Track sales commissions

by Intuit•172• Updated 5 days ago

QuickBooks Online currently does not have a calculation feature for sales commissions. However, there is a way for you to track your sales by employee, sales rep, etc. using its two tracking features: Class Tracking and Location Tracking.

For a better experience, open this article in QuickBooks Online. Launch side-by-side view

To turn on the Class Tracking or Location Tracking features

- Select the Gear icon at the top then Account and Settings (or Company Settings.)

- Select Advanced from the left navigation menu.

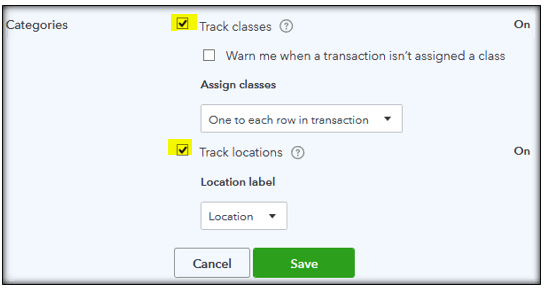

- Choose the pencil icon next to Categories.

- Put a check mark on the Track Classes or Track Locations checkmark boxes.

You may now set up your location list and turn on your class tracking.

After creating your Class or Location list, you can now add your sales people as either a Class or a Location to enable you to track their sales individually. When you enter in transactions, you'll have fields for Class and/or Location. You can then select the salesperson associated with that transaction.

To find out how much each salesperson sold, you can run sales reports by Class or Location. You can also run Profit and Loss reports by Class or Location. To pay your salesperson their commissions, run the Sales by Class/Location report, and then multiply your salesperson's commission percentage by the amount they sold then go to the Write Check window to pay your salesperson.

If you're writing checks to pay your team, consider adding QuickBooks Online Payroll.

If you're writing checks to pay your team, consider adding QuickBooks Online Payroll.

Note: Your reports may or may not display transactions based on your accounting method (cash basis or accrual basis.) When this happens, change your accounting method on the report.

More like this

- Pay your employees a commissionby QuickBooks

- Track the total sales for each salesperson without Class/Location trackingby QuickBooks

- Turn on class trackingby QuickBooks

- Work with the chart of accounts in QuickBooks Desktopby QuickBooks