- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Hi, I have a new starter on the 06.04.20 to be paid to the 30.04.20 on an average 37.5 week. My manual calculations for hours is 142.5 however QB is calculating 135.2?

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Other Questions

I've got the details you need about the system calculations of your new starter and how to match them with your manual amount, @vickiwood.

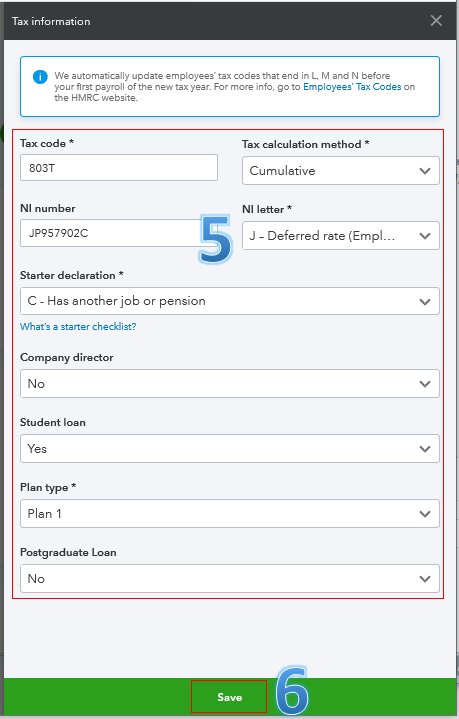

QuickBooks Online (QBO) calculates your new starter's payroll earnings based on the Tax Information you've set up in their profile. These are the Tax code, Tax calculation method, NI number, NI letter, and the Starter declaration. The pay rate in the Employment Details section and their pay schedule will also apply. These are the possible reasons the program is calculating 135.2 for the employee's hours.

To help fix this, let's open the new starter's profile. This way, we can ensure their tax information, pay rate, and pay schedule are set up correctly. I'll guide you how.

- Go to Employees from the left menu.

- Select the Employees tab.

- Locate and click the starter's name.

- Click the Edit (Pencil) icon within the Tax Information section.

- Review the tax details. If necessary, update them.

- Click Save.

- Check the pay rate in the Employment Details section. Change it if necessary.

- Verify the Pay schedule and other details.

- Hit Save again.

The screenshot below shows you the fifth to sixth steps. For more details, check out this article: Edit Employees.

Once done, run the payroll for your new starter again to be paid on 30/40/2020. You'll be able to view the correct hourly calculations to match them with 142.5.

As always, I'd suggest running any payroll reports in the program. These will help you ensure your payroll information is accurate. You can also keep track of your employee expenses from there.

I'll be right here to help if you need further assistance. Enjoy the rest of your day, @vickiwood.

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Other Questions

Hi @vickiwood

My guess is that it's something very simple.

Check the obvious things - have you definitely entered 37.5hrs as the average week?

(I don't use QB Payroll so don't really know how it works)

Do you need to enter Usual Working Days (Monday-Friday)?

Is this done correctly?

Based on 5-day week, there are 19 working days (ignoring the fact that two were bank holidays) so I'd agree with your 142.5hrs = 37.5hrs ÷ 5 x 19.

Notice that 135.2hrs ÷ 19 x 5 = 35.57hrs.

Could this be a typo on the 37.5hrs entry?

Hope this helps.

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Other Questions

Hi vickiwood,

Is the employee set to regular or irregular pay schedule and have you selected the typical working days?

Thanks