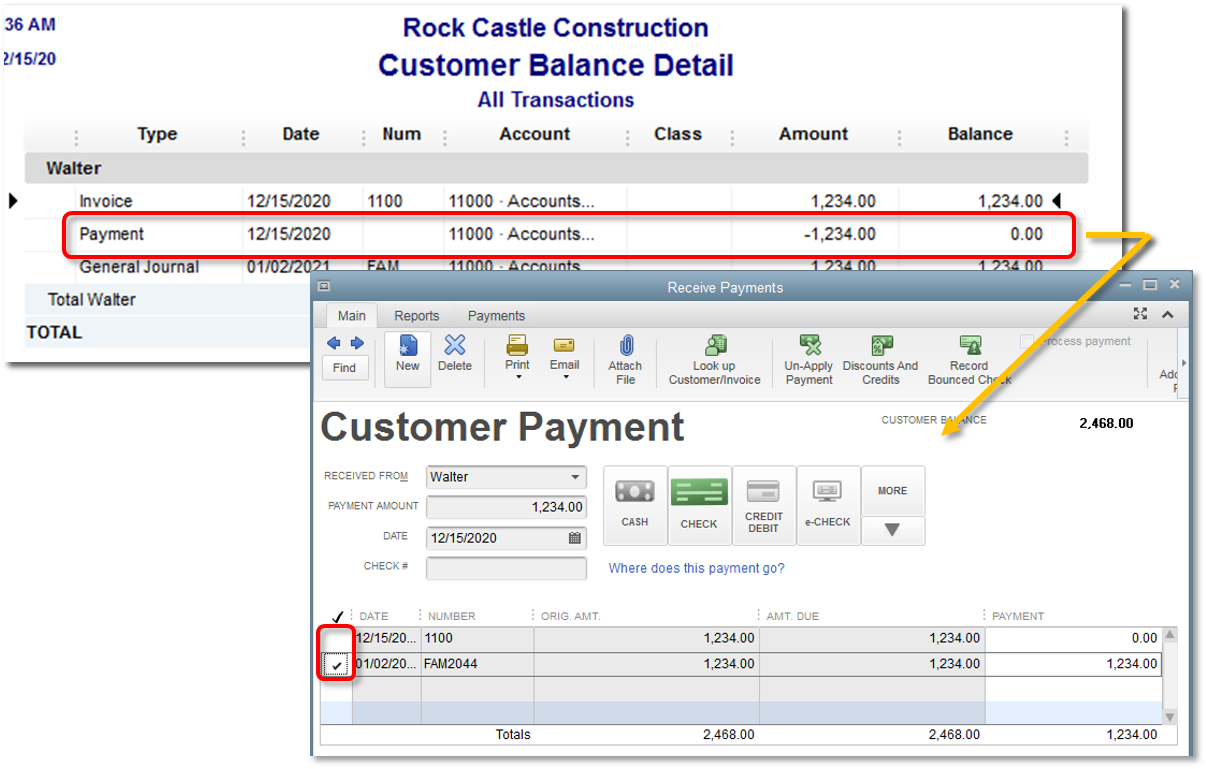

- From the Reports menu, select Customers Receivables, then choose Customer Balance Detail.

- Double-click the original payment line for the NSF transaction.

- In the Receive Payments window, move the checkmark from the invoice to the reversing journal entry.

- Select Save & Close. This reduces your bank account by the amount of the bounced check and marks the original invoice as unpaid.

Important: This will reduce your bank account by the amount of the bounced check. The invoice where the bounced check came from will be marked unpaid.

Step 4: Resend the open invoice (Optional)

- Go to the invoice where the bounced check originated.

- Add the item Bad Check Charge created in Step 1. Note: Skip this step if there are no additional bank charges or if you don't want to charge the customer.

- Select the Email icon on the Main tab, then choose Send.

QuickBooks Desktop for Mac

Prerequisites

- The customer payment must be a check already entered in QuickBooks.

- The payment must not be deposited to the Undeposited Funds account.

Instructions

- Go to the Customers menu and select Receive Payment.

- Find and open the check, then select Bounced Check.

- Complete the required information. Note: For bank fees, QuickBooks creates a bank service charge expense account if you don’t have one.

- Select Next to view a brief explanation of what happens to the invoice, check, and bank fees.

- Select Record.

Result:

- The invoice is marked unpaid and outstanding.

- A Bounced Check Charge is added for your customer. QuickBooks creates a Returned Check Charges income account if one doesn't exist.

- A journal entry is created to reverse the payment. To see details, double-click on the journal entry.

More like this

- What to do if your check bounces and your bank account has non-sufficient fundsby QuickBooks

- Record a bounced check using an invoiceby QuickBooks

- Manage a bounced check you wroteby QuickBooks

- Record a returned payment or bounced checkby QuickBooks