Understand your credit card processing statement

by Intuit•43• Updated 2 months ago

Learn how to read your processing statement.

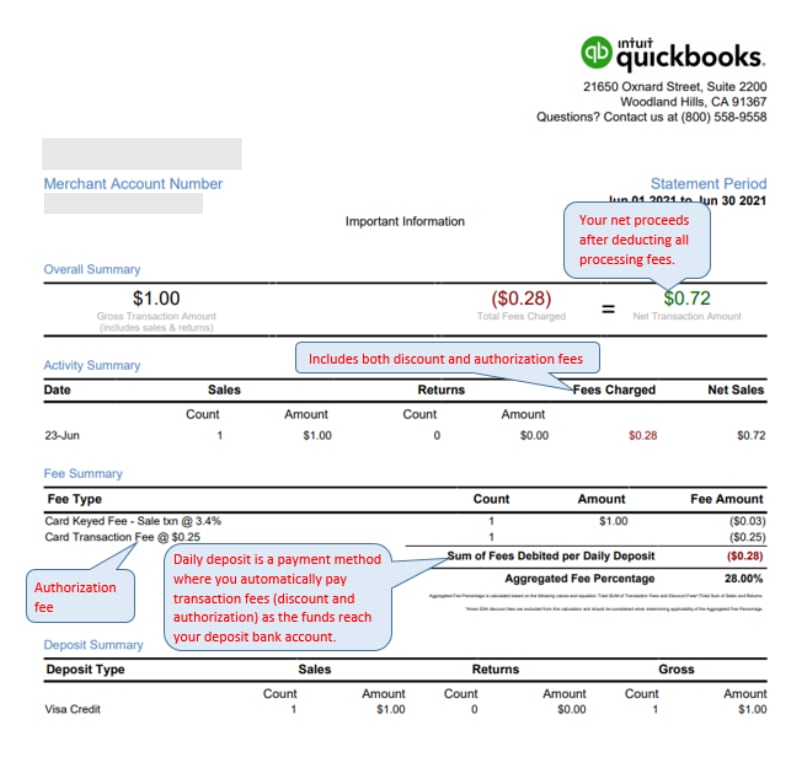

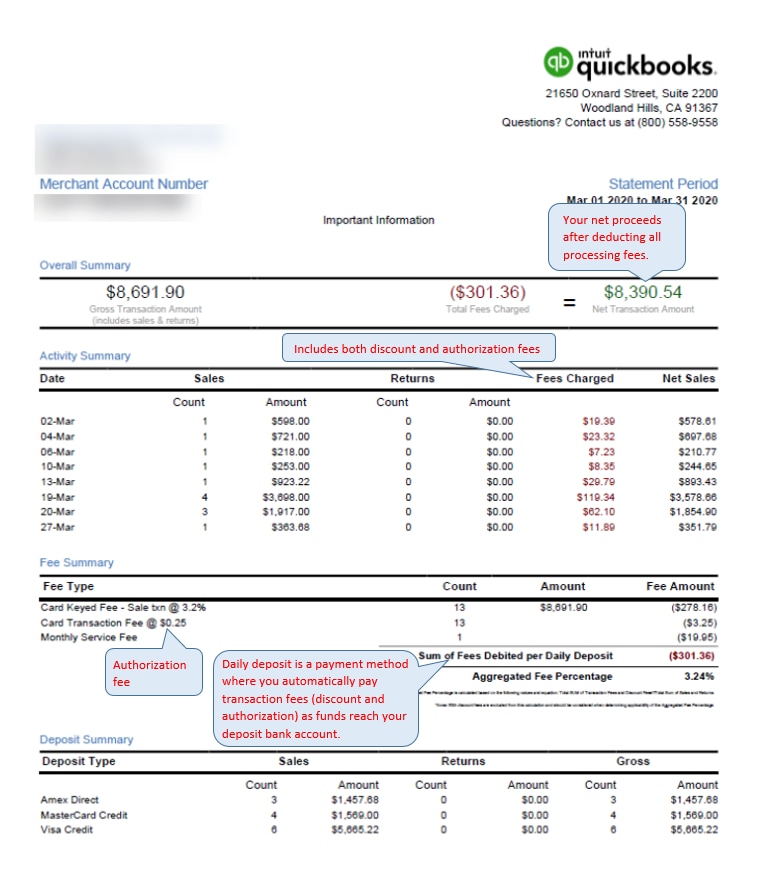

Your monthly statement shows your processing activity by date. You'll see info that helps you see how your business is doing and track the fees you pay for services. Check out these example statements:

Frequently asked questions

Discount fees

Discount fees are fees paid by a merchant to their customer’s card-issuing bank and card associations. In some cases, the card-issuing bank and the card association are the same company (American Express).

Authorization fees

An authorization fee is a per-transaction fee that applies to all credit cards that Intuit assesses.

Fee counts don't match the number of transactions

Fees for some transactions processed near the end of the month may show on the next month's statement.

Deposits don't match my sales by date

Sales you process after the daily batch time (3 PM Pacific time) might not post until the next day. Intuit withheld funds for a time before the deposit.

Lower the fees I pay

- Swipe cards whenever you can. Swiped rates are lower. You can order a QuickBooks GoPayment card reader through the QuickBooks GoPayment mobile app.

- Reverse bad sales before batch time (to void instead of refund).

- Don’t try to swipe again and charge a lower amount if your card gets declined.

- Get signatures whenever possible to guard against chargebacks.

More like this

- Fix customer's declined credit card paymentsby QuickBooks

- Recurring Credit Card Payment FAQsby QuickBooks

- Understand Intuit charges on your credit card or bank statementby QuickBooks

- Process payments in the Merchant Service Centerby QuickBooks