- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Employees and payroll

Thanks for posting here, @dubeysai,

I can help you do your W-2 corrections. Please note that the amendment process may differ for every QuickBooks Online Payroll versions.

If you're using QuickBooks Online Payroll Enhanced, you must create and file a W-2c form with the Social Security Administration manually. W-2C form is currently unavailable for this payroll service which is why you need to do it outside the program. See the General Instructions for Forms W-2c and W-3c section in General Instructions for Forms W-2 and W-3.

For QuickBooks Online Payroll Core, QuickBooks Online Payroll Premium, QuickBooks Online Payroll Elite and QuickBooks Online Payroll Full Service subscribers, we will be the one to fix it. Our experts will file a W-2C form with the SSA, and mail the W-2c to your employee. You’ll also receive a copy of the amended form.

To request a correction, please contact our Support Team. Here are the steps to do that:

- Go to the Help menu then select Contact us.

- Enter the keyword Payroll, Account Management and Billing in the What can we help you with? box.

- On the next screen, scroll down to the Choose a way to connect with us section.

- Choose Start messaging to initiate a discussion with a live agent or Get a call for callbacks.

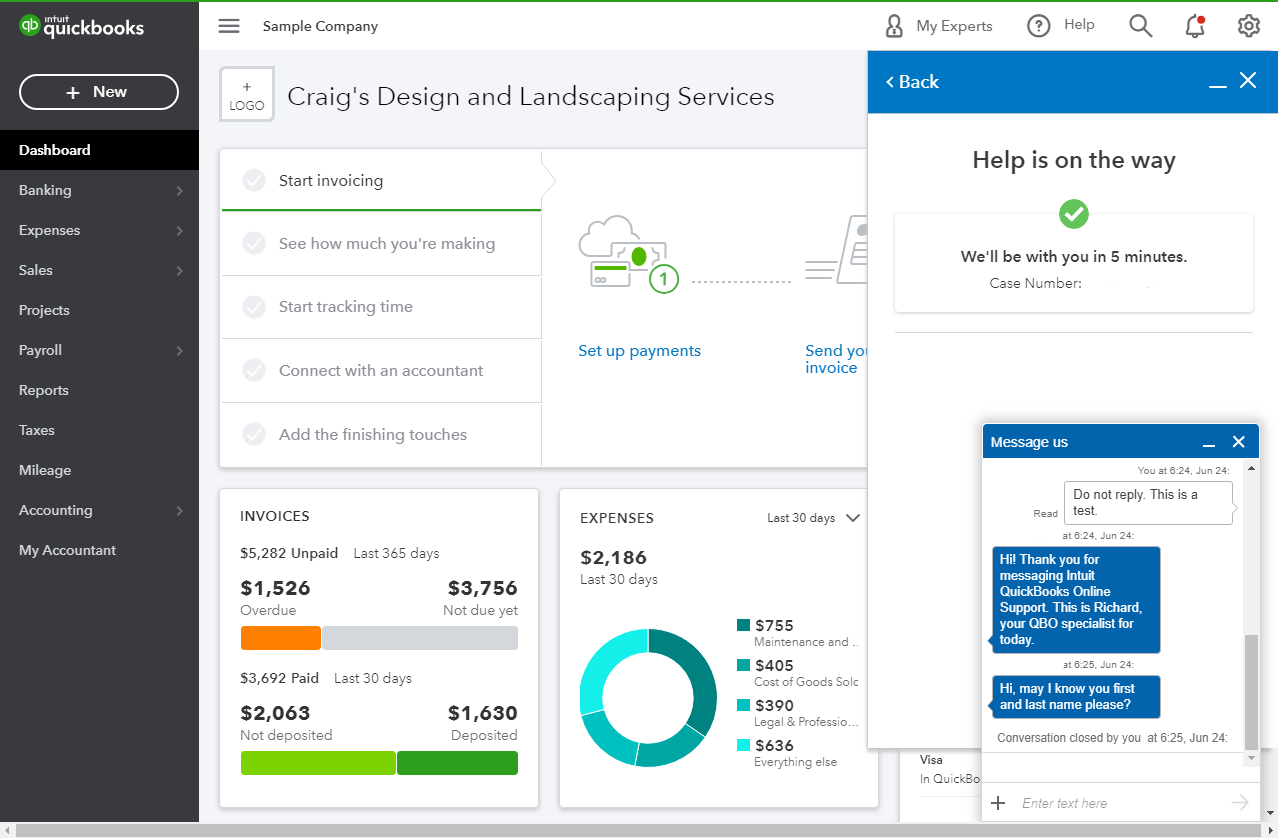

- When using the messaging option, make sure to enable pop-up windows. The chat box will appear at the bottom right section of your monitor, and an agent will be with you after filling in the information needed. See this:

When you're connected, provide all the information about your concern or request a viewing session with out representative.

The expert you talk to will let you know approximately when you and your employee should expect to receive the W-2C.

To check which subscription you have with us, go to the Account and Settings page. Follow the steps below:

- Go to the Gear icon and select Account and Settings.

- Select the Billing & Subscription tab.

- Your subscription is shown below your company ID.

Let me know if there's anything else I can help you. I'll be right here to assist you with your payroll forms and take care of other concerns in QuickBooks. Have a nice day!