Reclassify or move multiple transactions

by Intuit•6• Updated 3 weeks ago

This video shows the QuickBooks Online Advanced experience, but is useful for the Accountant view experience. Find the specific steps for your account below.

Prerequisites

First, make sure you know which transactions you want to reclassify. There are a few reports you can use to find this information, like the Profit and Loss report.

Follow this link to complete the steps in product

If you want to change the location of your transactions, set up locations for your account.

Reclassify and move transactions

Follow this link to complete the steps in product

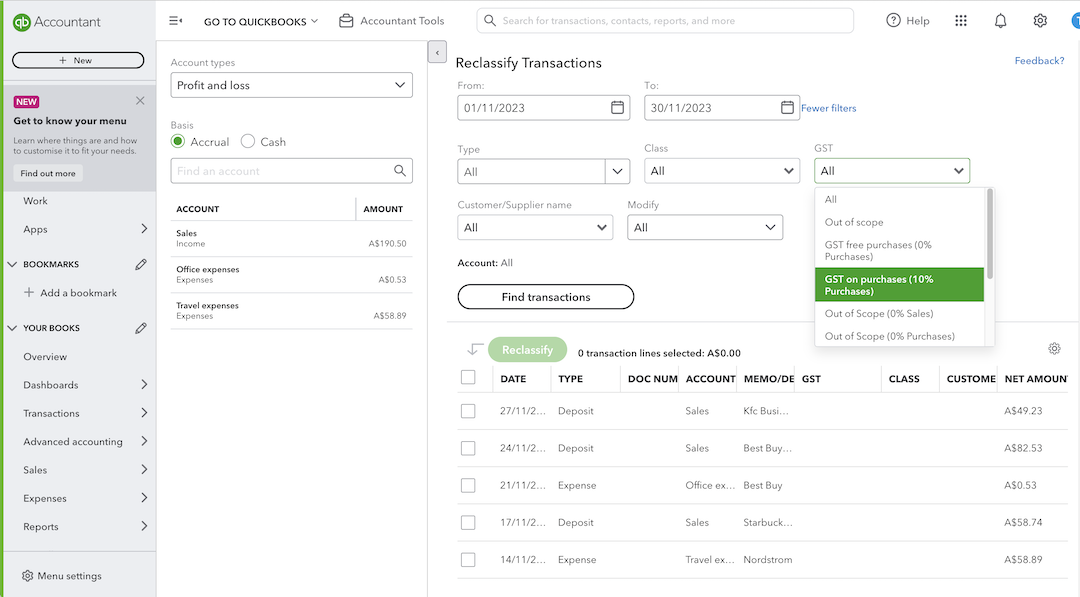

- Go to Settings ⚙ and select Reclassify transactions.

- Select Account types ▼ dropdown.

- Select Profit and loss to see income and expense accounts.

- Select Balance sheet to see your asset, liability, and equity accounts.

- Select Find transactions.

- Tick the box next to each transaction you want to change.

- Select Reclassify.

- For the transactions you’re changing, select a new account, class, or location.

Important: Before you move transactions to Accounts Receivable (A/R) or Accounts Payable (A/P), make sure there's a customer or supplier. Don’t leave these fields blank. - When you’re ready, select Apply.

Related links

More like this

- Bulk reclassify GST Codes on transactionsby QuickBooks

- Create and send multiple invoices in QuickBooks Online Advancedby QuickBooks

- Create multiple bills or expensesby QuickBooks

- Enter a split transaction into the account history in QuickBooks Onlineby QuickBooks