Create a payroll summary report

by Intuit•164• Updated 1 month ago

Learn how to create a payroll summary report to see what you've paid out in your QuickBooks Payroll.

If you want a quick view of your payroll totals, including employee taxes and contributions, you can run a Payroll Summary report for any date range, or group of employees in QuickBooks.

| Note: Not sure which payroll service you have? Here's how to find your payroll service. |

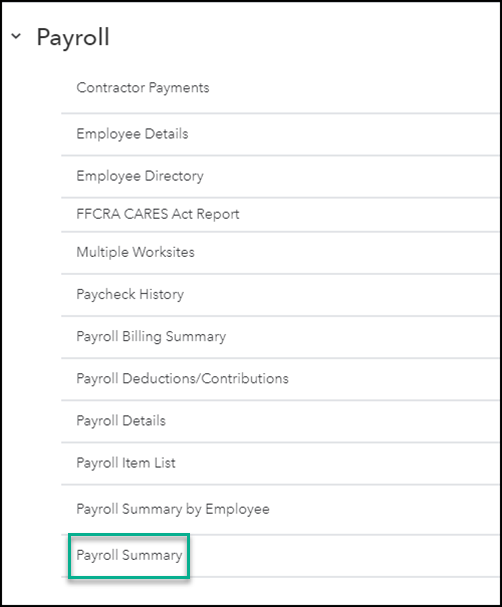

Create a payroll summary report

The payroll summary report gives you the total payroll wages, taxes, deductions, and contributions. Here's how to run a payroll summary report.

Note that the dates in this report are by paycheck dates only, not pay period dates.

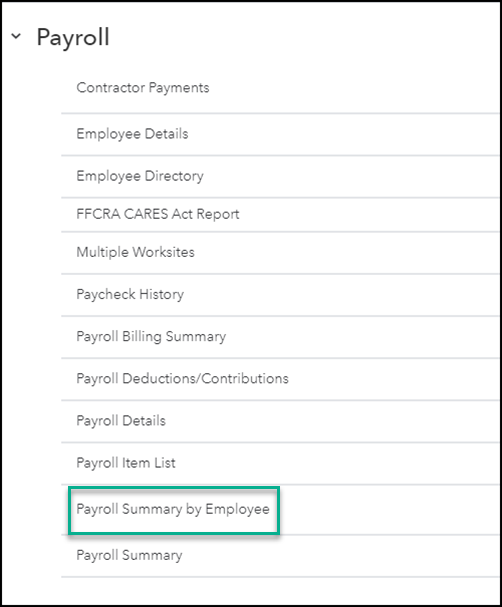

Create a payroll summary report by employee

Run a payroll summary by employee if you need to view the payroll wages, taxes, deductions, and contributions totaled by employees.

More like this

- Run payroll reportsby QuickBooks

- Customize reports and create custom summary reportsby QuickBooks

- Create prevailing wages and certified payroll reports in QuickBooks Desktop Payrollby QuickBooks

- Use reports to track cash flowby QuickBooks