Set up Colorado Family and Medical Leave Insurance Program (FAMLI)

by Intuit• Updated 2 months ago

Learn how to set up QuickBooks Payroll to track paid family and medical leave in Colorado.

Colorado has implemented paid family medical leave, called Family and Medical Leave Insurance Program (FAMLI). The program gives employees paid time off to care for themselves, ill family members, or a new child.

All Colorado employers are required to collect premiums effective January 1, 2023.

Find out more about Colorado FAMLI.

How the Colorado FAMLI program works

- The total contribution rate is 0.9% and is paid on the first $160,200 in wages.

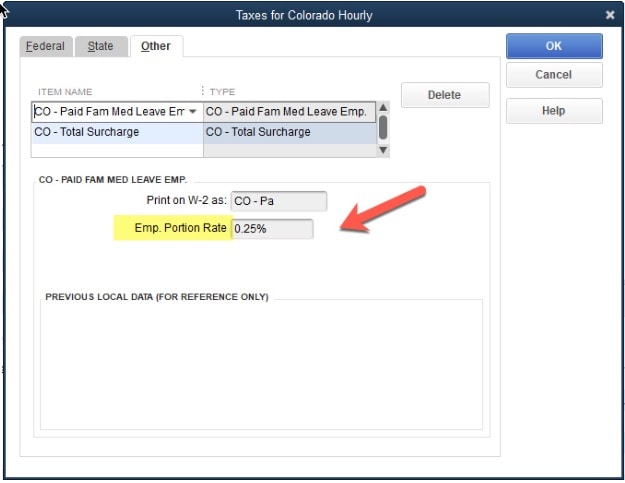

- Your employees pay 0.45% (or 50% of the 0.9%). Your business may choose to pay some or all of the employee portion as a benefit to your employees.

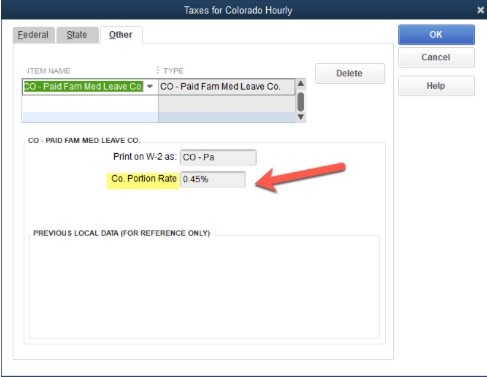

- If you have 10 or more employees, your business pays 0.45%. If you have 9 employees or less, you don’t pay an employer portion.

- If you offer your own paid leave program, you can apply for an exemption after the start of 2023. The agency will work with you to process refunds after private plan applications have been accepted. We’ll provide more info as it becomes available.

- If you use QuickBooks Online Payroll Core, Premium, or Elite with automatic tax payments and filings turned on, or you use QuickBooks Desktop Payroll Assisted, we pay and report the premiums for you.

- If you use QuickBooks Online Payroll Core, Premium, or Elite with automatic tax payments and filings turned off, or you use QuickBooks Desktop Payroll Basic, Standard, or Enhanced, you’ll need to pay and report the premiums yourself.

Add Colorado FAMLI to your employees

Select your product below.

| Note: Not sure which payroll service you have? Here's how to find your payroll service. |

Edit, remove, or delete Colorado FAMLI

Exempt employees from Colorado FAMLI

Frequently asked questions

Sign in now for personalized help

See articles customized for your product and join our large community of QuickBooks users.

More like this

- Set up and manage Washington Paid Family and Medical Leaveby QuickBooks•172•Updated January 31, 2024

- Understand workers’ compensation insuranceby QuickBooks•569•Updated May 02, 2024

- Set up and manage Massachusetts Paid Family and Medical Leaveby QuickBooks•76•Updated January 31, 2024