- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

FFCRA and CARES Acts including the PPP

You're in the right place to get the answers that you're looking for, @MistyC!

After your lender determines how much of the loan is forgiven, you can transfer the forgiven amount. You'll have to create a journal entry to debit the PPP Loan account for the amount forgiven, and credit the new PPP Loan Forgiveness account or sub-account for the amount of expenses to total the forgiven amount. First, let's create a new account to record the use of the PPP loan funds.

- In the Chart of Accounts, select Account ▼, then select New.

- Select Other Account Types, then choose Other Income.

- Click Continue.

- Enter a name for the account, like “PPP Loan Forgiveness.”

- Click Save and Close.

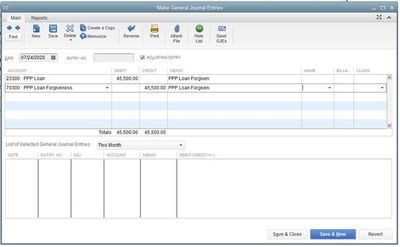

Then, follow the steps below on how to create the journal entry:

- Go to Company, then Make Journal Entries.

- Enter info as shown.

- Click Save and Close.

However, I'd still recommend seeking professional advice from your accountant about this. They can help you properly handle this type of scenario. With regard to the date of recording, we'll have to follow the constructive receipt rule defined by the IRS, which suggests that we'll need to record the date you receive the funds. You can also clarify this to your accountant. If you don't have one, not to worry! I can help run a search to find an accountant.

Here's how:

- Visit the ProAdvisor site.

- Enter your city or ZIP code in the Location field. It will display a list of accountants or bookkeepers near you.

- You can also filter the service provided, industry served, and product supported to narrow down the results.

I’m adding a guide that covers all the information about loan forgiveness including factors to help reduce the forgivable amount: PPP Loan Forgiveness.

Feel free to visit the Community again if you need help with QuickBooks. We're always here to help. Have a great day ahead.