- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Employees and payroll

Thanks for joining this thread, @tgeorgelas. I'd be glad to help you remove the liability payroll requirement in QuickBooks Desktop (QBDT).

To get rid of the overdue status and ensure that your tax reports are accurate, you can record them as historical tax payments in QBDT. Follow these steps to proceed:

- Click the Help menu, then select About QuickBooks.

- Press Ctrl + Alt + Y or Ctrl + Shift + Y to open the Setup YTD Amounts window.

- Click Next until you reach the Enter prior payments section.

- In the Enter Prior Payments window, select Create Payment.

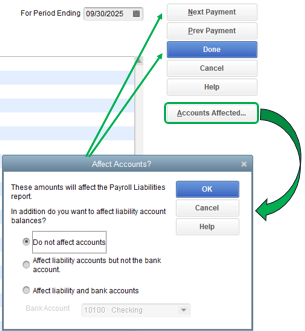

- Enter the Payment Date and For Period Ending date appropriately.

- In the Taxes and Liabilities field, select the payroll tax item, then enter the amount.

- Select test the Accounts Affected... button, then choose the appropriate option for how you want the payment to affect your Chart of Accounts.

- Click Next Payment (if you have another payment that needs to be recorded), or select Done to complete the process.

- Once done, click Finish.

I've also included an article that will guide you in recording historical payroll information into your QBDT Payroll: Enter Historical Tax Payments in Desktop payroll.

Otherwise, you can also record a negative payroll liability adjustment to clear it out. Here's an article for a detailed process: Adjust Payroll Liabilities in QuickBooks Desktop.

In case you need to track where your business stands in terms of employee expenses, you'll want to customize the payroll and employee reports.

Drop me a comment below if you have any other questions related to your payroll liabilities. I'll be happy to help you some more. Have a good one!