Import transactions from your Etsy shop into QuickBooks Online

by Intuit•22• Updated a day ago

Learn how to automatically import transactions from your Etsy shop into QuickBooks Online.

Get powerful accounting and expert tax help in one place with QuickBooks Online + Live Expert tax. Explore your options.

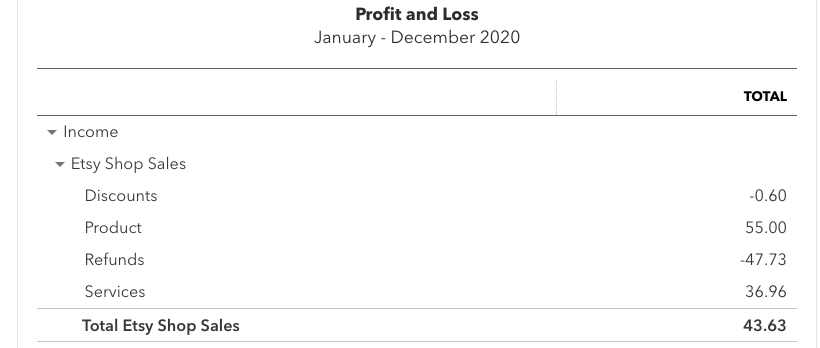

Do you sell your products on Etsy? You can use the Sync with Etsy app to bring transactions from your Etsy payment account into QuickBooks. The app automatically enters and categorizes each sale, refund, and fee. It’s a great way to save time and keep your books up to date.

For a better experience, open this article in QuickBooks Online. Launch side-by-side view

Here’s how to set up the app and get your Etsy transactions into QuickBooks.

Step 1: Set up accounts in QuickBooks if you need to

Before the Sync with Etsy app imports your transactions, make sure these accounts are set up in QuickBooks:

- The bank account where Etsy deposits your money from sales

- The bank or credit card account where Etsy charges your seller fees

You can check if these accounts are already in QuickBooks by going to your chart of accounts:

- Go to All apps

, then Accounting, then Chart of accounts (Take me there).

, then Accounting, then Chart of accounts (Take me there). - Look for the accounts in the list.

If they don’t exist in QuickBooks yet, follow the steps to add new accounts to your chart of accounts.

Step 2: Set up the Sync with Etsy app

With your accounts set up, you’re ready to connect QuickBooks to your Etsy shop:

To help keep your customer's account secure, direct them to sign in using the link in the following step before continuing. If they are unable to sign in, help them recover their Intuit account.

Note: You can copy the direct sign-in link and give it to your customer, if needed.

- Select Integrations

, then Find integrations (Take me there).

, then Find integrations (Take me there). - In the Search field, enter “Etsy” and select Sync with Etsy from the list.

- Select Get app now.

- Follow the instructions on the screen to set up the app, including these steps:

- Give Intuit permission to access your Etsy shop.

- Select the bank accounts you set up in step 1 so the app knows where to enter transactions.

- Select the import start date. The app can import transactions as far back as January 1 of the previous calendar year.

Note: If you choose a start date from the past, the app may import Etsy transactions that are already in your books. You may need to make adjustments so these transactions aren’t counted twice. See step 3 below.

After you finish setup, the app begins to import your Etsy transactions into QuickBooks. Depending on the number of transactions, it may take a few hours to finish.

After the first import, the app checks your Etsy payment account at least once every three hours and brings in the latest transactions.

| Important: When Sync with Etsy connects to QuickBooks, it adds accounts, services, and customer and vendor names to your company. We recommend you keep these items exactly as they are to ensure the app imports your Etsy transactions properly. |

Step 3: Adjust your books for past transactions if you need to

If you choose to import Etsy transactions from the past in step 2, the app may add transactions that you already have in your books. This may cause them to be counted twice in your accounting.

Review your QuickBooks income and expenses for any Etsy transactions that you posted before you set up the Sync with Etsy app. If you find any, learn how you can make adjustments to your books so your accounting stays accurate.

Note: You only need to make these kinds of adjustments after the first import. When the Sync with Etsy app imports new transactions, it automatically creates transfers that match to deposits or charges to your bank or credit card account. This helps prevent transactions from being counted twice and your income or expenses from being overstated.

Going forward: Reconcile your Etsy account and bank account

Like other accounts in QuickBooks, you’ll want to review your “Etsy

You can use your bank’s monthly statements or download monthly statements from Etsy. Note: Etsy’s statements show the transactions in your payment account for that period but do not have beginning and ending balances.

Learn more about how to reconcile your accounts.

Common questions about the Sync with Etsy app

More like this